Definition and Purpose of Massachusetts ST-10 Form

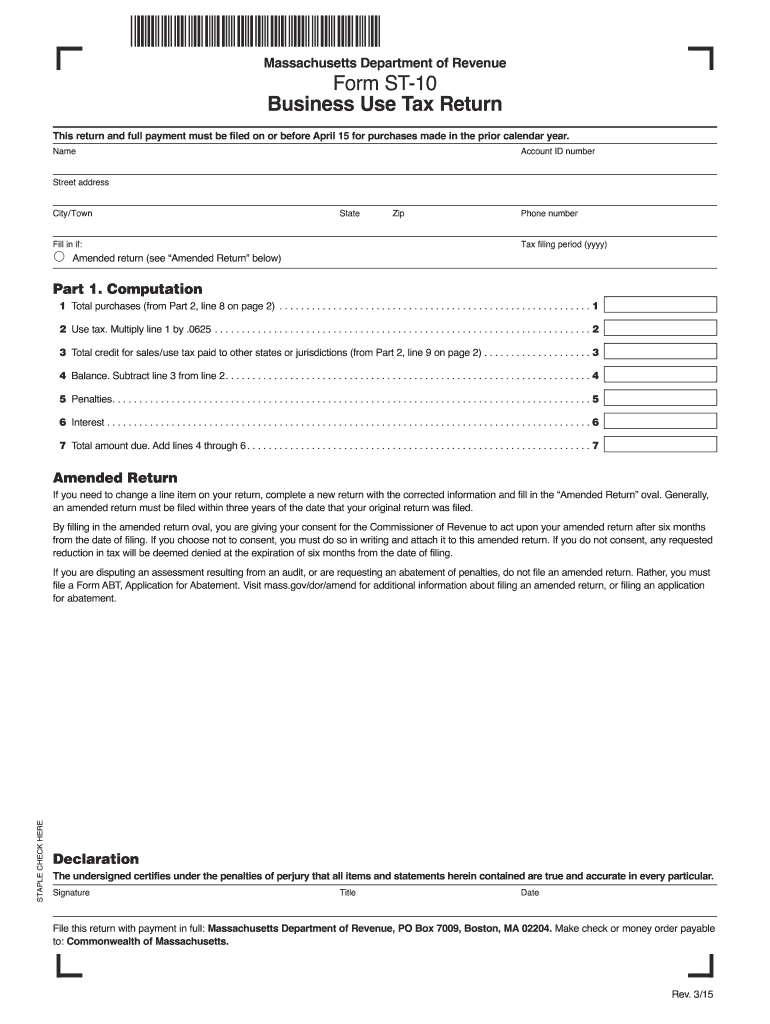

The Massachusetts Department of Revenue Form ST-10, commonly known as the MA ST-10 form, is a Business Use Tax Return utilized for reporting and remitting use tax on purchases made in the previous calendar year. This tax is applicable when sales tax was not collected at the point of sale on out-of-state purchases. The form requires comprehensive information, including taxpayer details and total purchase amounts, to calculate the appropriate use tax. Additionally, it allows taxpayers to claim credits for sales taxes paid to other jurisdictions. A key aspect is the declaration under penalties of perjury, ensuring the truthful and accurate submission of the form.

Steps to Complete the MA ST-10 Form

Completing the MA ST-10 form involves several key steps:

-

Fill in Taxpayer Information:

- Enter your business name, address, and taxpayer identification number.

- Provide detailed contact information to facilitate communication with the Department of Revenue.

-

Calculate Use Tax:

- List total purchases subject to use tax and apply the Massachusetts use tax rate.

- Deduct any credits for taxes paid to other states.

-

Complete the Declaration:

- Sign the form under penalties of perjury, attesting to the accuracy of the provided information.

-

Submit the Form:

- Ensure timely submission by the April 15 deadline to avoid potential penalties or interest.

How to Obtain the MA ST-10 Form

Securing the MA ST-10 form is straightforward:

-

Online Access:

- The form is available for download on the Massachusetts Department of Revenue’s official website.

-

Physical Copies:

- You can request a paper copy by contacting the Department of Revenue or visiting their local offices.

-

Third-party Software Integration:

- The form may be accessible through tax preparation software that supports Massachusetts tax filings.

Legal Use and Compliance Requirements

The MA ST-10 form ensures compliance with Massachusetts tax laws regarding the use tax:

-

Legal Obligation:

- Businesses are required to file this form if they owe use tax on out-of-state purchases.

-

Compliance Measures:

- Accurate reporting is monitored, with audits possible for discrepancies.

-

Penalties for Non-compliance:

- Failing to file or incorrect submissions may result in penalties, interest, and potential legal actions.

Who Typically Uses the MA ST-10 Form

The form is primarily used by businesses operating in Massachusetts:

-

Retailers and Wholesalers:

- Commonly required when purchasing inventory from out-of-state suppliers.

-

Service Providers:

- Companies purchasing equipment or supplies from states without sales tax agreements with Massachusetts.

Key Elements of the MA ST-10 Form

Important sections of the form include:

-

Taxpayer Identification and Contact Information:

- Essential for proper processing and record keeping.

-

Use Tax Calculation:

- Central to the document, requiring precise data entry for correct tax computation.

-

Credit Clauses:

- Enables deduction of taxes already paid in other states from the use tax owed.

Filing Deadlines and Important Dates

The MA ST-10 form has specific deadline requirements:

-

Annual Submission:

- Must be filed by April 15 for the previous calendar year's purchases.

-

Extensions and Amendments:

- Specific processes exist for requesting filing extensions or amending previously submitted returns.

Differences Between Digital and Paper Versions

The method of form submission can impact the filing process:

-

Digital Submission:

- Often faster and may provide instant confirmation and tracking of submission status.

-

Paper Filing:

- Requires mailing to specific addresses, with potential for delays. Ensure postal services' delivery times align with filing deadlines.

By providing comprehensive insights into these critical aspects of the MA ST-10 form, businesses can better understand their obligations and efficiently manage their use tax responsibilities.