Definition & Meaning

The "Number 20070401F - IRS" seems to refer to an internal tracking or identification number used by the Internal Revenue Service (IRS). While it does not appear to be standard public-facing form like the W-2 or 1040, it could potentially relate to specific directives, memorandum, or internal documentation. Understanding such numbers typically requires contextual information about their origin, purpose, and the specific IRS program or initiative they relate to. This number might be part of accounting or administrative processes within the IRS, aimed at simplifying the organization and referencing of documents.

How to Use the Number 20070401F - IRS

When dealing with unique identifiers like "Number 20070401F - IRS," it’s crucial to know their precise application. Generally, these numbers guide IRS employees in hearings, audits, or correspondences related to specific internal matters. If an individual or entity encounters this number, especially in communications or official documents, it is vital to follow the accompanying instructions or contact the IRS for clarification. Users should document any interactions concerning this number to ensure they understand its context and implications fully.

Steps to Complete the Number 20070401F - IRS Process

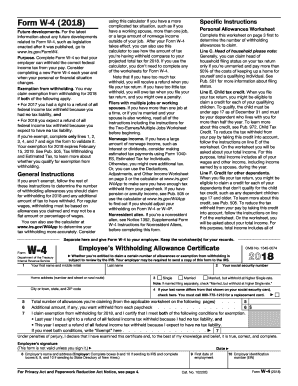

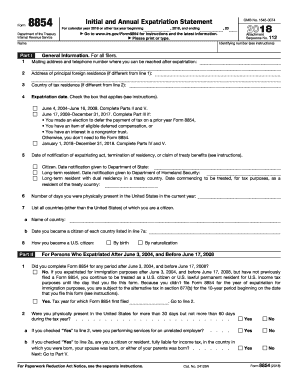

- Identify the Context: Determine where and why this number appears in your documentation or IRS correspondence. Understanding its purpose is critical.

- Gather Related Documents: Compile all documentation related to the number, including any supportive material provided by the IRS.

- Follow IRS Communications: Carefully read any IRS instructions or guidelines associated with this number. This includes understanding the proper forms and any required additional information.

- Contact IRS for Clarification: If any aspect of the process is unclear, reach out to the IRS through their official contact methods. IRS agents can provide further details and ensure you are correctly interpreting the number's usage.

- Document Interactions: Keep detailed records of any communications or transactions involving this number. This documentation can provide clarity and guard against misunderstandings.

Who Typically Uses the Number 20070401F - IRS

The primary users of "Number 20070401F - IRS" are likely those within the IRS. This can include agents, auditors, or legal staff handling internal processes. However, if individuals or entities encounter this number as part of tax-related queries or during interactions with the IRS, these users would include taxpayers, accountants, tax attorneys, and financial consultants. It is crucial for these external users to ascertain their role in any related process and follow compliance guidance carefully.

Important Terms Related to Number 20070401F - IRS

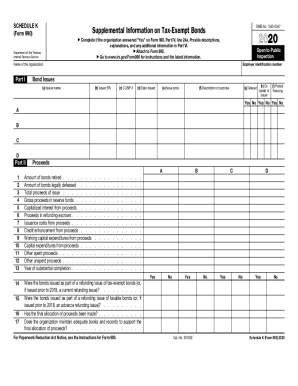

- IRS Identification Numbers: Codes or numbers the IRS uses to track tax accounts, compliance, or procedural documents.

- Internal Memo: A document utilized within organizations, like the IRS, for internal communication.

- Audit Trail: A record that shows who has accessed a computerized system and the operations performed.

- Taxpayer-specific Links: Direct connections to specific taxpayers, which might involve processes including collections or disputes.

IRS Guidelines

IRS guidelines about tracking numbers predominantly focus on security, privacy, and accurate record-keeping. When interfacing with tracking numbers like "Number 20070401F - IRS," stakeholders must ensure they adhere to data protection regulations, such as limiting access to sensitive information and confirming the identity of involved parties. Moreover, compliance with IRS instructions regarding such numbers is essential to maintain integrity and transparency in financial dealings.

Filing Deadlines / Important Dates

For numbers like "20070401F" relevant in IRS documentation, specific deadlines might be imposed depending on its context and usage. If related to compliance or audit responses, the IRS typically specifies a timeline for response or submission. Sticking to these deadlines prevents penalties and ensures timely resolution. Individuals and organizations should keep track of these dates and maintain a calendar of IRS-required actions.

Penalties for Non-Compliance

Failure to properly use or respond to IRS references like "Number 20070401F - IRS" can result in penalties ranging from administrative actions to fines. Non-compliance can further complicate tax matters, leading to more detailed audits or legal action. Consistent adherence to IRS guidance when handling any agency communications is necessary to avoid potential legal and financial consequences.

Form Submission Methods (Online / Mail / In-Person)

Without a clear public-facing form designation, form submission associated with "Number 20070401F - IRS" follows general IRS document procedure. Typically, methods available include:

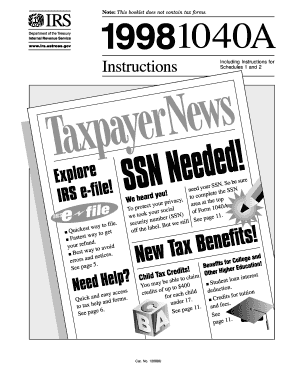

- Online Submission: Via IRS portals or through software that complies with IRS standards.

- Mail Submission: Sending documents to the designated IRS office address.

- In-person Submission: Directly delivering documents at IRS office locations when applicable.

Each method requires adherence to IRS specifications for accurate processing. Ensuring correct contact information, documentation completeness, and compliance with privacy provisions is essential.