Definition & Meaning

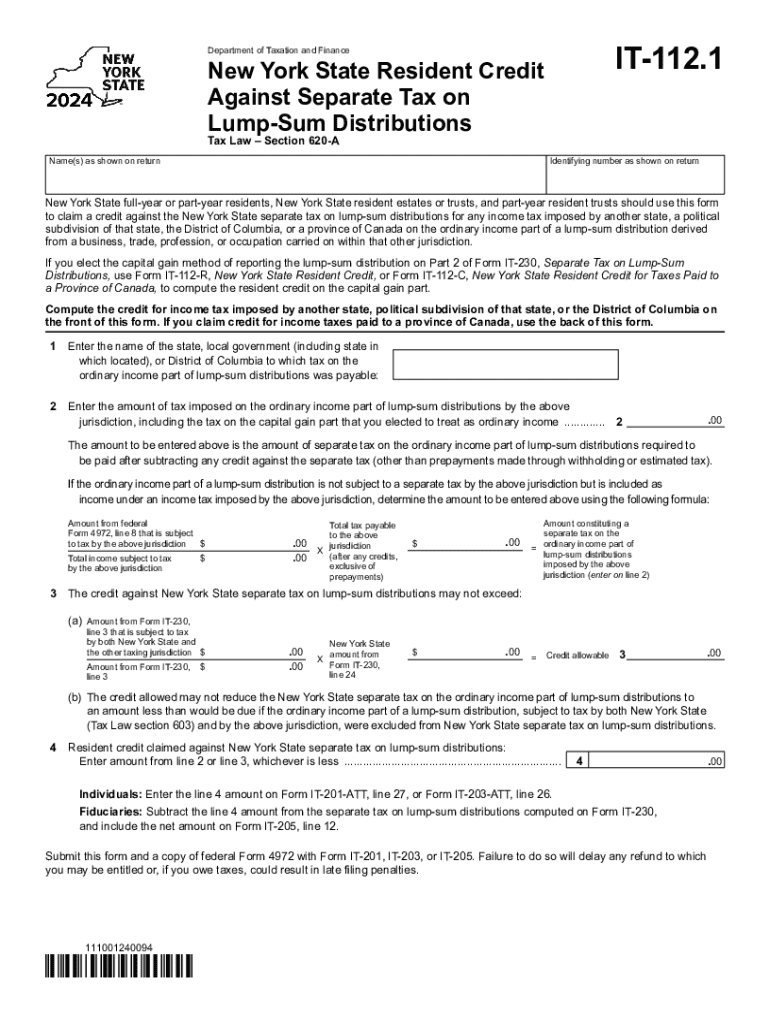

Form IT-112.1, titled "New York State Resident Credit Against Separate Tax on Lump-Sum Distributions," allows New York State residents to claim a credit for taxes they have paid to other jurisdictions, including states and Canadian provinces, on lump-sum distributions. This form applies to taxes imposed on ordinary income that results from these distributions, helping to ensure taxpayers are not double-taxed on these amounts. Understanding the intent and benefits of this form is crucial for eligible taxpayers seeking relief from additional tax burdens.

How to Use the Form IT-112.1

Using Form IT-112.1 involves specific instructions that guide New York State residents in claiming their credit. Taxpayers must begin by carefully reading the form's instructions to understand the required data and computations. Calculating the credit correctly is essential, as it is based on the comparison of the New York State tax rate to the tax rates of the other jurisdictions. Proper adherence to these instructions ensures that residents leverage the full potential of the credit against taxes they have already paid elsewhere.

Steps to Complete the Form IT-112.1

- Gather Necessary Information: Taxpayers should collect details about the lump-sum distribution, including the total amounts and the taxes paid to other jurisdictions.

- Calculate the Credit: Use the form's worksheet to compute the allowable credit. This involves applying appropriate tax rates and following the accompanying examples.

- Fill Out the Form: Complete all sections of the IT-112.1 to reflect the accurate credit amount. Ensure every input matches the tax documents and calculations.

- Attach to Tax Return: After filling out, the form must be attached to the New York State tax return to finalize the credit claim.

Why You Should Use Form IT-112.1

Form IT-112.1 is vital for New York residents who have received lump-sum distributions subject to tax by multiple jurisdictions. By using this form, eligible residents avoid paying double taxes on the same income. This relief helps in effectively managing cash flow by ensuring that taxes, already paid to other states or regions, do not diminish disposable income further. Proper utilization of this form can lead to significant savings, especially for those with substantial distributions subject to tax.

Important Terms Related to Form IT-112.1

Understanding certain key terms is fundamental when dealing with Form IT-112.1:

- Lump-Sum Distributions: Large, one-time payments typically from retirement accounts, annuities, or similar sources.

- Ordinary Income: Standard taxable income subjected to normal tax rates.

- Separate Tax: A tax applied independently from regular income tax, specifically on lump-sum incomes. Familiarity with these terms ensures comprehension and correct handling of the form.

Eligibility Criteria

Eligibility for using Form IT-112.1 requires that the taxpayer be a resident of New York State and have paid taxes on lump-sum distributions to another jurisdiction. Documentation proving residency and the taxes paid abroad is necessary. Additionally, taxpayers must determine that the other jurisdiction imposed taxes on the distributions at rates different from New York's, allowing for a potential credit. Meeting these criteria confirms eligibility and streamlines the approval process.

Legal Use of Form IT-112.1

The legal framework around Form IT-112.1 is designed to eliminate double taxation and abide by interstate tax agreements. Proper, legal use of the form involves fully honest disclosure of all details relevant to the claim. Taxpayers should maintain copies of all supporting documents and report accurate figures. Misuse or incorrect information on this form can result in penalties or disallowance of the claimed credit, emphasizing the need for compliance.

Filing Deadlines / Important Dates

Timing is an essential aspect of tax forms, and Form IT-112.1 must be filed by the standard New York State individual income tax return deadline. This is typically April 15 each year, unless otherwise extended by the state. Missing this deadline may lead to penalties or forfeiture of the credit. Taxpayers should plan to complete and compile all needed documents well in advance, ensuring sufficient time to resolve any discrepancies or questions about the form before submission.