Definition & Meaning

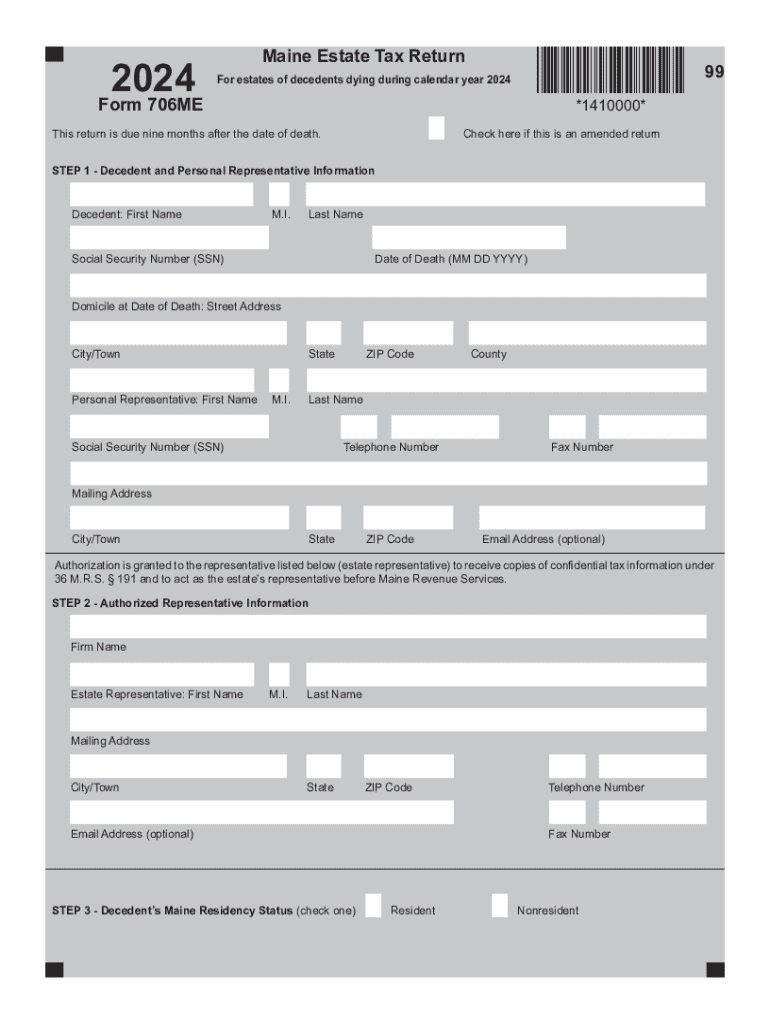

The 99 Form 706ME, also known as the Maine Estate Tax Return, is a tax document required for the estate of a decedent in the state of Maine. This form is used to calculate the estate tax owed to the state, similar to the federal estate tax return but with specific requirements that reflect Maine's statutes. It is obligatory if the decedent was a resident of Maine or if the estate holds real or tangible property in the state, thereby ensuring compliance with state tax regulations.

How to Use the 99 Form 706ME Maine Estate Tax Return

The form is utilized to report the estate’s total value, tax payable, and other required financial information. Executors or personal representatives must compile detailed information about the decedent’s assets, including property, cash, securities, and other investments. Once the comprehensive data is gathered, fill each section accurately according to the form's instructions. Verification of these details is crucial to avoid later complications.

How to Obtain the 99 Form 706ME Maine Estate Tax Return

To acquire Form 706ME, you can download it from the Maine Revenue Services website. This ensures that the most current version is used. Alternatively, copies might be available from financial advisors or estate planning attorneys familiar with estate management in Maine. It’s also advisable to ensure you secure any associated guidance notes or instructions to accurately fill out the form.

Steps to Complete the 99 Form 706ME Maine Estate Tax Return

- Gather all necessary documentation, including financial statements, asset appraisals, and records of liabilities or debts.

- Begin with the identification section by providing information about the decedent and the executor.

- Fill out asset details, categorizing them accurately to reflect estate value.

- Calculate any deductions allowed under Maine law, such as debts, funeral expenses, and charitable donations.

- Compute the total taxable estate and determine the tax liability applying any credits.

- Review the form for accuracy and completeness.

- Submit the completed form to the Maine Revenue Services by the prescribed deadline.

Filing Deadlines / Important Dates

The filing deadline for Form 706ME aligns with specific thresholds. Generally, the return must be filed within nine months following the decedent's date of death. Extensions can be requested, typically granting an additional six months, but this does not postpone any due tax payments. Being aware of these dates helps avoid penalties or interest on unpaid taxes.

Required Documents

Supporting documents for Form 706ME include the decedent's last will and testament, federal estate tax returns, and detailed appraisals of assets and real estate. Additional necessary paperwork might consist of previous tax returns, records of debts and liabilities, and any relevant legal agreements. Assembling these beforehand streamlines the filing process and ensures accuracy.

Legal Use of the 99 Form 706ME Maine Estate Tax Return

Form 706ME is legally binding, a requirement under Maine law for estate representatives managing the closure of a decedent’s tax obligations. It ensures the estate is assessed fairly against Maine’s estate tax laws. Accurate completion safeguards the estate’s interests and compliance with state tax enforcement procedures, reducing the risk of audits or legal disputes.

Penalties for Non-Compliance

Failing to file the 99 Form 706ME on time or inaccurately declaring estate values can result in significant penalties and interest charges from Maine Revenue Services. The state may impose fines for late filing or payments, potentially leading to enforcement actions. To mitigate risk, timely filing and full disclosure are essential. This underscores the importance for estate representatives to fully understand and comply with all filing conditions.