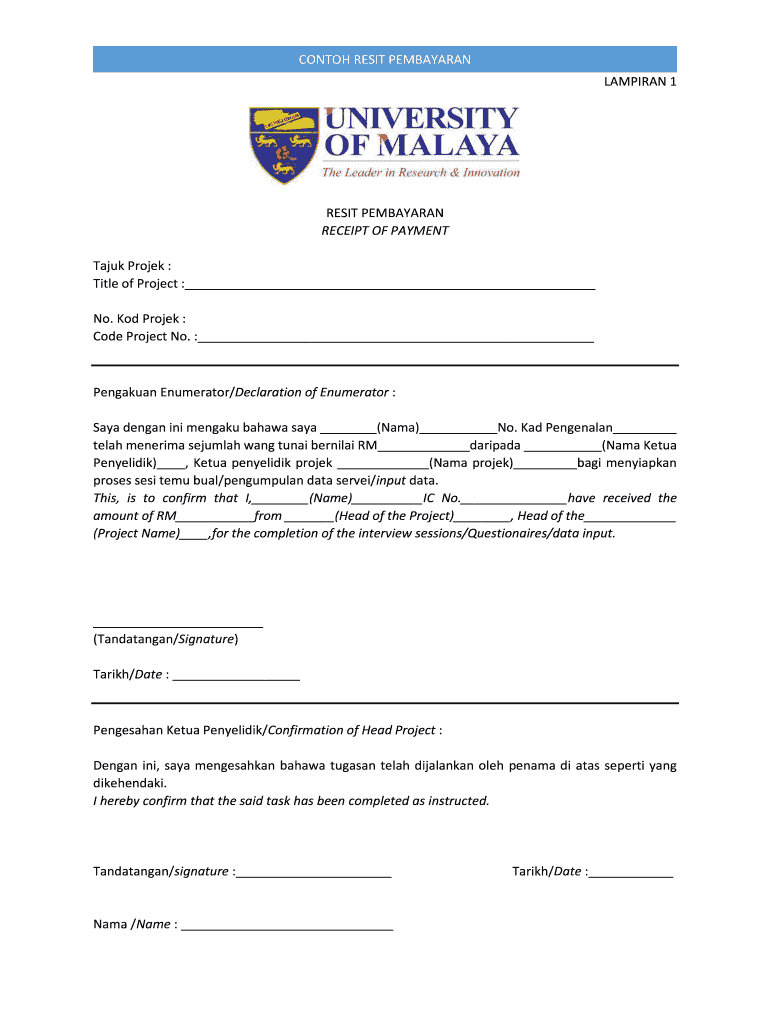

Definition and Meaning of Resit Bayaran

Resit bayaran is a formal document acknowledging the receipt of payment for goods or services rendered. This document serves as proof of a financial transaction, outlining essential details such as the amount paid, date of payment, purpose, and the parties involved in the transaction. It plays a crucial role in financial accounting, tax submissions, and record-keeping for both individual and business transactions.

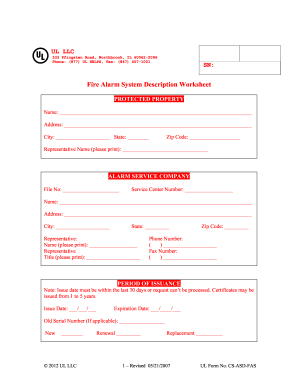

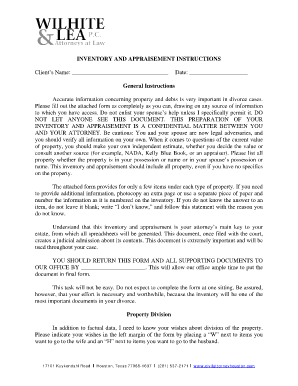

Key Components of a Resit Bayaran

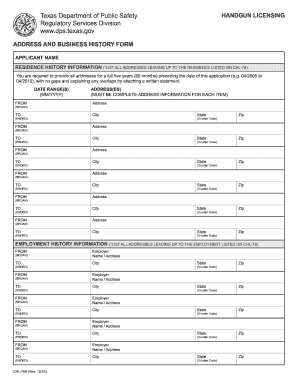

- Payee and Payer Information: Includes names and contact details of the individual or entity receiving payment and the one making the payment.

- Date of Payment: The specific date when the payment was made, which is important for accounting and tax purposes.

- Description of Services or Goods: A clear, concise description outlining what the payment was for, providing context to the financial transaction.

- Amount Paid: The total amount that was transacted, often itemized in case of multiple services or goods.

- Signature: Often, the document may require signatures of authorized individuals for verification.

Having a clear understanding of what constitutes a resit bayaran ensures that parties involved keep accurate records, which is vital for future reference and financial audits.

How to Use the Resit Bayaran

Using a resit bayaran properly ensures its effectiveness as a formal acknowledgment of payment. Different contexts may require variations in usage, depending on the nature of the transaction.

