Definition and Purpose of the FAFSA Form

The Free Application for Federal Student Aid, commonly known as FAFSA, is a critical document used to apply for federal grants, loans, and work-study funds. It is essential for students seeking financial aid for post-secondary education. The form requires detailed information about a student's household finances, including both assets and debts. This form helps determine eligibility for federal student aid by analyzing the financial strength of the student's and their family's current circumstances.

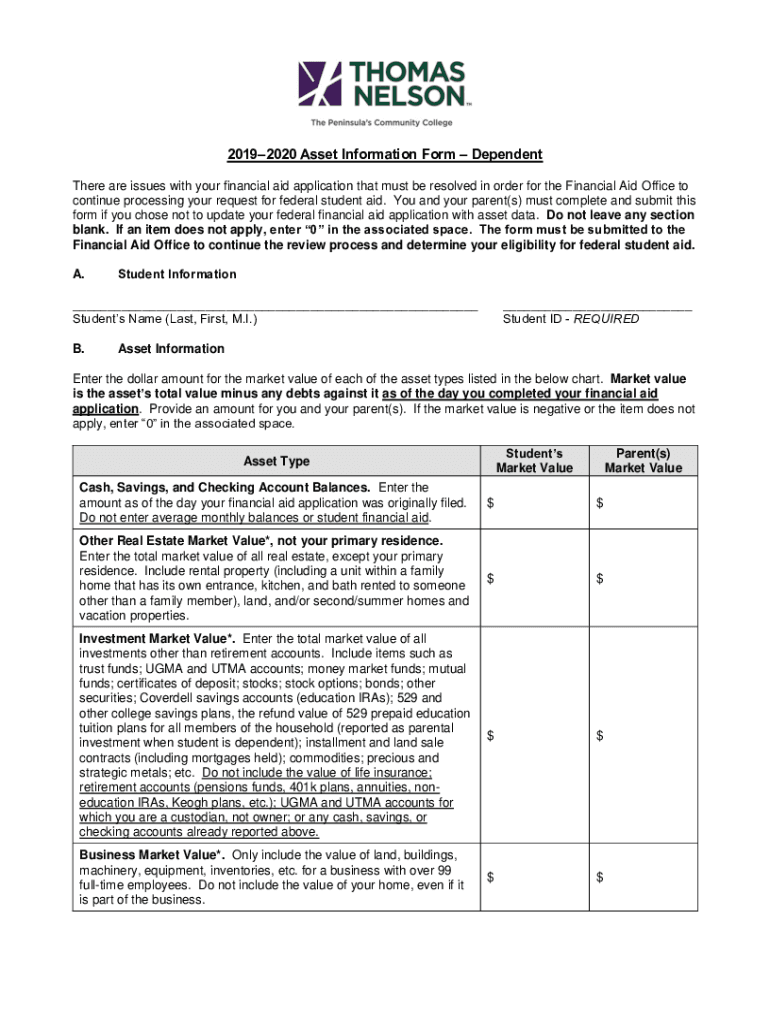

Important Assets and Debts to Report on the FAFSA

When completing the FAFSA, specifically the "Which Assets and Debts are Reported on the FAFSA" section, it is crucial to provide precise information on various financial components. Key assets that must be reported include cash on hand, current bank account balances, and investments such as stocks, bonds, and real estate holdings excluding the family's principal home. Additionally, college savings plans such as 529 plans must be accounted for. On the debts side, families should list debts that are directly associated with investments, such as mortgages on rental properties.

Steps to Complete the FAFSA Form

- Gather Required Financial Documents: Collect federal tax returns, W-2s, and records of untaxed income.

- Create an FSA ID: A Federal Student Aid ID is needed for signing the form electronically.

- Access the FAFSA Form Online: Visit the official FAFSA website to begin the application process.

- Provide Personal and Household Information: Fill in details such as Social Security Number and family structure.

- Report Financial Information: Enter details about assets and debts as mentioned in the previous section.

- List Schools to Receive Your Information: Include all post-secondary institutions you are considering.

- Sign and Submit the FAFSA: Use your FSA ID to sign the form and submit it electronically.

Key Terminology and Definitions

- Expected Family Contribution (EFC): The measure of a family's financial strength used to determine aid eligibility.

- Assets: Financial resources like savings, investments, and properties excluding the main residence.

- Debts: Financial obligations related to investments and income-generating properties.

Legal Implications of Submitting the FAFSA

Accurate and honest reporting on the FAFSA is not only ethical but legally required. Misrepresentation of financial information can lead to serious consequences, including fines or debarment from receiving aid. FAFSA submissions are subject to verification processes, ensuring all reported details meet federal guidelines.

Eligibility Criteria for Federal Student Aid

Eligibility for federal student aid through FAFSA depends on citizenship status, possession of a valid Social Security Number, and enrollment as a regular student in an eligible degree or certificate program. Students must show a financial need and maintain satisfactory academic progress in college or career school.

Form Submission Methods

FAFSA can be submitted online, which is the recommended and fastest method. An online submission offers several advantages, like error-checking in real-time and immediate submission confirmation. Alternatively, students can submit a paper version by mailing it, though this method takes longer to process.

Required Documentation for Form Completion

- Social Security Numbers: Needed for both students and parents.

- Driver’s License Numbers: Provides additional identification verification.

- Records of Taxable Income: Including W-2 forms and tax return documents.

- Records of Untaxed Income: Such as child support or veteran’s noneducation benefits.

- Current Bank Statements: Essential for accurately reporting cash and savings.

Examples of Using FAFSA Effectively

Consider a student whose family owns a small business. To properly complete the FAFSA form, the student should include the net worth of the business if it employs over 100 full-time employees. This example illustrates the complexity some applicants may face and the necessity of understanding which assets need to be declared.

Filing Deadlines and Important Dates

Filing the FAFSA early is beneficial as some financial aid programs operate on a first-come, first-served basis. The federal deadline for FAFSA submission is typically June 30 of the academic year for which aid is requested. However, individual states and colleges may have their deadlines, which are often earlier. It is crucial to check these dates annually to ensure timely filing.

Digital vs. Paper Version of the FAFSA

Submitting the FAFSA digitally is the most efficient approach, offering quicker processing times and immediate feedback on any errors. The digital platform allows applicants to save the progress and complete the form at their own pace. In contrast, the paper form is more time-consuming as it requires manual assistance and longer mailing times.

Tips for Smooth FAFSA Completion

- Prepare Early: Start gathering documents well ahead of time to avoid last-minute scrambling.

- Stay Organized: Keep a checklist of required information and documents.

- Seek Assistance: Contact financial aid advisors or use FAFSA support if uncertain about any section.

- Review Carefully: Double-check all entries to ensure accuracy before submission.

By adhering to these guidelines and understanding the intricacies of the FAFSA process, applicants can maximize their opportunities for securing financial aid for their education.