Definition and Importance of Pass-Through Entities

Pass-through entities include structures like S Corporations and Partnerships, which represent crucial options for businesses due to special tax considerations. Unlike traditional corporations, these entities do not pay income taxes at the corporate level. Instead, profits and losses "pass-through" to the owners, who report them on their personal tax returns. This mechanism helps avoid the issue of double taxation and often results in tax savings, making them an attractive choice for many business owners.

Key Components

- Single Taxation Level: Income only taxed at the individual owner's level, not at the business level.

- Flexibility in Profit Distribution: Allows for the allocation of profits and losses in a manner that can be most beneficial for taxation purposes.

- Owner Restrictions: S Corporations are limited to 100 shareholders, whereas partnerships can have multiple partners, with fewer restrictions on ownership.

How to Use Pass-Through Entities Effectively

Using a pass-through entity can be advantageous but requires a thorough understanding of the tax implications and regulatory requirements.

Setup and Management

- Consult a Professional: Engage with legal and tax advisors to ensure proper setup and compliance with IRS regulations.

- Record Keeping: Maintain comprehensive records of income distribution and shareholder or partner agreements.

- Tax Compliance: Ensure timely and accurate filing of individual tax returns to reflect income and losses.

Scenarios of Usage

- Ideal for Small to Medium Enterprises (SMEs): Beneficial for businesses seeking to reduce their taxable income.

- Agility in Decision Making: Lesser ownership complexities lead to quicker decision processes.

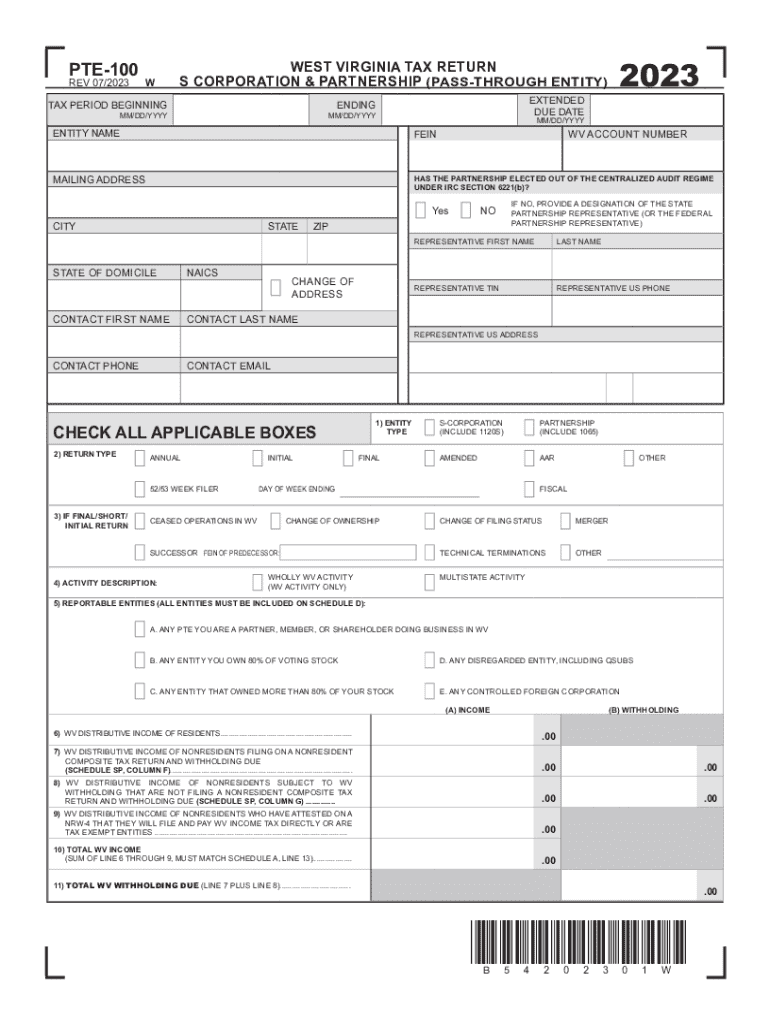

Steps to Complete an S CORPORATION or PARTNERSHIP Form

Completing the form requires careful preparation and understanding of the various sections and schedules.

- Gather Required Financial Documents: Collect information about income, expenses, and distributions.

- Complete Entity Information Section: Provide necessary details such as address, EIN, and ownership structure.

- Document Income and Deductions: Clearly outline all sources of income and applicable deductions.

- Attach Relevant Schedules: Ensure all relevant schedules (like K-1s for partners) are completed and filed.

Who Typically Uses Pass-Through Entities

Pass-through status is often chosen by business owners seeking specific tax efficiencies.

Frequent Users

- Small Business Owners: Preferable for businesses with a few owners wishing to avoid corporate taxation.

- Real Estate Investors: Utilize partnership structures to allocate property income and losses.

- Professional Services Firms: Choose S Corporations to balance tax efficiency with formal corporate structure.

Legal Use and Compliance for Pass-Through Entities

Operating as an S Corporation or Partnership involves specific legal considerations.

Obligations

- Compliance with IRS Guidelines: Always adhere to federal deadlines such as the March 15th filing for S Corporations.

- State Regulations: Each state might impose unique requirements, making local compliance equally essential.

- Annual Meetings and Minutes: Particularly for S Corporations, maintain records of annual shareholder meetings.

Important Terms Related to Pass-Through Entities

Understanding the vocabulary associated with these entities can help ensure proper compliance and utilization.

- K-1 Form: A document used to report each owner's share of income, deductions, and credits.

- EIN (Employer Identification Number): A unique identification for businesses, necessary for tax filing.

- Distributive Share: The portion of income or loss assigned to each S Corporation shareholder or partner in a partnership.

State-Specific Rules

Each state has its own set of rules regarding the taxation and operation of pass-through entities.

Examples of State Variations

- California: Involves franchise tax on S Corporations beyond the federal tax implications.

- Texas: No state income tax, yet businesses are subject to franchise taxes based on revenue.

- New York: Requires S Corporations to file a specific state-level form distinct from the federal filing.

Filing Deadlines and Important Dates

Adhering to the correct filing deadlines is critical to avoid penalties.

- S Corporation Deadline: March 15th for calendar year filers.

- Partnership Deadline: Same as the individual income tax deadline, usually April 15th.

- Extensions: File Form 7004 to request a six-month extension if needed.

Ensuring compliance with these deadlines helps maintain pass-through status and avoids potential legal and financial pitfalls.