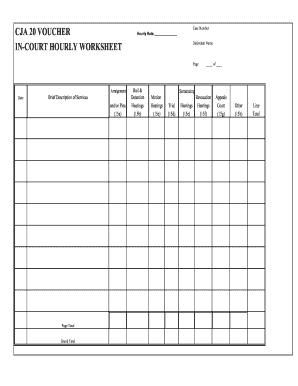

Steps for Using the Resit Bayaran

- Complete the Document: Fill in all relevant information such as names, contact details, and specifics about the transaction.

- Obtain Necessary Signatures: Ensure that both the payer and payee sign the document if required, to authenticate the transaction.

- Distribute Copies: Provide one copy to the payer and retain one copy for your records. This is critical for maintaining accurate financial documentation.

- Digital Accessibility: Use tools like DocHub to create, edit, and manage the resit bayaran online, enhancing accessibility.

Scenarios Where a Resit Bayaran is Used

- Freelance Work: A freelancer provides services and requires a payment receipt for their client.

- Retail Transactions: When a customer purchases a product, the store issues a receipt as proof of purchase.

- Event Booking: Deposits for venue bookings often require a receipt confirming the transaction.

Adhering to these steps will ensure that the resit bayaran serves its purpose effectively and with legal backing.

Steps to Complete the Resit Bayaran

Completing a resit bayaran requires careful attention to detail to ensure accuracy and compliance with relevant financial regulations.

Detailed Procedure for Completing the Form

- Header Section: Clearly label the document as "Resit Bayaran" at the top of the page.

- Input Basic Information:

- Enter the date of the transaction.

- List the names and contact information of both the payer and payee.

- Describe the Transaction:

- Provide a detailed description of the goods or services exchanged.

- Include any relevant transaction IDs or references if applicable.

- Financial Details:

- State the total amount received.

- If applicable, break down the amount by line items for clarity.

- Signatures:

- Print and sign where required to authenticate the document.

Examples of Form Fields

- Date: January 10, 2023

- Payer Name: John Doe

- Payee Name: ABC Services Inc.

- Description: Payment for graphic design services

- Total Amount Paid: $500

Completing these steps thoroughly ensures that the resit bayaran is valid and acceptable for both parties involved.

Who Typically Uses the Resit Bayaran

Various individuals and entities utilize the resit bayaran in different contexts, highlighting its versatility and importance in financial transactions.

Common Users of Resit Bayaran

- Freelancers and Contractors: To acknowledge payments from clients for services rendered.

- Retail Businesses: To provide customers with proof of purchase after a transaction.

- Event Planners: To confirm payments made for venue rentals or services.

- Educational Institutions: To recognize tuition or fee payments from students or guardians.

By understanding the typical users of a resit bayaran, individuals and businesses can better appreciate its significance in maintaining financial integrity and transparency.

Important Terms Related to Resit Bayaran

Familiarizing oneself with terminology associated with resit bayaran enhances clarity when handling financial transactions and records.

Key Terms to Know

- Invoice: A detailed statement of goods or services provided, often preceding the payment.

- Payment Receipt: Another term often used interchangeably with resit bayaran, denoting proof of payment.

- Transaction Record: A complete record of financial exchanges, including payments both received and made.

- Proof of Payment: Any documentation that serves as evidence that payment has been made.

- Fillable Form: A digital version of the resit bayaran that allows users to input information easily prior to printing.

Understanding these terms is crucial for anyone engaging in financial transactions or needing to issue or receive a resit bayaran.

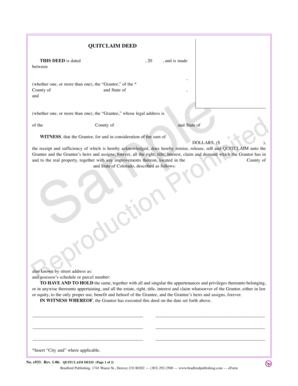

Legal Use of the Resit Bayaran

A resit bayaran not only serves as a receipt but also has legal implications in various contexts, ensuring both parties are protected.

Legal Considerations

- Acknowledgment of Payment: It serves as legal proof that a specific payment has been made, which can be referenced in disputes.

- Tax Documentation: Recognized by tax authorities, it helps keep accurate records that are essential during audits or tax submissions.

- Contractual Evidence: In certain cases, it forms part of a contractual agreement, backing claims made in business transactions.

By recognizing the legal implications of a resit bayaran, individuals can ensure compliance with financial regulations and safeguard their interests in any dispute.

Examples of Using the Resit Bayaran

Real-world examples help illustrate how a resit bayaran is utilized effectively within different transactions.

Practical Applications

- Example One: A graphic designer completes a project for a client and issues a resit bayaran confirming receipt of payment, detailing the services rendered.

- Example Two: A catering company provides food services for an event and gives the party organizer a resit bayaran post-payment for accounting records.

- Example Three: In a school setting, parents might receive a resit bayaran upon payment of fees, which can later be used as proof for tax deductions relevant to education expenses.

These examples demonstrate the resit bayaran’s relevance across varying scenarios, reinforcing its function in both personal and professional contexts.