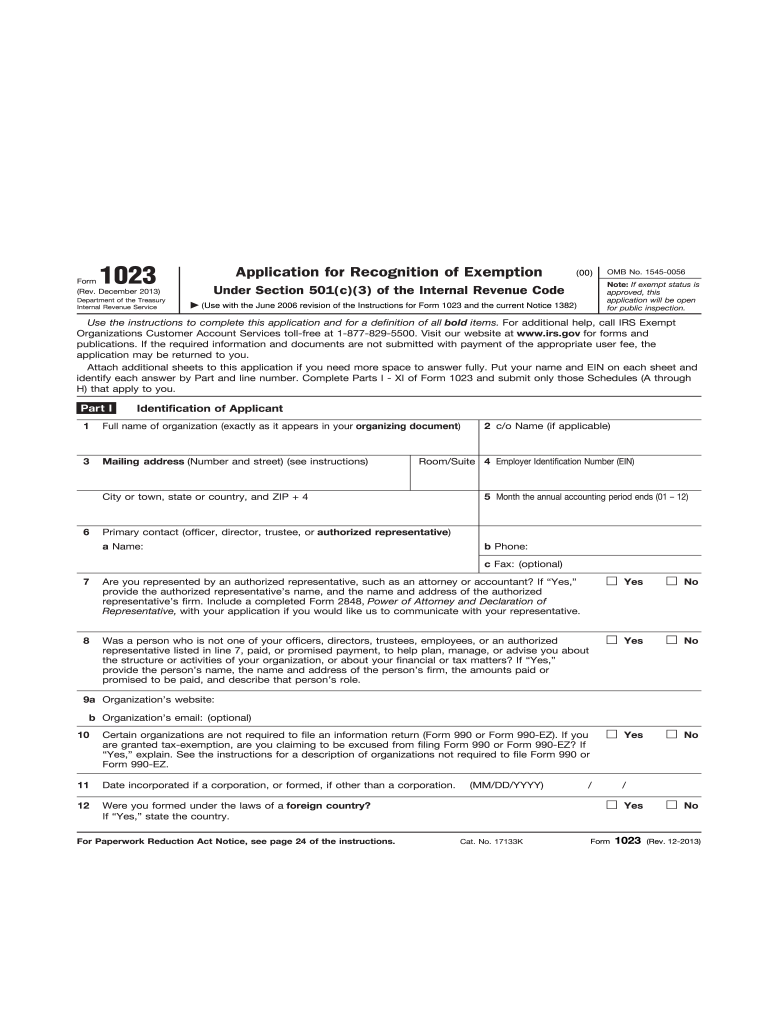

Definition and Purpose of Form 1023

Form 1023 is an application used by organizations to apply for recognition of exemption from federal income tax under section 501(c)(3) of the Internal Revenue Code. This designation is critical for non-profits because it allows them to be exempt from federal income tax, receive tax-deductible charitable contributions, and access other benefits that facilitate their operations. Organizations primarily involved in religious, charitable, scientific, or educational activities typically use this form to formalize their non-profit status, ensuring compliance with federal tax regulations.

Key Elements of the 2 Form

The 2013 version of Form 1023 includes several important sections that applicants need to complete. Each part requires specific information about the organization:

- Part I: Identification of Applicant - Requires basic details like the organization's name, address, and EIN.

- Part II: Organizational Structure - Inquires about the legal structure, like articles of incorporation or articles of organization.

- Part III: Required Provisions in Your Organizing Document - Ensures that the organization's documents include the necessary clauses for 501(c)(3) status.

- Part IX: Financial Data - Necessitates accurate reporting of current and past financial activities and forecasts for the next three years.

Adequate completion of these sections is crucial as they form the basis for the IRS's decision-making process regarding exemption status.

Steps to Complete the 2 Form

-

Gather Required Information: Before starting, collect all necessary organizational documents, financial records, and details about the structure and mission.

-

Fill Out Identification Details: Complete Part I with accurate information about the organization.

-

Proof of Organizational Structure: Attach copies of your articles of incorporation, bylaws, and any relevant organizational documents as requested in Part II.

-

Include Financial Data: Use Part IX to provide detailed financial documentation, including revenues, expenses, and projection.

-

Submit Additional Schedules: Depending on the organization's activities, additional schedules or attachments may be required, such as Schedule B for political activities.

-

Review and Finalize: Carefully check all information for accuracy and completeness before submission to avoid processing delays.

Eligibility Criteria for Filing Form 1023

Eligibility for filing Form 1023 primarily hinges on the organization’s mission aligning with the 501(c)(3) requirements. Generally, organizations must operate exclusively for religious, charitable, scientific, or educational purposes. Moreover, no part of their earnings should benefit private shareholders or individuals, and they must not engage significantly in political campaigns or lobbying activities.

Organizations that do not meet these criteria may need to file Form 1023-EZ, a simplified version for smaller entities or those with gross receipts normally not exceeding $50,000.

IRS Guidelines for 2 Form

The IRS provides specific guidelines for completing and submitting Form 1023. These guidelines clarify:

- Document Format: All documentation must be clear, legible, and complete.

- User Fees: The application requires payment of a fee, which varies based on the organization's gross receipts.

- Submission Method: The form may be submitted electronically through the IRS website to expedite processing.

Adhering to these guidelines is critical to ensuring that applications are processed efficiently and accurately.

Legal Use of the 2 Form

Once granted, the 501(c)(3) status affirms that the organization legally operates as a non-profit exempt from federal taxes. Maintaining this status requires ongoing compliance with specific regulations, such as filing annual returns and ensuring mission-related expenditures.

Failing to adhere to these legal standards can result in revocation of tax-exempt status, back taxes, and penalties, substantially impacting the organization's sustainability and reputation.

Important Terms Related to Form 1023

- EIN: Employer Identification Number, a unique number assigned for tax purposes.

- Bylaws: Internal rules governing the organization’s operations and management.

- Non-Profit: An organization that uses its surplus revenue to achieve its goals rather than distributing it as profit or dividends.

Understanding these and other relevant terms is essential for accurately completing the form and maintaining compliance with IRS regulations.

Penalties for Non-Compliance with Form 1023 Requirements

Filing Form 1023 incorrectly or failing to comply with its requirements can result in significant repercussions, including:

- Loss of Tax-Exempt Status: Organizations may lose their tax-exempt status if they fail to meet the ongoing IRS criteria.

- Financial Penalties: Incorrect financial data or incomplete forms can lead to fines or additional taxes.

- Legal Consequences: Misrepresentation of an organization’s purpose or activities can lead to legal investigations or sanctions.

To prevent these issues, meticulous attention to detail is crucial when completing Form 1023, along with adherence to IRS regulations post-approval.