Definition and Purpose of Form 3949-A

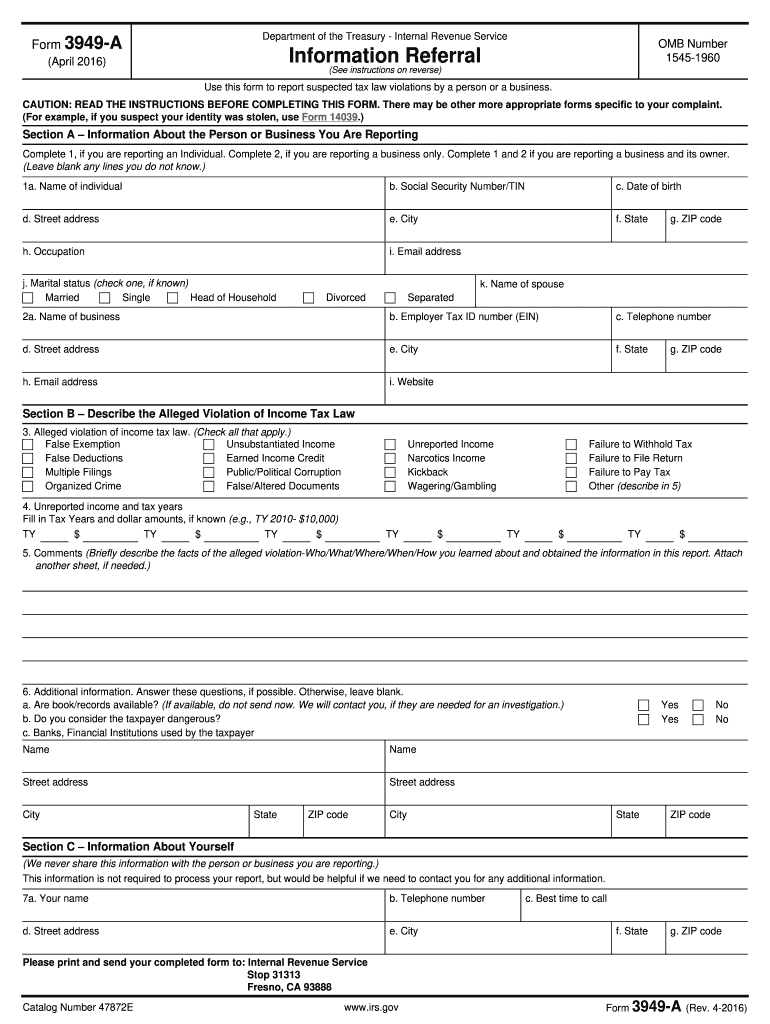

Form 3949-A is a document from the Internal Revenue Service (IRS) utilized for reporting suspected violations of federal tax laws by individuals or businesses. It provides taxpayers with a structured means to report noncompliance with tax regulations, such as underreporting income, failing to file required returns, or other tax-related misconduct. This form is particularly significant because it allows the public to assist the IRS in identifying potential tax fraud, which can lead to investigations and appropriate corrective actions.

The form requires the reporting individual to provide detailed information about the suspected tax violations, including the name and address of the individual or entity involved, a description of the alleged violations, and any additional relevant details that may aid in the investigation. It is important to note that Form 3949-A is not intended for various specific complaints, such as allegations pertaining to identity theft or issues with tax preparers.

How to Use Form 3949-A

Using Form 3949-A involves a clear process to ensure that your report is effectively communicated to the IRS. Here are the essential steps to follow:

-

Obtain the Form: Access Form 3949-A online via the IRS website or through other resources providing tax forms.

-

Provide Accurate Information:

- Fill out sections detailing the taxpayer's or business's name.

- Include the contact information for the individual or business you are reporting.

- Describe the suspected violations clearly and concisely, providing as much detail as possible.

-

Review and Sign: Once completed, review the form for accuracy. While you can submit the form anonymously, providing your contact information can facilitate any follow-up from the IRS.

-

Choose Submission Method:

- Submit the form online or print it and send it via mail, ensuring it reaches the appropriate IRS address.

How to Obtain Form 3949-A

Form 3949-A is available through several channels. Here’s how to obtain it:

-

From the IRS Website: The most straightforward method is to download the form directly from the IRS official website. This ensures you are using the most current version.

-

Local IRS Offices: You can also visit a local IRS office where physical copies of the form may be available.

-

Tax Preparation Services: Some tax professionals and accounting firms may have copies available, or they can assist you in filling it out if needed.

Steps to Complete Form 3949-A

Completing Form 3949-A accurately is crucial to ensure that the IRS can effectively process your report. Follow these steps:

-

Fill in Your Information: If you choose not to remain anonymous, complete the first section with your name, address, and contact information.

-

Information About the Alleged Violator:

- Provide full name, address, and any other identifying details regarding the individual or business being reported.

-

Description of Allegations:

- Clearly describe the suspected violations. Include specifics such as what tax laws may have been violated and any supporting details.

-

Supporting Documentation: While not mandatory, attach any evidence that supports your claims. This can include documents or transaction records relevant to the violations.

-

Submit the Form: After reviewing, submit the form either through the IRS online submission portal or by mailing it to the designated address.

Important Considerations Related to Form 3949-A

Understanding key elements associated with Form 3949-A can enhance the efficacy of your submission and compliance with IRS guidelines. Here are some critical considerations:

-

Anonymity: Reports can be anonymous; however, providing your information may assist the IRS in follow-up inquiries if they arise.

-

Legal Implications: Misuse of the form for inappropriate purposes or providing false information may lead to legal repercussions.

-

No Feedback from IRS: After submitting Form 3949-A, you typically will not receive feedback or updates about the status of your report. The IRS maintains strict confidentiality regarding such investigations.

-

Limitations of Use: The form should not be used for reporting identity theft or issues regarding the conduct of tax professionals, which are handled through separate channels.

Who Typically Uses Form 3949-A?

Form 3949-A is generally used by various individuals and organizations, including:

-

Concerned Taxpayers: Individuals who suspect that someone is committing tax fraud or evading taxes often utilize this form to report their findings to the IRS.

-

Businesses: Business entities may file the form if they encounter fraudulent activities affecting their operations or competition, especially if they know of competitors engaging in illegal tax practices.

-

Whistleblowers: Individuals with inside knowledge of tax violations in a specific business or organization may use the form as a means to report misconduct without revealing their identities.

This form serves a vital role in encouraging public involvement in maintaining tax compliance and integrity within the financial system.