Definition and Meaning

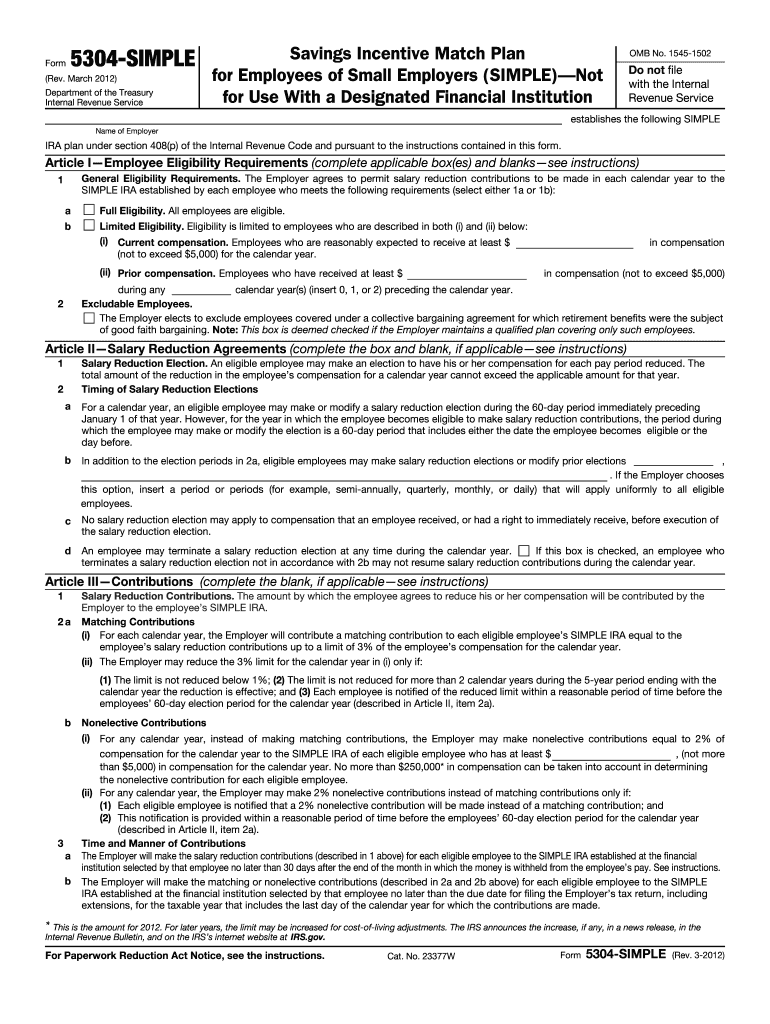

Form 5304-SIMPLE is a standardized document provided by the IRS for employers wishing to set up a Savings Incentive Match Plan for Employees of Small Employers (SIMPLE IRA). This model document facilitates the establishment of a retirement savings plan allowing employees to make pre-tax salary reduction contributions with additional matching or nonelective contributions from their employer. This form is particularly beneficial for small businesses seeking a cost-effective way to offer retirement benefits to their employees.

Form 5304-SIMPLE does not need to be filed with the IRS, but it serves as an essential record-keeping tool for the employer. The primary objective of this form is to outline the terms, eligibility, and administrative procedures governing the SIMPLE IRA plan.

Steps to Complete the 5304-SIMPLE

Completing the 5304-SIMPLE involves several steps to ensure compliance with IRS requirements:

-

Assess Eligibility:

- Confirm that your business meets the eligibility criteria to establish a SIMPLE IRA. Generally, your company must have 100 or fewer employees who earned $5,000 or more during the previous year.

-

Determine Employee Eligibility:

- Decide on the employee eligibility criteria. By default, employees who received at least $5,000 in compensation during any two preceding years and are expected to earn at least $5,000 in the current year can participate.

-

Select Contribution Type:

- Choose between a matching contribution of up to three percent of the employee’s compensation or a nonelective contribution of two percent for each eligible employee, regardless of their salary reduction contributions.

-

Fill out the form:

- Provide general business information and specify the terms of the SIMPLE IRA plan. Ensure all sections concerning eligibility, contribution types, and procedures are completed accurately.

