Definition and Meaning

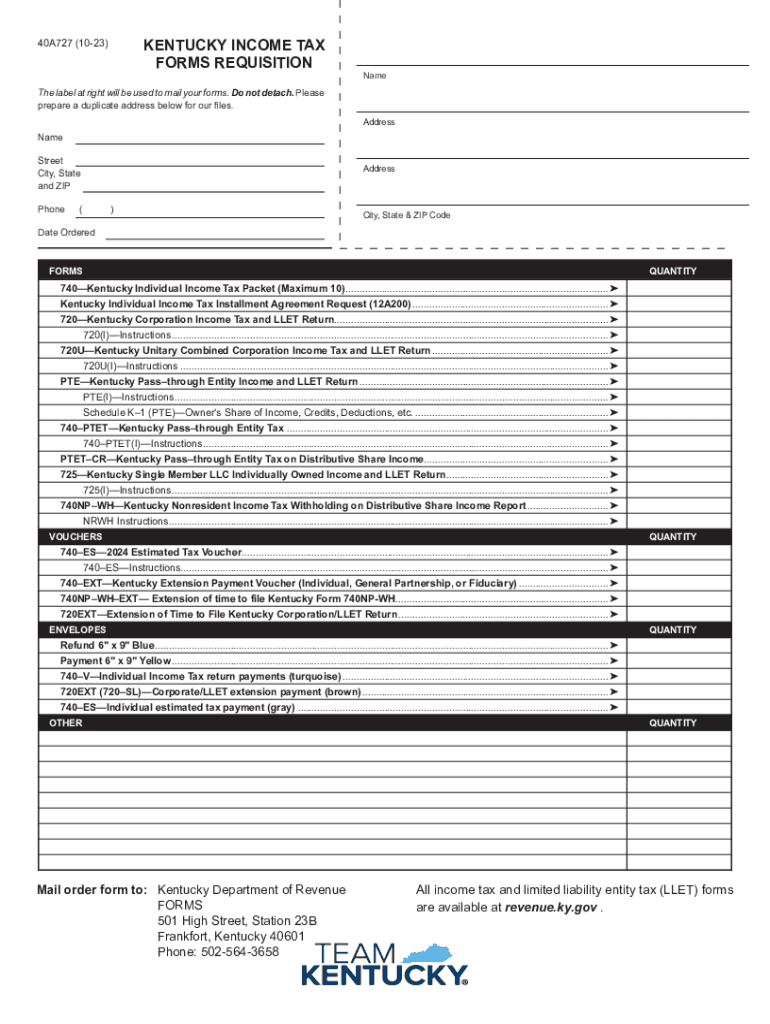

The "Kentucky Income Tax Forms Requisition" is a document used by individuals and businesses to request various income tax forms from the Kentucky Department of Revenue. This form serves as a guide for users to obtain the necessary tax forms required for filing purposes. The requisition can include requests for individual and corporate tax packets, installment agreements, and related instructions. The primary goal is to streamline the tax filing process by ensuring that taxpayers have all the necessary documents in advance.

How to Use the Kentucky Income Tax Forms Requisition

Using the Kentucky Income Tax Forms Requisition is a straightforward process designed to assist taxpayers in obtaining the required documentation for filing their state taxes.

-

Assess Your Needs: Determine what specific tax forms you need, such as individual tax forms, corporate packets, or installment agreements. Review your tax situation to decide which forms will be pertinent.

-

Fill Out the Requisition Form: Complete the requisition form with your personal or business details, including your name, address, and contact information. Ensure you list all forms needed accurately.

-

Submit to the Department of Revenue: Follow the mailing instructions provided to ensure the form reaches the Kentucky Department of Revenue. Double-check for any specific requirements about where and how to submit the form.

-

Wait for the Documents: Once submitted, the forms will be sent to you based on the requirements indicated on the requisition.

How to Obtain the Kentucky Income Tax Forms Requisition

There are several ways to obtain the Kentucky Income Tax Forms Requisition:

-

Online Access: Visit the Kentucky Department of Revenue's official website to download the requisition form. Online access ensures you have the most recent version and any updates made by the state.

-

In-person Requests: If you prefer a physical copy or require assistance, you may visit your local tax office in Kentucky to request the form.

-

Request by Mail: For individuals without internet access, the requisition form can be requested by contacting the Kentucky Department of Revenue and asking for it to be mailed to your address.

Steps to Complete the Kentucky Income Tax Forms Requisition

The completion of the Kentucky Income Tax Forms Requisition involves several key steps:

-

Gather Personal Details: Prepare your personal information, including your full name, mailing address, and contact number.

-

Identify Required Forms: Clearly identify which tax forms you need. This ensures you request the correct forms, enabling a smooth tax filing process.

-

Accurate Completion: Fill out the requisition accurately, ensuring all the fields are completed as per the form's instructions.

-

Review and Verify: Before mailing the form, review it for any errors or omissions.

-

Mailing the Form: Follow the mailing instructions carefully to send your completed requisition to the designated address of the Kentucky Department of Revenue.

Key Elements of the Kentucky Income Tax Forms Requisition

Understanding the core components of the Kentucky Income Tax Forms Requisition is crucial:

-

Form Identification: A section where you specify the forms you are requesting, like individual income tax forms, corporate forms, etc.

-

Requester Information: A block for providing your contact details, particularly vital for receiving the requested documents.

-

Instructions and Notices: Includes specific instructions on how to complete and submit the form, ensuring compliance with state requirements.

State-Specific Rules for the Kentucky Income Tax Forms Requisition

The requisition may contain rules specific to Kentucky state, such as:

-

Resident vs. Non-resident Requirements: Differentiating the tax needs for residents and non-residents of Kentucky might affect the type and number of forms required.

-

Income Thresholds: Kentucky may have unique income thresholds that dictate different forms or tax packets.

-

State Filing Laws: Be aware of any changes or updates in state filing laws that may impact the use of this requisition.

Who Typically Uses the Kentucky Income Tax Forms Requisition

This requisition form is primarily used by:

-

Individual Taxpayers: Residents and non-residents who need to request individual income tax forms.

-

Businesses: Corporations and partnerships seeking corporate tax packets or installment agreements.

-

Tax Professionals: Accountants and tax preparers requesting forms on behalf of clients, ensuring accurate and timely submission.

Filing Deadlines / Important Dates

Key dates associated with the Kentucky Income Tax Forms Requisition include:

-

Form Submission Deadline: The requisition form should ideally be submitted well in advance of the tax filing deadline to ensure timely receipt of necessary documents.

-

Tax Filing Dates: Align the requisition submission with Kentucky's tax filing deadlines to prevent any delays in filing.

-

Amendment Dates: If amendments are needed, note any specific deadlines for requesting additional forms.