Understanding the Acord Agent of Record Form

The Acord Agent of Record form serves as a crucial document in the insurance industry, establishing a formal relationship between a policyholder and their chosen insurance agent. This form designates the agent authorized to act on behalf of the policyholder in matters relating to their insurance coverage. Essentially, it acts as a written acknowledgment of this relationship, which ensures that agents receive any due commissions while facilitating smoother communication between all involved parties.

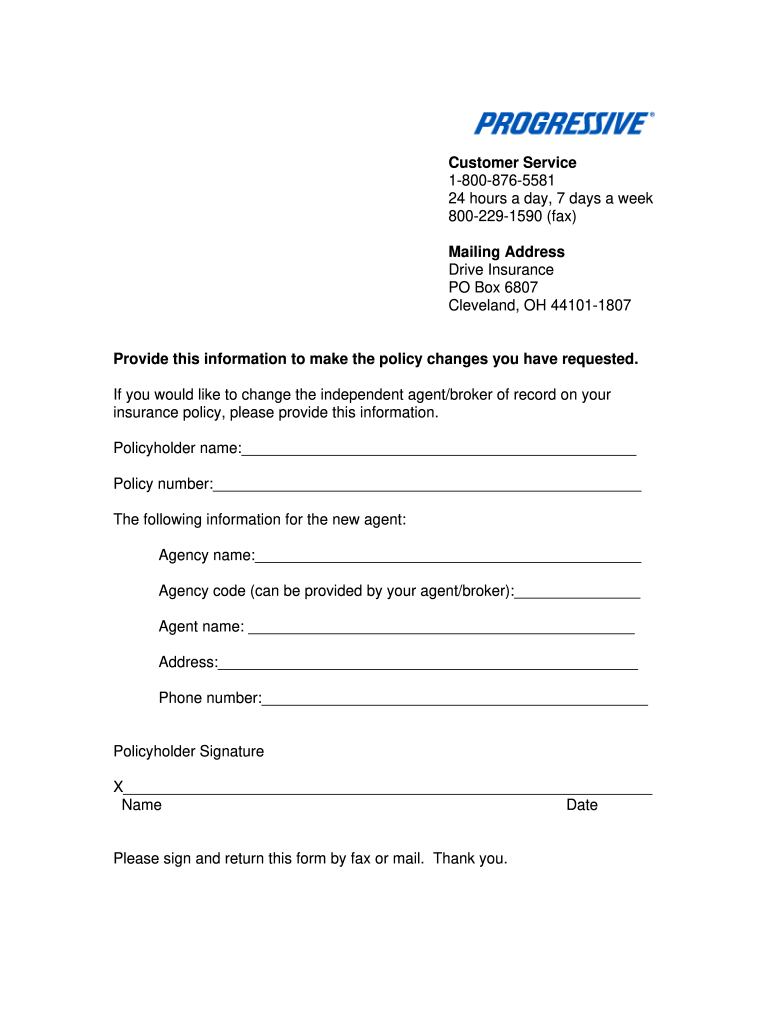

Steps to Complete the Acord Agent of Record Form

Filling out the Acord Agent of Record form requires careful attention to detail. Here are the steps to ensure accurate completion:

-

Gather Required Information: Collect all necessary details, including the policyholder's name, contact information, and policy number.

-

Enter Agent Information: Fill in the agent's name, agency name, and contact details. It is essential to ensure this information matches what is on record with the insurance company.

-

Signatures: Both the policyholder and the new agent must sign the form. This action confirms that both parties agree to the change in representation.

-

Submission: Decide on the method of submission—this can typically be done via mail, fax, or electronically, depending on the insurance provider's requirements.

-

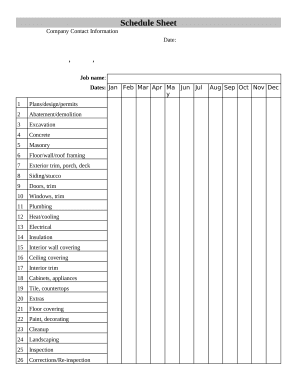

Follow Up: After submission, check with the insurance company to confirm receipt and processing of the form to avoid any lapse in coverage.

Importance of the Acord Agent of Record Form

This form plays a vital role in managing insurance relationships. By officially designating an agent, policyholders can ensure that their interests are represented when it comes to claims, policy changes, and renewals. Here are some specific reasons for its importance:

- Commission Tracking: The form helps the insurance company track commissions due to agents, which is essential for their compensation.

- Decision-Making Authority: It clearly outlines who has the authority to make decisions regarding the insurance policy, reducing potential conflicts.

- Ensures Continuity: If a policyholder intends to change agents, using this form helps ensure a smooth transition without interruptions in service or coverage.

Legal Use of the Acord Agent of Record Form

The Acord Agent of Record form is legally recognized within the insurance industry. When properly executed, it confirms the policyholder's intent and authorizes the agent to operate on their behalf. Understanding the legal implications is crucial, as improper use could lead to disputes over authority or commissions.

- Documentation: Keeping a signed copy of this form protects both the policyholder and the agent in case of disagreements.

- Compliance: Agents are required to comply with state and federal regulations, and this form helps facilitate transparent operations.

Key Elements of the Acord Agent of Record Form

The form typically contains several sections, which include the following key components:

- Policyholder Information: Full name, address, phone number, and policy number.

- Agent Information: Agent’s full name, agency name, and contact details.

- Signatures: Lines for signatures of both the policyholder and the agent, along with the date to validate the agreement.

- Effective Date: Space to insert the date when the agent of record status changes take effect.

This structured format ensures clarity and makes it easy for all parties to understand their roles and responsibilities.

Common Usage Scenarios for the Acord Agent of Record Form

The Acord Agent of Record form is utilized across varied scenarios, including:

- Changing Agents: When a policyholder wishes to switch their representation to a new insurance agent.

- Agency Changes: When an insurance agent moves to a different agency and continues to represent the same clients.

- Assignment of Authority: In situations where an agent is empowered to manage claims or policy updates on behalf of the policyholder.

Understanding these scenarios is important for agents and policyholders alike, as it ensures that everyone is aware of how and when to use this form effectively.