Definition & Meaning

The Regular Homestead Application is a form used by property owners in the United States, specifically in states like Minnesota, to apply for homestead status, which can provide significant tax benefits. Homestead status typically allows homeowners to reduce the cost of their property taxes on their principal residence. By declaring a property as a homestead, owners might be eligible for credits, both at state and local levels, that lower their overall property tax burden.

Importance of Declaring Homestead Status

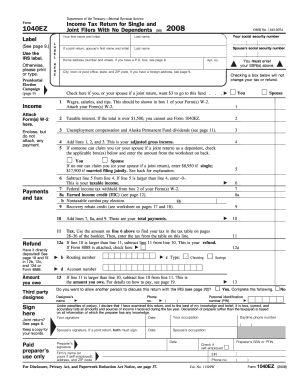

- Tax Reductions: Allows a reduction in the taxable value of the home.

- Homeownership Benefits: Confirms property ownership and primary residence status, often making homeowners eligible for specific benefits.

- Protection from Creditors: In some jurisdictions, declaring a homestead can offer a degree of protection against creditors, as it often limits the liability on an indebted homeowner’s primary residence.

How to Use the Regular Homestead Application

Using the Regular Homestead Application effectively requires a clear understanding of its purpose and requirements. The process involves gathering specific information about the property and its occupants, which is essential for the application to be considered valid.

Necessary Information for Application

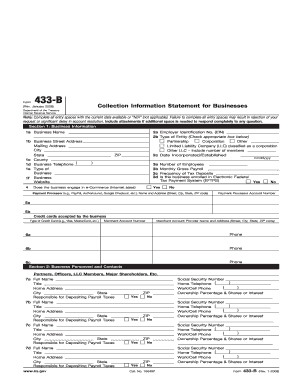

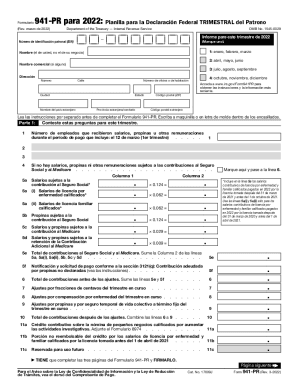

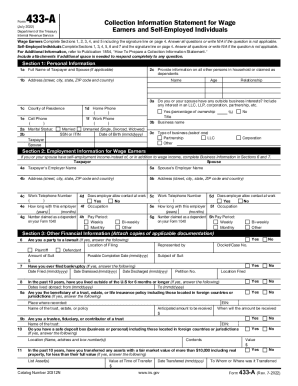

- Property Details: Description of the property, including address and legal description.

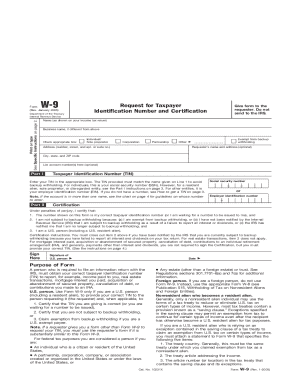

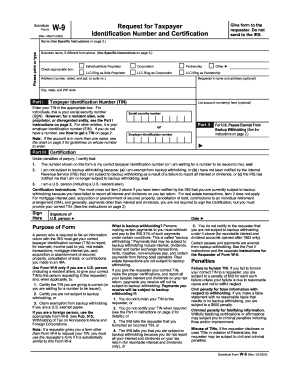

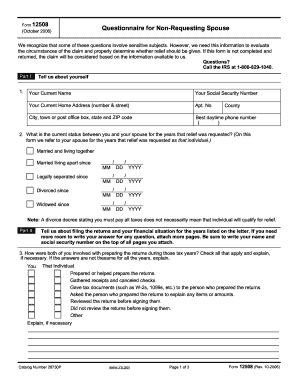

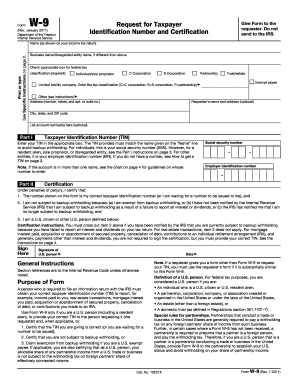

- Occupant Information: Names and Social Security numbers of the owner(s) and occupants.

- Spouse Information: Details if applicable, even if the spouse isn't listed on the property title.

Online and Physical Form Use

- Online Forms: Accessible through state-specific websites or PDF format for electronic filing.

- Paper Forms: Available at county offices or through mail requests for those preferring non-digital methods.

Steps to Complete the Regular Homestead Application

Completing the Regular Homestead Application involves several critical stages:

- Gather Required Documentation: Including proof of residency and property ownership.

- Fill Out Property and Occupant Sections: Ensure accurate and honest input of all required fields.

- Signature and Verification: Verify all information before signing.

- Submission Deadline: Submit the complete application by the specific deadline to qualify for the tax year.

Section-by-Section Guidance

- Property Section: Provide detailed descriptions, including parcel number.

- Occupants Section: Include all residents occupying the property.

- Additional Sections: May require additional documentation for specialized conditions or exemptions.

Eligibility Criteria

The eligibility for filing a Regular Homestead Application varies slightly from state to state but generally includes:

- Primary Residency Requirement: The property must be the owner’s principal place of residence.

- Ownership: Applicant must have legal ownership of the property.

- Residency Duration: Criteria such as length of residence might apply; typically must reside for more than a certain number of months in a year.

Common Conditions

- Single-Family Homes: Often eligible if they serve as the primary residence.

- Multi-Family Units and Farms: May include eligibility specifics based on unit configurations and usage.

Filing Deadlines / Important Dates

Timely submission is crucial as it directly impacts tax benefits for that fiscal year.

Key Deadlines to Remember

- Annual Application Due Date: Typically by December 15 for states like Minnesota.

- Renewal or Re-filing: Periodically required, usually annually, depending on state guidelines.

Consequences of Missing Deadlines

- Missing the deadline may result in a missed opportunity for tax savings for that tax year.

- Late applications could lead to disqualification from benefits until the next filing period.

Required Documents

Submitting a complete and accurate application usually involves attaching several documents:

- Proof of Ownership: Deed or title showing ownership details.

- Proof of Residency: State IDs, utility bills, or voter registration showing the address.

- Additional Identification: May need Social Security numbers or federal tax returns for identity verification.

Document Submission Tips

- Ensure that all documents are up-to-date and legible copies.

- Some jurisdictions may require notarization of certain statements.

Penalties for Non-Compliance

Failure to comply with rules or providing false information can lead to significant penalties.

Common Penalties

- Fines or Legal Repercussions: For knowingly providing false statements.

- Revocation of Benefits: Loss of homestead status and possible retroactive tax assessments.

Preventing Non-Compliance

- Review state laws specific to the homestead declaration.

- Ensure thorough and honest documentation and representation of all required information.

Legal Use of the Regular Homestead Application

Filing the Regular Homestead Application has specific legal implications which vary by state.

Legal Considerations

- Document Accuracy: Legal obligation to provide truthful information.

- Tax Implications: Understanding how homestead status affects tax liability and benefits.

Advisory for Legal Compliance

- Engage with legal or tax professionals to ensure all documentation meets legal standards.

- Keep updated records to provide necessary evidence in case of audits or requests from tax authorities.