Definition & Purpose of the MO-1120ES

The MO-1120ES form is a financial document used by corporations in Missouri to declare estimated tax payments for the fiscal year 2024. It facilitates the advance payment of corporation income taxes, helping businesses avoid large lump-sum payments at the year's end. This form is particularly critical for corporations that anticipate owing tax to the Missouri Department of Revenue. It serves as a planning tool, allowing corporations to manage their cash flow effectively while ensuring compliance with state tax regulations.

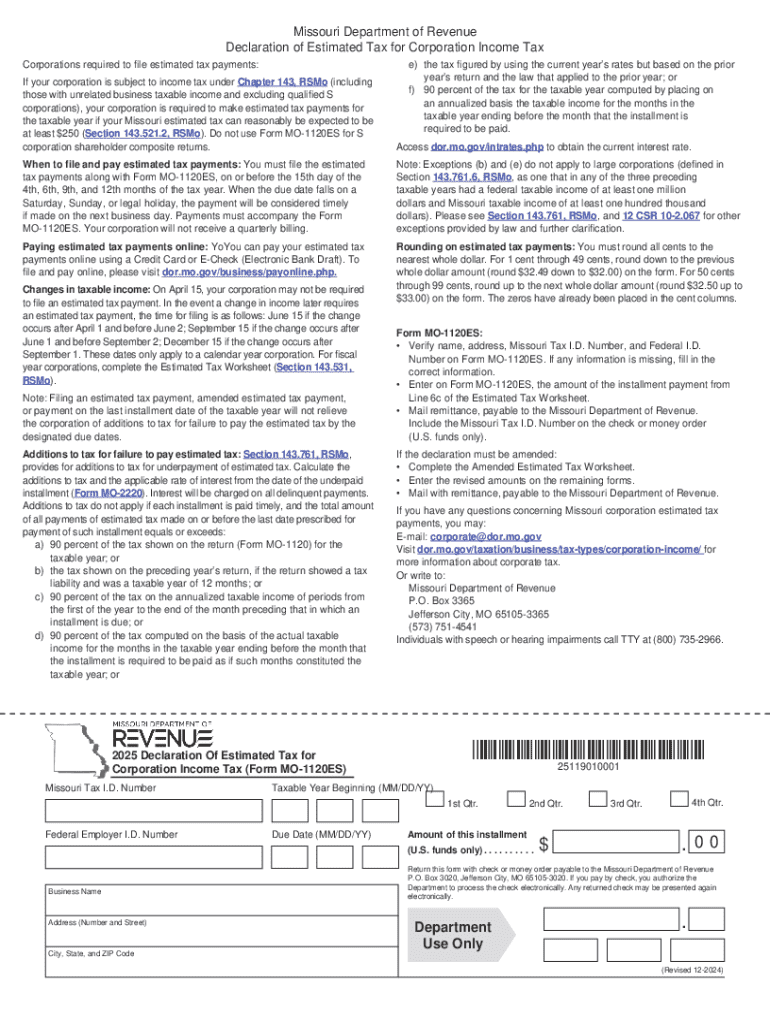

How to Use the MO-1120ES

Corporations begin by estimating their annual income, expenses, and applicable deductions to determine the anticipated tax liability. The MO-1120ES requires corporations to divide this estimated tax into four equal quarterly payments. To accurately complete the form, detailed financial records and forecasts are necessary. Adequate attention should be given to ensuring the computations align with Missouri tax laws to prevent underpayment.

Step-by-Step Completion Process

- Calculate Estimated Income: Determine the corporation's expected income for the year.

- Estimate Deductions: Identify relevant deductions to reduce taxable income.

- Compute Taxable Income: Subtract deductions from income to get the taxable amount.

- Calculate Tax Liability: Apply Missouri's corporation tax rate to the taxable income.

- Divide and Schedule Payments: Split the total tax liability into four payments.

- Complete Form Fields: Fill in required details on the MO-1120ES, ensuring accuracy.

Obtaining the MO-1120ES

Corporations can acquire the MO-1120ES form from the Missouri Department of Revenue's official website. The form can also be found at local tax offices throughout Missouri or ordered by mail upon request. Access to an electronic version allows for efficient completion and submission, streamlining the tax filing process.

Who Typically Uses the MO-1120ES

The MO-1120ES form is primarily used by corporations operating within Missouri that are subject to state income taxes. It caters to various business entities, including:

- Limited Liability Companies (LLCs)

- Corporations

- S Corporations

- Partnerships

Businesses that foresee owing more than a minimal threshold in taxes are mandated to file this form to avoid penalties.

Filing Deadlines & Important Dates

Missouri requires corporations to adhere to specific filing deadlines to avoid interest and penalties. The quarterly estimated tax payments are due on:

- April 15

- June 15

- September 15

- December 15

It's crucial for corporations to mark these dates and ensure timely payments to remain in good standing with the Missouri Department of Revenue.

Penalties for Non-Compliance

Non-compliance with filing the MO-1120ES can lead to significant financial penalties. Missouri imposes interest on underpayments, calculated from the due date of each installment until the payment is made. Additionally, a penalty may be assessed if the total tax paid by the deadline falls below a certain percentage of the annual tax liability.

Examples of Penalties

- Interest Charged: Accruing daily until payment is made.

- Late Payment Penalty: Added to the underpaid amount.

- Filing Penalty: Charged for failing to submit the form on time.

State-Specific Rules for Missouri

The MO-1120ES operates under specific Missouri tax laws. For example, corporations must consider state-specific deductions and credits, which may impact the estimated tax calculation. Additionally, Missouri's tax rate and any applicable exemptions must be factored into the total tax liability estimates.

Required Documents for Filing

To effectively fill out the MO-1120ES, businesses need to prepare various financial documents, such as:

- Previous tax returns

- Quarterly financial statements

- Bank statements

- Detailed records of income and expenses

These documents ensure the accuracy of the estimated tax calculations and compliance with Missouri's tax regulations.