Definition and Purpose of TC Form

The TC Form is a petition document used for requesting a redetermination from the Utah State Tax Commission (USTC). This form serves as a formal appeal against decisions or assessments made by the USTC, allowing petitioners to contest the original rulings. The form requires detailed information about the petitioner, the representative (if applicable), and the specific issue being appealed. It acts as a critical tool for individuals or businesses seeking to resolve tax discrepancies and aligns with legal standards set by the USTC.

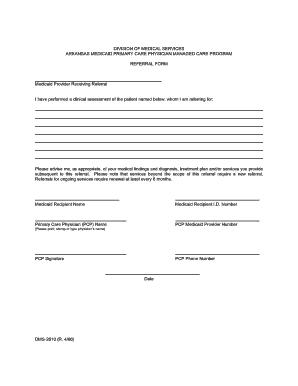

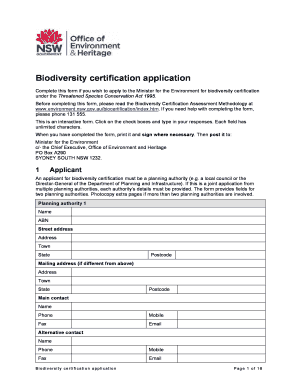

Key Elements of the Form

- Petitioner Information: Includes the name, contact details, and identification number of the individual or entity filing the appeal.

- Representative Information: Details of the authorized representative, if one is involved in the appeal process, including their professional details.

- Type of Tax: Specifies the category of tax under dispute, such as income, corporate, or sales tax.

- Primary Issue: A clear and concise description of the dispute or error that the petitioner seeks to address.

- Relief Request: The specific relief or adjustment being requested by the petitioner, offering a direct solution to the perceived issue.

Steps to Complete the TC Form

To correctly complete the TC Form, carefully follow this step-by-step process:

- Gather Required Information: Before starting, ensure all necessary documents and information are at hand, such as previous tax assessments or correspondence with the USTC.

- Complete Petitioner and Representative Details: Fill in all relevant fields accurately, including names, addresses, and identification numbers.

- Describe the Tax Type and Issue: Clearly describe the type of tax and the primary issue in dispute. Be precise to avoid ambiguity.

- State the Desired Relief: Indicate the specific relief sought, providing justification for the request.

- Sign and Date the Form: Both the petitioner and representative, if any, must sign the form to certify accuracy.

- Review for Completeness: Double-check that all information is correct and complete before submission.

Examples and Common Scenarios

- Individual Appeals: A taxpayer might dispute an incorrect income tax assessment due to clerical errors.

- Business Disputes: A small business could appeal a sales tax decision where exemptions were not properly applied.

Form Submission Methods

The TC Form can be submitted using several methods, facilitating convenience and accessibility:

- Online Submission: Utilize the USTC's online portal to file the form electronically, benefiting from immediate confirmation of receipt.

- Mail-in Option: Alternatively, the form can be printed and mailed to the USTC at their official address. Ensure it is postmarked by the appropriate deadline to avoid penalties.

- In-Person Delivery: For those preferring direct interactions, the form can be submitted in person at a local USTC office. This option may provide the opportunity to clarify any immediate questions.

Filing Deadlines and Important Dates

- Deadline Awareness: Familiarize with specific deadlines associated with filing the TC Form, ensuring timely submission to avoid forfeiting appeal rights.

- Response Timing: Understand the expected timeline for USTC's response, aiding in planning further actions if necessary.

Legal Use and Implications

Using the TC Form is crucial for maintaining compliance with Utah state tax regulations, acting as an official avenue for appeals. It holds legal weight, and inaccuracies or omissions can result in delayed or nullified appeals. Proper completion and submission demonstrate due diligence in pursuing tax justice.

Who Typically Uses the TC Form?

The form caters to a diverse audience, predominantly individuals and business entities within Utah:

- Individual Taxpayers: Seeking resolution for personal tax discrepancies or amendments.

- Businesses and Corporations: Contesting corporate or sales tax assessments that impact financial operations.

- Tax Professionals and Representatives: Acting on behalf of clients to leverage legal avenues for tax dispute resolutions.

Penalties for Non-Compliance

Failing to adhere to submission guidelines or deadlines associated with the TC Form can lead to significant consequences:

- Forfeiture of Appeal Rights: Late submissions may result in the inability to contest USTC decisions.

- Financial Penalties and Interest: Accumulating fines on disputed amounts if not addressed within stipulated time frames.

- Legal Ramifications: Potential legal proceedings where non-compliance is persistent or intentional.

Avoidance Strategies

- Timely and accurate completion and submission of the form to prevent compliances issues.

- Professional consultation with tax advisors for complex cases or clarity on appeal procedures.

Important Terms and Context

Understanding certain terms and processes related to the TC Form is essential for effective handling:

- Appeal: The request to review and potentially alter a decision made by the USTC.

- Redetermination: The process by which the USTC reassesses an individual's or entity's tax situation based on new evidence or errors found in the initial evaluation.

- Petitioner: The individual or entity filing the appeal.

Practical Context

This form is a vital component of the legal framework ensuring transparency and fairness in state tax matters, allowing taxpayers to contest decisions that adversely affect their financial standing.

Software Compatibility and Integration

While specific tax software platforms support Utah tax forms, including TurboTax and QuickBooks, it is crucial to verify the compatibility with the TC Form for seamless integration and submission. This alignment enhances efficiency and ensures accurate data handling across various digital platforms. Utilize software with up-to-date state tax guidelines to prevent discrepancies during filing.

Digital vs. Paper Version

Consider the benefits and drawbacks of using a digital format versus traditional paper submission:

- Digital Form: Offers faster processing, reduced errors, and ease of access.

- Paper Form: May be preferred for hands-on review, particularly for those unfamiliar with digital platforms or requiring physical records.