-

Communicate with Employees:

- Provide eligible employees with a summary description of the SIMPLE IRA plan, including the terms, eligibility criteria, and forms for salary reduction agreements.

-

Maintain Records:

- Retain copies of the completed form and employee notifications for your records. Although not submitted to the IRS, maintaining these documents is crucial for compliance and auditing purposes.

Key Elements of the 5304-SIMPLE

Several critical elements are integral to the 5304-SIMPLE form:

-

Eligibility Terms: Employers must clearly define the eligibility requirements for employees, both for the initial setup and ongoing participation in the SIMPLE IRA.

-

Contribution Details: Information on the chosen contribution method—matching or nonelective—is necessary, including any changes in contribution types, which must be communicated to employees in a timely manner.

-

Administrative Procedures: Employers are responsible for ensuring all administrative procedures are in place, including salary reduction agreements and timely contribution deposits.

-

Record Retention: Employers must keep detailed records outlining the operation and administration of the SIMPLE IRA plan, including completed forms and employee notifications.

Common Usage Scenarios

The 5304-SIMPLE is often employed in various business settings:

-

Small Businesses: Companies with fewer than 100 employees frequently use this form to provide a retirement savings option in a cost-effective and administratively simple manner.

-

Family-Owned Businesses: Such businesses benefit as they can easily set up retirement plans without significant costs associated with more complex 401(k) plans.

-

Start-Ups: Start-ups with limited resources but a desire to offer competitive benefits often use the 5304-SIMPLE to improve employee retention and attract talented personnel.

IRS Guidelines

IRS guidelines dictate that:

-

Plan Operation: Plans must adhere to the contribution and operation rules specified in the 5304-SIMPLE documents. Simplified reporting requirements reduce administrative burdens.

-

Notification: Employees must be informed promptly of their eligibility and any changes affecting contribution types or administrative procedures.

-

Fidelity Bonding: Employers should consider fidelity bonding to protect the plan against loss owing to fraud or dishonesty.

Eligibility Criteria

To establish a SIMPLE IRA under the 5304-SIMPLE:

-

Employee Count: The employer must have 100 or fewer employees who were compensated at least $5,000 in the preceding calendar year.

-

Compensation Standards: Employers may set compensation thresholds for eligibility, though this must be clearly stated when distributing the plan’s summary description to employees.

Penalties for Non-Compliance

Failure to adhere to 5304-SIMPLE regulations can lead to:

-

Operational Failures: These may result in disqualification of the plan and loss of its tax-favored status.

-

Tax Penalties: Incorrect contributions or filing errors may attract penalties or additional taxes for both the employer and employee.

-

Corrective Action Costs: To correct any administrative errors, employers might incur costs associated with bringing the plan back into compliance, including IRS fees or penalties.

Digital vs. Paper Version

The 5304-SIMPLE is available in both digital and paper versions:

-

Digital Version: Offers the advantage of easy editing, distribution, and storage. Compatible with various tax and accounting software, enhancing accessibility and efficiency.

-

Paper Version: Though less convenient, a paper version might be preferred for one-time use or companies without extensive digital infrastructure.

Businesses can choose the format that best aligns with their operational preferences and resources, ensuring both versions are compliant with IRS regulations.

Who Typically Uses the 5304-SIMPLE

Primarily utilized by:

-

Small Employers: Firms with reduced headcounts find this an efficient solution for maintaining a retirement plan without incurring excessive costs.

-

Newly Established Companies: Simplified setup and operation make it suitable for new businesses seeking to offer retirement benefits right from the start.

-

Partnerships and LLCs: These business types often prefer SIMPLE IRAs as they accommodate various partner or member contributions seamlessly.

Filing Deadlines and Important Dates

Critical dates include:

-

April 15: Deadline to establish a SIMPLE IRA plan for the year in question.

-

November 1: Employers must inform employees about the upcoming year’s plan details, including eligibility and contribution information.

-

Year-End: Last day for employees to make salary reduction contribution agreements effective for the upcoming year.

Being aware of these deadlines ensures that the employer maintains compliance with all necessary regulatory requirements.