Definition & Meaning

The Idaho broadband equipment investment credit is a tax incentive offered under Idaho State Tax law designed to encourage investments in broadband equipment. This credit is aimed at enhancing the telecommunications infrastructure by providing financial relief to businesses that invest in eligible broadband technologies. It serves as an encouragement for businesses to upgrade or expand their broadband capabilities, ensuring better connectivity across the state of Idaho.

Eligibility Criteria

To claim the Idaho broadband equipment investment credit, businesses must meet specific eligibility requirements. Primarily, the credit is available for investments in qualified broadband equipment as defined by the state. Broadly, these are telecommunications infrastructures that facilitate enhanced broadband services. Companies must ensure their equipment purchases conform to specifications approved by the Idaho Public Utilities Commission. Additionally, there might be specific usage or compliance criteria outlined by state law that companies must adhere to fully to qualify.

Key Elements of the Idaho Broadband Equipment Investment Credit

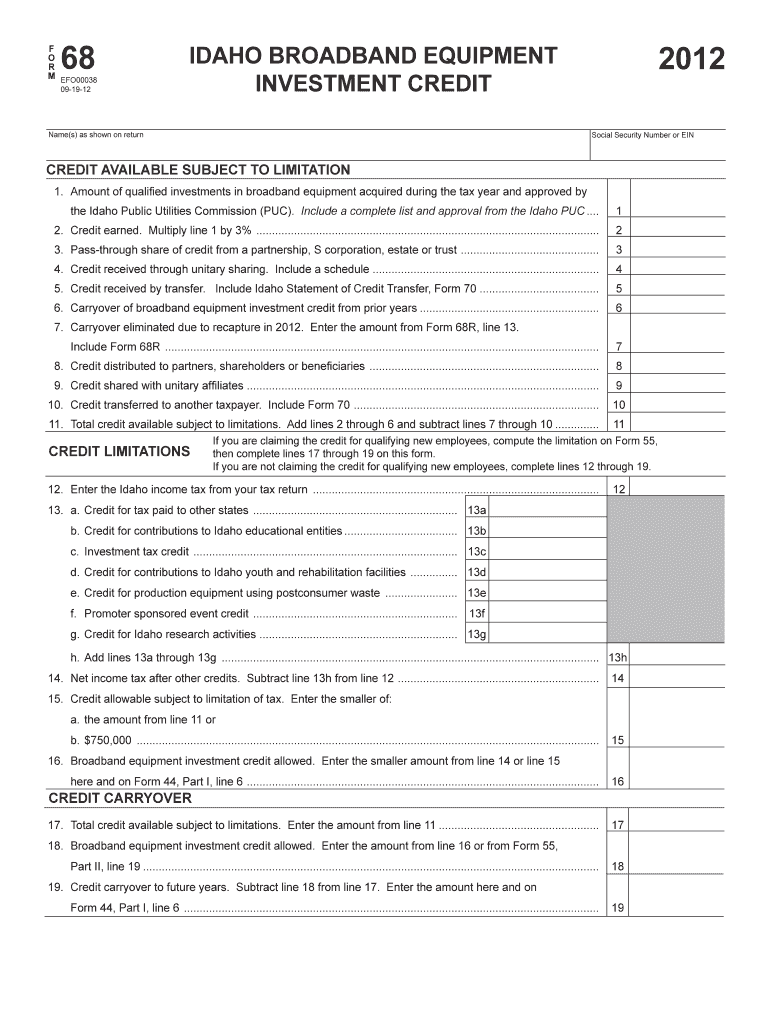

The Idaho broadband equipment investment credit encompasses several essential components that claimants need to understand for proper utilization. Key elements include:

- Qualified Equipment: Specifications and types of equipment that qualify for the credit.

- Investment Limitations: Maximum credit available and how it corresponds to the scale of the investment.

- Transfer Provisions: Guidelines for transferring unused credit to other entities or future tax years.

- Carryover Provisions: Rules allowing businesses to carry over unused credits to future fiscal years.

How to Obtain the Idaho Broadband Equipment Investment Credit

Securing the Idaho broadband equipment investment credit involves a procedural approach that businesses must strictly follow. Initially, they need to document their broadband equipment purchases accurately. This involves retaining all receipts, purchase orders, and specifications that demonstrate the equipment meets the required qualifications. Next, submitting an approval request to the Idaho Public Utilities Commission is critical. Once the commission verifies and approves eligibility, businesses can claim the credit on their Idaho state tax return.

Important Terms Related to the Credit

Understanding the terminology associated with the Idaho broadband equipment investment credit is crucial for proper application. Here are some important terms:

- Telecommunications Equipment: Instruments or devices used for transmission, receipt, and processing of information via telecommunication lines.

- Broadband Service: High-speed internet service that is always on and faster than traditional dial-up access.

- Credit Transferability: The capability of transferring the credit benefits to another eligible entity or tax period.

Steps to Complete the Credit Application

Applying for the Idaho broadband equipment investment credit involves a few structured steps:

- Identify Eligible Purchases: Assemble all records and paperwork for broadband equipment qualifying for the credit.

- Commission Approval: Submit equipment details to the Idaho Public Utilities Commission for pre-approval.

- Claim on Tax Return: Once approval is secured, claim the credit on the state tax return using the applicable forms.

- Retention of Documentation: Maintain thorough records of purchases and state filings for audit purposes.

Application Process & Approval Time

Applicants should expect a review period when applying for this credit. The approval process generally involves submitting detailed documentation to the Idaho Public Utilities Commission, which will then review the submissions to ensure compliance with state laws and equipment standards. Approval timelines may vary, but it’s essential for businesses to submit their applications well ahead of tax filing deadlines to ensure ample time for review and potential additional documentation requests.

Business Types That Benefit Most from the Credit

While the credit is available to various businesses, those in areas with underdeveloped internet services stand to benefit the most. Telecommunications companies and internet service providers investing in expanding their infrastructure may utilize this credit to offset significant investment costs. Additionally, businesses in rural Idaho regions, which often suffer from limited broadband access, can use these incentives to bridge service gaps, thereby broadening their customer base and enhancing service quality.