Definition & Meaning

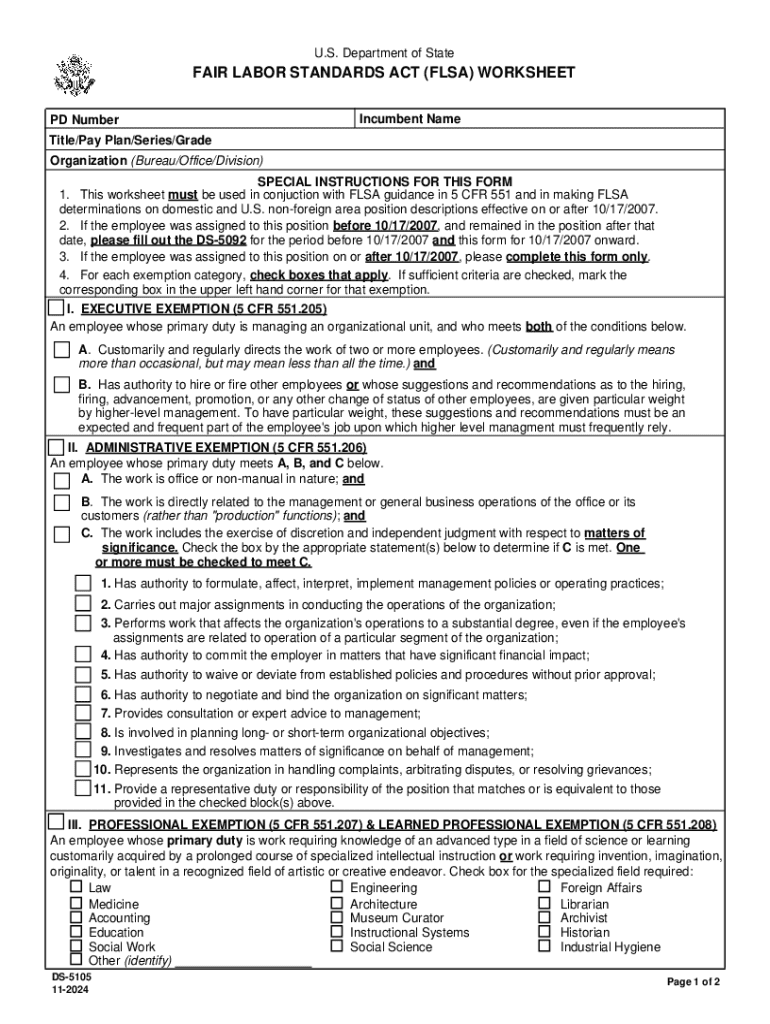

The DS-5105 Fair Labor Standards Act (FLSA) Worksheet is a crucial document created by the U.S. Department of State. It is designed to help determine whether employees in domestic and non-foreign U.S. areas qualify for FLSA exemptions. The FLSA is a significant labor law that establishes minimum wage, overtime pay eligibility, recordkeeping, and child labor standards. The worksheet outlines specific criteria to assess exemption categories, including Executive, Administrative, Professional, Creative Professional, and Computer Employee. Utilizing this worksheet ensures accurate compliance with FLSA regulations by identifying appropriate exemptions.

Key Exemption Categories

- Executive: This category involves high-level managerial roles with specific salary and duty requirements.

- Administrative: Covers employees performing office or non-manual work related to management or general business operations.

- Professional: Applies to jobs requiring advanced knowledge in a field of science or learning, typically proven by a degree.

- Creative Professional: Pertains to roles that require invention, imagination, originality, or talent in recognized artistic fields.

- Computer Employee: Encompasses positions in computer systems analysis, programming, software engineering, or similar areas, under certain conditions.

How to Use the DS-5105 Fair Labor Standards Act (FLSA) Worksheet

Users must understand how to correctly fill out the DS-5105 for effective FLSA exemption assessment. Begin by gathering necessary employment data and complying with timeline requirements outlined in FLSA guidance.

Step-by-Step Instructions

- Review Employee Criteria: Verify job descriptions align with exemption categories listed.

- Follow FLSA Guidance: Use current legislation and guidelines for accurate assessment.

- Document Evidence: Maintain supporting documentation indicating how each exemption applies to an employee.

- Update Regularly: Re-evaluate positions annually or with each job role change to ensure ongoing compliance.

Important Terms Related to DS-5105 Fair Labor Standards Act (FLSA) Worksheet

Understanding specific terminology is essential when working with the DS-5105 and FLSA regulations.

- Exemption: Refers to positions not subject to standard FLSA provisions such as overtime pay.

- Non-Foreign Areas: U.S. territories where standard federal labor laws apply.

- Minimum Wage: The lowest wage permitted by law or special agreement.

Glossary of Terms

- Salary Basis: A predetermined and fixed salary that is not reduced due to variations in the quality or quantity of work performed.

- Discretionary Authority: The level of authority given to an employee to make significant decisions on behalf of the employer.

Steps to Complete the DS-5105 Fair Labor Standards Act (FLSA) Worksheet

Filling out the DS-5105 accurately is vital for compliance. Here’s a checklist to guide the process:

- Gather Employment Details: Collect job descriptions, employment contracts, and pay records.

- Evaluate Exemption Requirements: Use worksheet to align employee roles with FLSA categories.

- Document Rationalizations: Provide written explanations for exemption decisions.

- Review and Approve: Confirm that completed worksheets are verified by a compliance officer or legal team.

Legal Use of the DS-5105 Fair Labor Standards Act (FLSA) Worksheet

Ensuring legal adherence, the DS-5105 worksheet must be used within specific guidelines.

Compliance Checks

- Regular Audits: Organizations are advised to conduct periodic internal audits to avoid potential FLSA violations.

- Legal Consultation: When in doubt, seek legal advice to interpret complex employee situations.

- Recordkeeping: Maintain thorough documentation for all completed worksheets as they may be reviewed by labor auditors.

Examples of Using the DS-5105 Fair Labor Standards Act (FLSA) Worksheet

Shedding light on practical use, examples are significant for understanding the worksheet’s applicability.

Practical Scenarios

- Scenario A: A business evaluates a managerial position that falls under the Executive exemption. The role includes overseeing two or more employees and involves significant decision-making authority.

- Scenario B: An IT company assesses a software developer for exemption as a Computer Employee. The role meets the salary and duty requirements set by the FLSA.

Form Submission Methods (Online / Mail / In-Person)

It's essential to submit the DS-5105 through the correct channels for validation.

Available Submission Routes

- Online Applications: Utilize online platforms to upload completed worksheets to the appropriate department.

- Mail Submission: Send printed copies through certified mail to ensure delivery confirmation.

- In-Person Drop Off: When necessary, submit directly at designated offices to obtain a receipt of submission.

Form Variants and Alternatives

Understanding different versions can be valuable for compliance and procedural accuracy.

Related Documents

- Alternative Tools: While DS-5105 is specific to FLSA exemptions, other forms might address broader employment compliance requirements.

- Historical Versions: Keep track of past versions of the worksheet to understand changes in criteria over time.

- Electronic Tools: Consider digital tools that integrate with DS-5105 for streamlined processing and record-keeping.