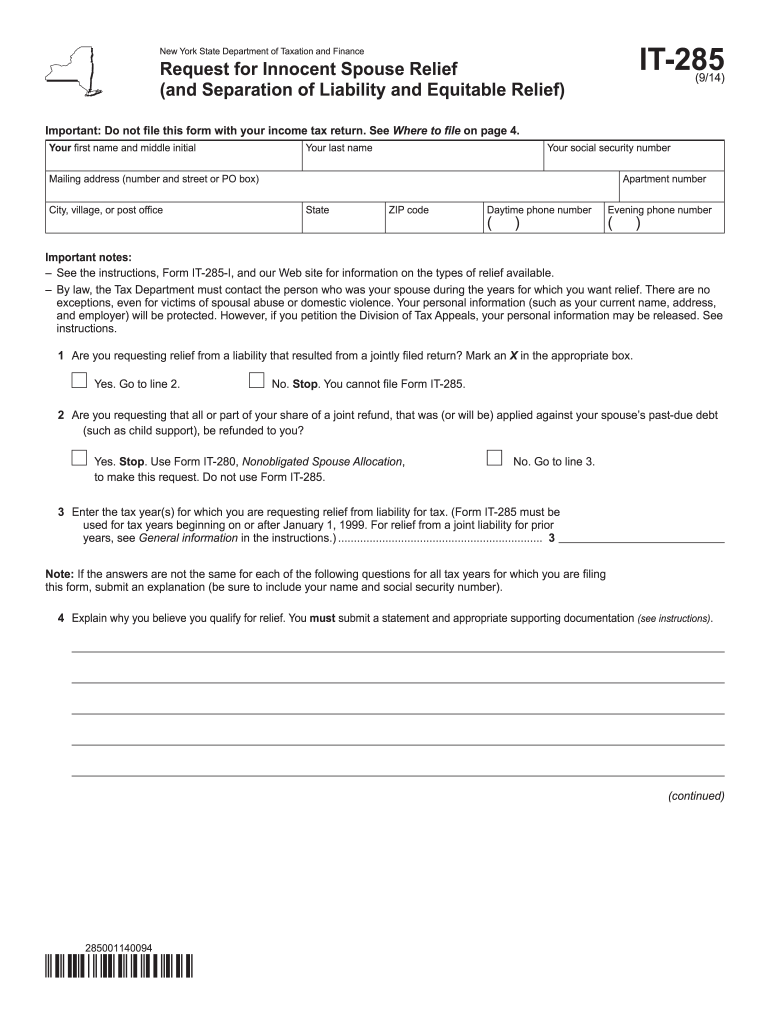

Definition & Purpose of the IT-285 Form

The IT-285 form is an official document used by the New York State Department of Taxation and Finance for taxpayers seeking Innocent Spouse Relief. This relief is applicable for those who filed a joint tax return but wish to be absolved from additional taxes their spouse erroneously or fraudulently incurred. This form helps establish the distinction between the liabilities shared and those attributable solely to one party.

How to Use the IT-285 Form

Using the IT-285 form involves completing sections that detail your marital status, financial involvement, and reasons for seeking relief. Ensure your explanations are thorough, as they support your eligibility claim. This form should be filled separately from your income tax returns, as it specifically addresses the nature of tax liabilities under innocent spouse provisions.

Obtaining the IT-285 Form

You can access the IT-285 form through the New York State Department of Taxation and Finance's official portal. Alternatively, you might receive it from a tax professional who assists with similar tax-related concerns. Always ensure you're using the correct version, such as the 2014 edition, to align with applicable guidelines during that tax year.

Steps to Complete the IT-285 Form

- Personal Information: Start by providing your name, address, and Social Security Number. Ensure accuracy to match the records.

- Marital Status: Declare your current marital situation as it relates to the tax year in question.

- Financial Disclosure: Include details about your involvement in household finances, differentiating your responsibilities from your spouse's.

- Reason for Relief: Clearly articulate the basis for requesting relief, supported by any relevant documentation or evidence of erroneous or fraudulent tax filings.

- Review and Submission: Recheck responses for completeness before submitting via the prescribed state method—typically by mail—to the appropriate tax department address.

Who Uses the IT-285 Form

Typically, individuals residing in New York who perceive themselves as unfairly burdened by their spouse's tax discrepancies on a jointly filed return utilize this form. It acts as a recourse for relief against unwarranted financial obligations arising from their spouse's errors or fraudulent actions.

Legal Implications and Use

Filing the IT-285 form aligns with provisions under the Internal Revenue Code allowing innocent spouse relief. Correct use ensures proper distinction in tax obligations. Misrepresentations on the form can lead to legal consequences, highlighting the importance of accurate and truthful submissions in these situations.

Key Elements of the IT-285 Form

- Eligibility Information: Crucial to establish your understanding and meeting of the relief criteria.

- Financial Contribution Details: Detailed accounts of your role and your spouse's within household financial responsibilities.

- Supporting Documentation: External evidence corroborating your claims and reasons for seeking relief from shared liabilities.

Required Documents and Submission Methods

Supporting documents such as financial records, prior tax returns, and records proving discrepancies are critical when submitting the IT-285 form. Submission typically occurs via mail to the New York State Department of Taxation and Finance, ensuring that all required documentation is enclosed to substantiate the relief request.

Form Variants and IRS Guidelines

The IT-285 operates within guidelines similar to federal IRS forms that provide relief from joint liabilities, including forms addressing innocent spouse relief at the federal level. While functionally comparable, ensure adherence to state-specific regulations and submission processes distinguished from federal procedures.