Definition and Purpose of Form 507

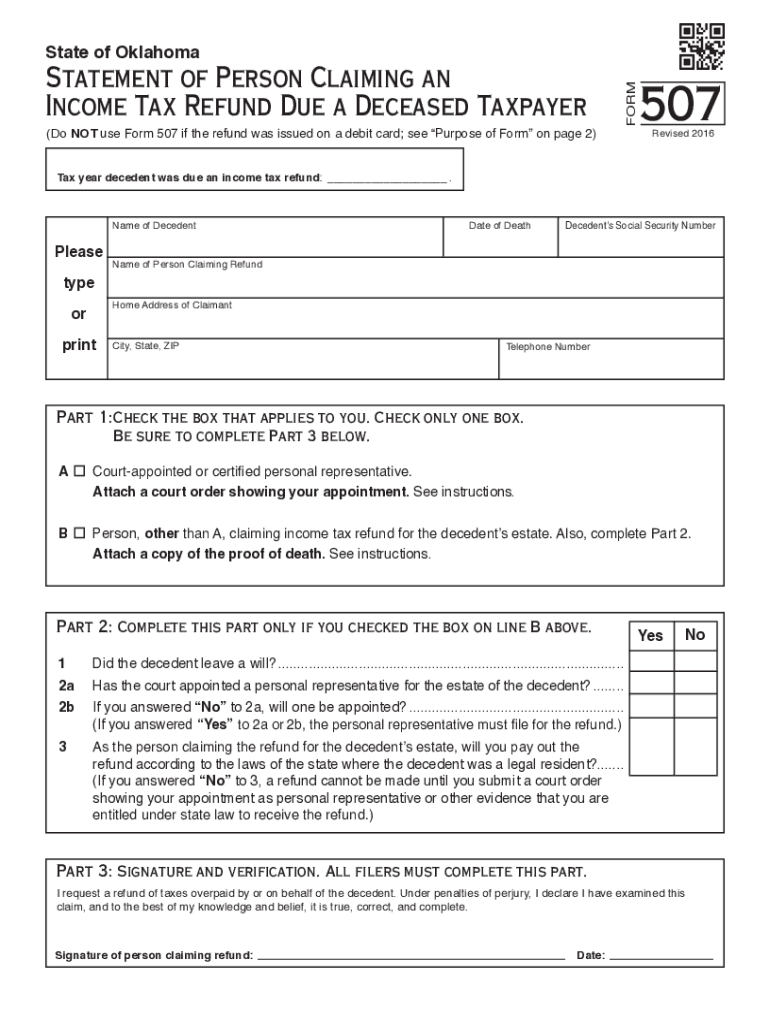

The 2016 Form 507 is a statement used to claim an income tax refund on behalf of a deceased taxpayer. This document is essential for those managing the fiscal affairs of a deceased individual, ensuring that any owed refunds from the government are correctly redirected to the appropriate party, often a personal representative or next of kin. By filling out this form, claimants provide necessary verification and request the claimed amount, managing financial obligations left unresolved at the time of the taxpayer's death.

Eligibility Requirements for Claiming

To be eligible to use the 2016 Form 507, the claimant must demonstrate a valid relationship with the deceased taxpayer. This generally includes:

- Being a court-appointed personal representative of the deceased's estate.

- Next of kin or a surviving spouse acting without court appointment.

Each claimant category requires specific documentation to prove their eligibility, such as court appointment orders or familial relationship certifications.

Necessary Documentation for Submission

Proper documentation is crucial when submitting the 2016 Form 507. This includes:

- Proof of death: A certified copy of the death certificate.

- Legal proof of the claimant's authority: For court-appointed representatives, legal documentation such as letters testamentary or letters of administration.

Failing to provide these documents can result in delays or rejection of the claim.

Completing the 2016 Form 507: Step-by-Step Guide

-

Identify the Deceased Taxpayer: Begin by providing the full name and social security number of the deceased.

-

Enter Claimant Details: Fill in the claimant's personal information, ensuring clarity and accuracy.

-

Describe Relationship to the Deceased: Clearly state the claimant's relationship to the deceased, supported by legal documentation if necessary.

-

Attach Required Documentation: Enclose proof of death and any necessary legal documents that establish the claimant's right to the refund.

-

Review and Sign: Carefully check all entered information for accuracy and sign the form to validate it.

Filing Methods Available

The completed 2016 Form 507 can be submitted through several channels:

- Mail: Send to the address specified in the form instructions.

- In-Person: Direct submission at designated IRS offices.

Different submission methods might impact processing times, so choose based on urgency and convenience.

Key Elements to Consider

Understanding the essential components of the 2016 Form 507 is critical:

- Proof of Authority: Demonstrating legal standing is mandatory.

- Accuracy: Ensure all personal and financial information is precise to avoid delays.

- Documentation Requirement: The necessity of attachments cannot be overstated; they are pivotal to the claim's success.

Common Scenarios for Usage

The form sees frequent use in various scenarios such as:

- Surviving Spouse: A widowed spouse claiming a jointly filed tax return refund.

- Estate Executors: Court-appointed executors managing the estate, ensuring debts are settled, and assets allocated.

State-Specific Considerations

While the federal form is standardized, state-specific nuances can affect its application. Oklahoma, for instance, might have particular procedures or supplementary documentation requirements. Claimants should verify state regulations to ensure compliant filing.

Consequences of Non-Compliance

Neglecting to file or improperly completing Form 507 can lead to:

- Delayed Refunds: Errors or omissions prolong processing times.

- Legal Repercussions: Potential legal challenges from interested parties if due process is not followed.

Adhering to instructions and requirements minimizes these risks.