Definition & Meaning

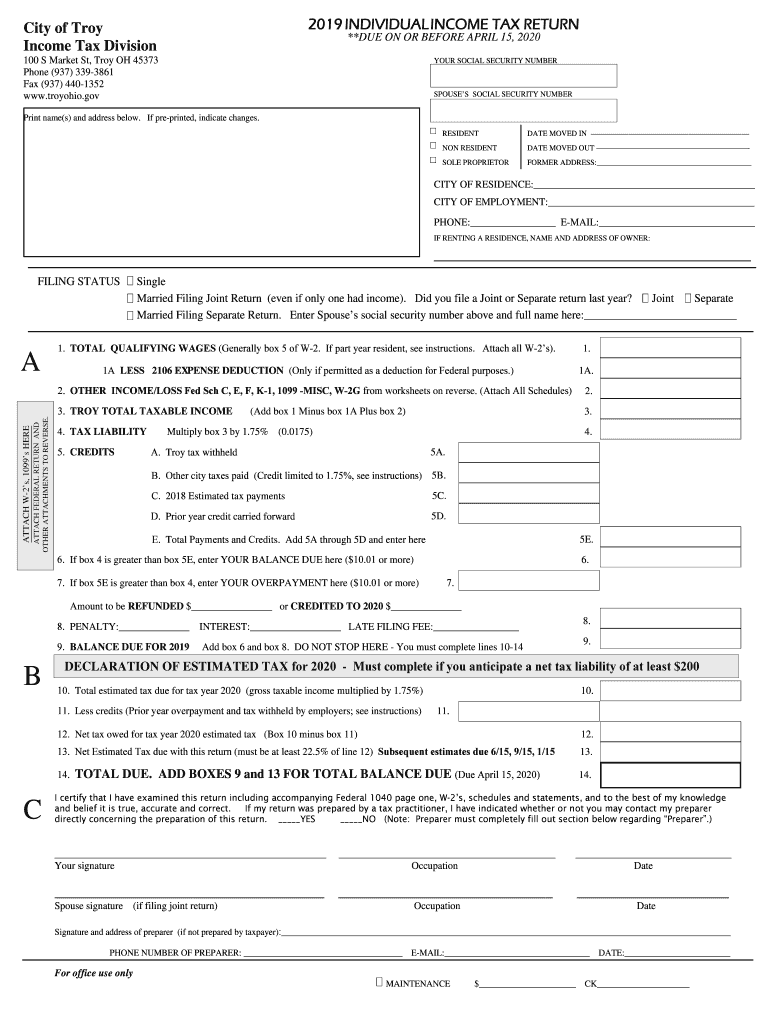

The 2019 Individual Income Tax Return for the City of Troy, Ohio, is a local tax form used primarily by residents and those who earned income within Troy in 2019. This form is essential for reporting personal income, calculating local tax obligations, and determining any credits or penalties. It includes various sections where filers need to provide their personal information, report their income, and document any pertinent financial details related to their tax situation.

- Purpose: To ensure compliance with local tax regulations and facilitate the collection of necessary taxes from individuals who either reside in or earn income within Troy.

- Scope: Covers income reporting, tax calculation, applicable credits, and any penalties that may apply.

Key Elements of the Form

The form consists of several critical components, each serving a specific function in the tax calculation and reporting process.

- Personal Information: This section collects basic data about the filer, including name, address, and social security number.

- Income Reporting: Requires detailed information on different income sources, including wages, salaries, and other personal revenues.

- Tax Calculations: Details the procedures for calculating the total taxes owed after considering all income, deductions, and applicable credits.

- Credits and Penalties: Includes areas to document eligible credits and any penalties for late payments or underpayment of taxes.

Steps to Complete the Form

Completing the City of Troy's 2019 income tax return involves several stages, ensuring all information is accurate and comprehensive.

- Gather Necessary Documents: Collect all relevant financial documents, including W-2s, 1099s, and federal tax returns.

- Fill Out Personal Information: Ensure all personal details are accurately entered in the corresponding sections.

- Report All Income: Enter information from your W-2s and any other income documentation into the income sections.

- Calculate Taxes Owed: Use the form's guidelines to compute the taxes you owe.

- Include Credits and Penalties: Fill in any applicable credits and penalties.

- Review for Accuracy: Double-check all entries for correctness before submission.

- Submit Form: Submit the completed form via the chosen method, such as online or mail.

Required Documents

Prior to filing the form, having a complete set of documentation is crucial for accuracy and compliance.

- W-2 Forms: To report wages and salaries.

- 1099 Forms: For additional income sources not covered under W-2.

- Previous Year’s Federal Return: To ensure consistency and verify prior filings.

- Receipts for Deductible Expenses: If applicable, to substantiate claims for deductions.

Filing Deadlines / Important Dates

Filing deadlines are critical to avoid penalties and ensure timely processing.

- April 15, 2020: Standard deadline for submission, aligning with federal tax deadlines.

- Late Filing: Potential penalties apply for submissions post-deadline.

Penalties for Non-Compliance

Failure to correctly file the City of Troy's 2019 tax return can result in various penalties.

- Late Filing Penalty: Incremental charges based on the period of delay.

- Underpayment Penalty: Applicable if taxes paid are less than owed.

- Interest on Late Payments: Interest accrues over time for unpaid taxes.

How to Obtain the Form

Obtaining the form is straightforward for taxpayers in the City of Troy.

- Online: Download from official city websites or tax portals.

- In-Person: Available at local tax offices or city government facilities.

- Mail: Request a physical copy to be sent to your address.

Software Compatibility

Compatibility with various tax preparation software can streamline the filing process.

- TurboTax and QuickBooks: Popular programs that can assist in completing the form quickly.

- DocHub Integration: Use DocHub for editing and signing the form digitally, ensuring accessibility and ease of use.

Taxpayer Scenarios

Different scenarios require specific attention when filling out the tax return.

- Self-Employed Individuals: Must include additional documentation for business income.

- Retirees: Considerations for pension and social security income.

- Students: Possible eligibility for educational credits or deductions based on educational expenses.

State-Specific Rules

While this form pertains to Troy, Ohio, understanding its alignment with Ohio state tax laws is beneficial.

- Residency Requirements: Different criteria for full-time residents versus part-time residents or those earning income in the city while residing elsewhere.

- Local Tax Rates: Specific rates applicable to Troy that may differ from those in other Ohio municipalities.