Definition and Meaning

The "20224 OFFICE OF CHIEF COUNSEL Number: INFO 2" is a formal response from the Internal Revenue Service (IRS) regarding specific inquiries or issues. This document, released in March 2006, explores regulations and interpretations linked to taxation, particularly focusing on transactions involving tax credits and depreciation for solar energy installations used by non-profits. The legal constraints come from sections of the Internal Revenue Code (IRC) that dictate how tax-exempt entities interact with such tax benefits.

Importance of the Document

This communication serves as an authoritative clarification, providing essential insights into IRS positions on particular tax questions. Understanding the constraints outlined can significantly influence how donors and non-profits plan transactions related to solar energy to ensure compliance with tax laws.

How to Use the Document

Understanding and correctly interpreting the 20224 OFFICE OF CHIEF COUNSEL document is critical for taxpayers and advisors involved in charitable planning or renewable energy projects with tax-exempt organizations.

Steps for Effective Use

- Identify Relevant Sections: Familiarize yourself with specific IRC references mentioned to comprehend the lawful boundaries concerning tax benefits like depreciation and credits.

- Application in Project Planning: Utilize insights to guide decisions on financing, leasing arrangements, or donations related to renewable energy projects involving non-profits.

- Consult with Experts: Seek advice from tax professionals to ensure interpretations adhere to IRS guidelines and harness potential benefits legally.

Steps to Complete Necessary Understanding

Engaging with this document strategically ensures its productive use in financial planning relative to tax-exempt entities and tax credit applicability.

Analyze Complexities

- Regulatory Comprehension: Investigate bridges between tax exemptions, credits, and accelerated depreciation restrictions.

- Case-by-Case Assessment: Consider distinctive circumstances in solar energy acquisitions and usage by non-taxable organizations.

Utilize IRS Resources

- IRS Code Interpretation: Leverage additional resources for in-depth comprehension, ensuring clarity around complex legal information embedded within the document.

Who Typically Uses the Document

This detailed guidance primarily benefits stakeholders in renewable energy projects and legal advisors engaging with non-profit organizations.

Key Users

- Tax Advisors: Provide clarity on legal boundaries for tax benefits associated with renewable energy.

- Non-Profit Administrators: Understand potential financial impacts and compliance requirements when considering energy projects.

- Corporate Donors: Shape their philanthropic efforts and verify eligibility for tax incentives in collaborative projects.

Key Elements of the Document

Numerous segments in this IRS release highlight critical components and stipulations regarding the tax treatment of solar property involving non-profits.

Principal Features

- Tax Credit Eligibility: Defines circumstances under which donors cannot claim credits or depreciation if the property use involves tax-exempt entities.

- Legal Interpretations: Provides nuanced interpretations of complex tax situations, aiding in adherence to lawful practices.

Legal Use of the Document

Using the document correctly ensures lawful adherence to federal tax requirements.

Ensuring Compliance

By applying the IRS’s outlined stipulations, entities ensure their financial maneuvers involving solar installations for non-profits comply with federal tax laws.

IRS Guidelines

The document elaborates on how specific IRC sections impact the ability to claim tax benefits in relevant transactions.

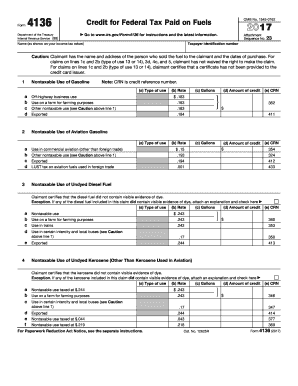

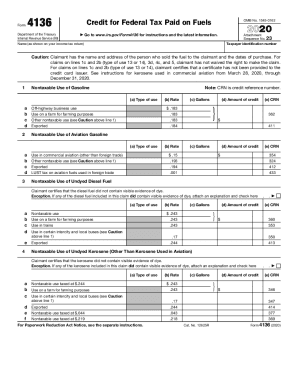

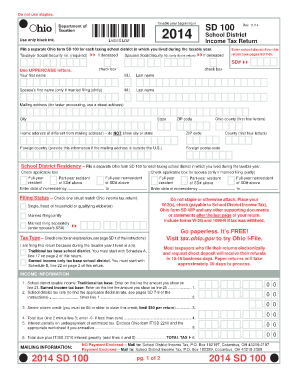

Relevant IRC Sections

- Section 168: Governs accelerated depreciation practice in certain contexts, key for solar energy usage.

- Section 48: Discusses investment credits, highlighting exceptions for property used by tax-exempt organizations.

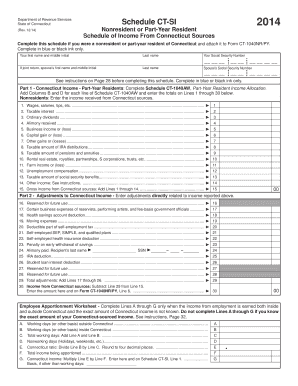

Filing Deadlines and Important Dates

While the 20224 document itself may not detail filing deadlines, its interpretations influence compliance timelines for involved parties.

Essential Timeframes

- Project Timing: Planning trades in alignment with both donor considerations and tax cycles is crucial for maximizing legal benefits under the outlined guidelines.

Software Compatibility

Accessing this document and integrating its guidance in broader tax software systems can facilitate compliance enforcement.

Tax Planning Software

- TurboTax, QuickBooks: Employing these platforms may require adjunct understanding of IRS rulings to properly incorporate guidance from addressed transactions involving solar energy and non-profits.

Penalties for Non-Compliance

Non-adherence to stipulations within the document may result in financial or legal penalties, highlighting the need for meticulous compliance instilled by the IRS.

Avoiding Repercussions

Failure to observe these precise guidelines could trigger audits or adjustments from the IRS, emphasizing a thorough understanding of constraints and opportunities detailed herein.