Definition & Meaning

The "Form FTB 2006" is an official document used by the California Franchise Tax Board. It is typically used by taxpayers in California to report particular tax-related information. While folding tax forms is not recommended due to potential issues related to scanning and processing, understanding this form's purpose and role in tax filing can be beneficial. It often serves as a supplementary form to other primary tax documents, ensuring comprehensive tax reporting.

How to Use the Form FTB 2006

To effectively use Form FTB 2006, follow these steps:

- Download the Form: Begin by downloading the form from the official California Franchise Tax Board (FTB) website or obtain a hard copy from an authorized location.

- Read the Instructions: Carefully go through the accompanying instructions to understand the details required.

- Fill Out the Form: Use black or blue ink or type directly on the digital form if available. Ensure all required fields are completed accurately.

- Double-Check Information: Verify the accuracy of the information provided to prevent errors during processing.

- Submit the Form: Depending on your preference, either submit it online through the FTB's digital platform or mail the completed form to the provided address.

Steps to Complete the Form FTB 2006

Completing Form FTB 2006 involves several key steps:

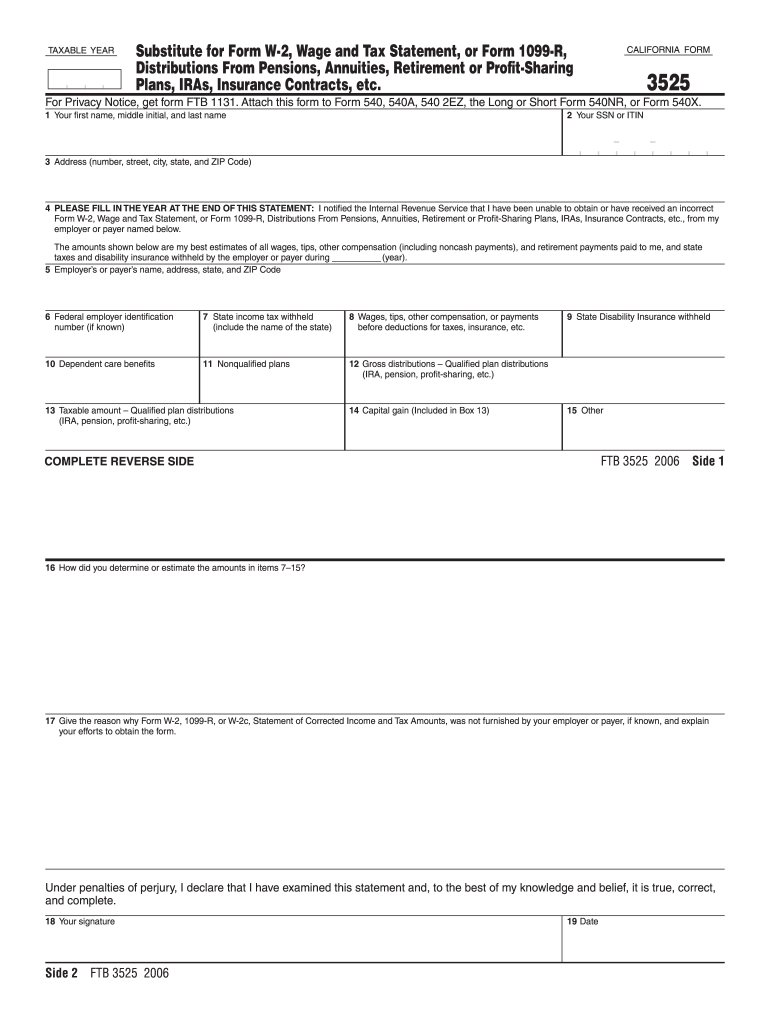

- Identify Taxpayer Information: Start by clearly entering your personal information such as name, social security number, and address.

- Input Tax Details: Follow the instructions to input any specific tax-related figures or data necessary for your situation.

- Attach Necessary Documentation: If required, include additional forms or supporting documentation.

- Review for Accuracy: Conduct a final review of the form for completeness and correctness, ensuring no sections are left incomplete.

Key Elements of the Form FTB 2006

Important components of the Form FTB 2006 typically include:

- Taxpayer Identification: Personal or business details for identification purposes.

- Financial Information: Sections for income reporting or other financial specifics.

- Certification and Signature: A final section to confirm authenticity and consent with your signature.

- Supplementary Sections: Additional fields may be relevant depending on the specific nature of your tax obligations.

Who Typically Uses the Form FTB 2006

Form FTB 2006 is generally used by:

- California Residents and Businesses: Individuals and entities within the state needing to report specific tax information.

- Tax Preparers and Accountants: Professionals who assist clients in fulfilling state tax obligations through the completion of required forms.

- Individuals Filing Amended Returns: Those needing to correct previously submitted tax information.

State-Specific Rules for the Form FTB 2006

The use of Form FTB 2006 is governed by state-specific guidelines, which may include variations in requirements such as:

- Submission Deadlines: Aligning with California’s tax calendar, ensuring timely filing to avoid penalties.

- Californian Legal Provisions: Adhering to tax laws unique to California, including regulations on deductions and credits.

- Additional Filing Requirements: Addressing any unique financial conditions applicable in the state.

Examples of Using the Form FTB 2006

Examples of scenarios where Form FTB 2006 might be utilized:

- Filing Amendments: Correcting previous tax submissions due to errors or changes in financial circumstances.

- Reporting Additional Income: Declaring extra sources of income not initially reported on a primary tax form.

- Compliance with State Audits: Providing additional documentation requested during state audits.

Filing Deadlines and Important Dates

Key deadlines associated with Form FTB 2006 include:

- Annual Tax Filing Date: Typically aligns with California’s regular tax return deadlines.

- Extension Requests: Dates for submitting extensions if needed, potentially differing from federal deadlines.

- Specific Submission Periods: Depending on individual circumstances, there may be unique deadlines linked to the use of Form FTB 2006.

Form Submission Methods

When it comes to submitting Form FTB 2006, there are several options:

- Online Submission: Many find electronic filing using the California Franchise Tax Board's online system to be efficient.

- Mail Submission: Traditional mailing of paper forms is permitted, but ensure proper postage and address use.

- In-Person Submission: Although less common, dropping off forms at designated locations is an option for personal delivery.

Penalties for Non-Compliance

Failing to comply with requirements related to Form FTB 2006 can result in:

- Monetary Fines: Additional costs for late submission or inaccuracy.

- Legal Actions: In severe cases, non-compliance may lead to state-imposed legal consequences.

- Impact on Credit: Negative effects on financial standing if compliance issues are recorded publicly.

Software Compatibility for Form Completion

Taxpayers using software to simplify their filing process find:

- TurboTax and QuickBooks: Software like these support many tax forms and may include options for Form FTB 2006.

- Cloud-Based Platforms: Integration capabilities with applications like DocHub for digitally mastering document management.

- File Conversion Features: Tools to convert and work with various formats ensuring submission-ready documents.