Definition and Meaning

The "IG memo SBSE-04-1212-107 Substitute Printed, Computer-Prepared, and Computer-Generated Tax Forms and" is a directive primarily used within the U.S. Internal Revenue Service (IRS) framework. This memo facilitates the use of substitute forms that are printed, computer-prepared, or computer-generated as alternatives to official IRS tax forms. These substitutes must meet specific guidelines prescribed by the IRS to ensure accuracy, consistency, and compliance in tax reporting. These guidelines aim to provide taxpayers and tax preparers with the flexibility to use modern technology while maintaining the integrity of the information submitted to the IRS.

How to Use the IG Memo SBSE-04-1212-107

To use the IG memo SBSE-04-1212-107, individuals or organizations must ensure that the substitute tax forms they create conform to the IRS standards detailed in the memo. This includes verifying that all required fields are present, format guidelines are strictly followed, and the forms are readable and consistent. Users should also ensure that their software or manual processes for generating these forms incorporate the latest IRS updates. Usage involves:

- Ensuring all tax form fields are complete and correctly aligned.

- Verifying the readability and quality of the printed or computer-generated forms.

- Using software programs that are compatible with IRS tax computation standards.

Steps to Complete the Forms

-

Gather Required Information: Collect all necessary data, which may include financial records, personal identification details, and other pertinent tax-related information.

-

Select Appropriate Software or Tools: Use software known for accurate tax form computation that's compatible with IRS standards, such as TurboTax or QuickBooks.

-

Input Data Into the System: Enter all required data into the system. Ensure that information is exactly as it should appear on official IRS forms.

-

Review and Verify Accuracy: Cross-reference the entered data with original records to verify accuracy before proceeding to print or submit.

-

Generate the Form: Create a computer-prepared or printed version of the form following the IRS substitute form guidelines outlined in the memo.

-

Submit the Form: Choose the appropriate submission method - whether electronically or via mail, dependent on form type and IRS guidelines.

IRS Guidelines

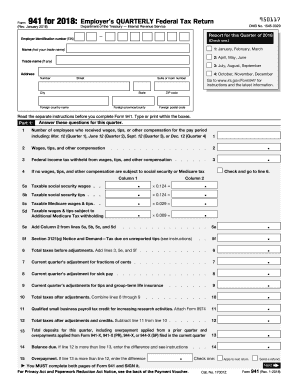

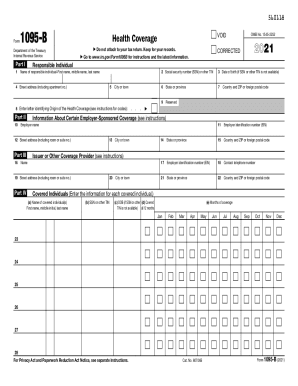

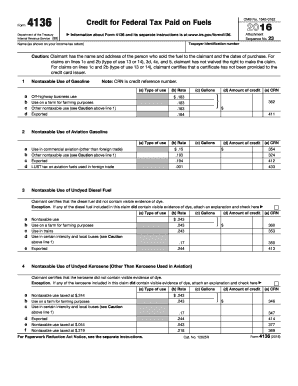

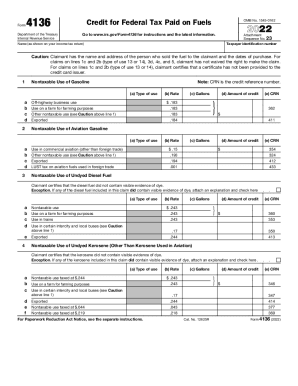

The IRS provides comprehensive guidelines to ensure substitute tax forms align with official standards. This includes specifications for layout, field placement, font size, and barcode requirements. It's imperative that users adhere strictly to these guidelines to ensure acceptance and prevent processing delays. The guidelines cover:

- The design and formatting requirements for substitute forms.

- Field-specific instructions to ensure accuracy in tax reporting.

- Compliance measures to prevent data errors and omissions.

Important Terms Related to IG Memo SBSE-04-1212-107

Understanding key terms associated with the IG memo is crucial for its proper application:

- Substitute Form: A tax form alternative that mimics an official IRS form.

- Tax Reporting Standards: Specific criteria set by the IRS for the preparation and submission of tax forms.

- IRS Compliance: Adherence to IRS regulations and requirements in tax documentation.

Legal Use of the IG Memo SBSE-04-1212-107

The memo authorizes taxpayers and preparers to utilize substitute forms under specific conditions prescribed by the IRS. Legal use ensures that the substitution does not compromise data integrity, accuracy, or the efficiency of tax data processing. Taxpayers must:

- Follow the IRS’s legal stipulations for substitute form creation and submission.

- Uphold confidentiality and integrity in handling and transmitting tax information.

- Ensure their use of substitute forms does not infringe on IRS regulations.

Required Documents

Before utilizing substitute tax forms, assemble all necessary documents including:

- Previous year’s tax returns for reference.

- Income statements, such as W-2s or 1099s.

- Receipts and records for deductible expenses.

- Identification documents for validation purposes.

These documents are vital for accurate data entry and completion of substitute forms.

Software Compatibility (TurboTax, QuickBooks, etc.)

Substitute tax forms created under the IG memo must be compatible with leading tax preparation software, which streamlines data input and ensures alignment with IRS standards. Compatibility ensures:

- Ease of data transfer from various accounting systems.

- Automatic updates of tax forms as per the latest IRS guidelines.

- Efficient processing and submission of tax documentation.

Reliable software options include TurboTax, QuickBooks, and various IRS-approved platforms that integrate seamlessly with substitute tax form generation.

Digital vs. Paper Version

The choice between digital and paper versions of these substitute forms can impact processing efficiency and data management. While digital forms are more convenient for electronic filing and record-keeping, paper versions may still be necessary for certain submissions or when preferred by the filer. Considerations include:

- Digital versions offer quick edits and rapid electronic submissions.

- Paper forms provide a tangible backup and may be essential for specific filing procedures.

- Compliance with IRS electronic filing requirements when choosing digital options.

By understanding these key aspects, users can maximize the potential of the IG memo SBSE-04-1212-107 and maintain adherence to IRS tax form requirements, thus facilitating efficient tax form processing and administration.