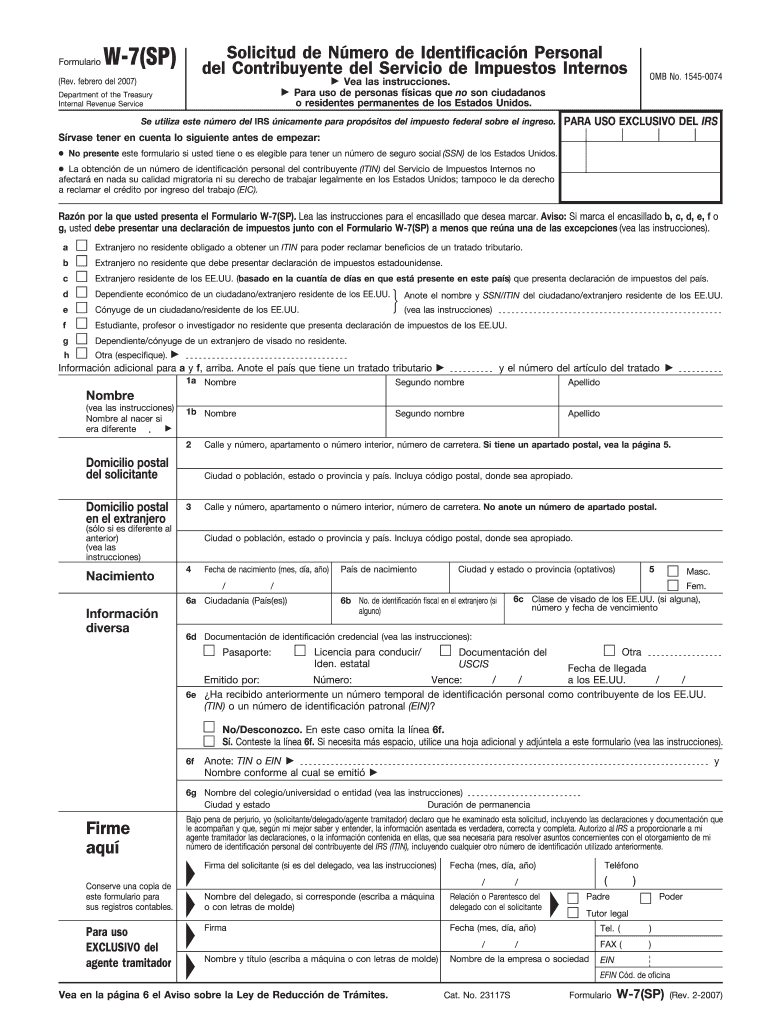

Definition & Purpose of Form W-7(SP)

The Form W-7(SP) is an application used by individuals who are not U.S. citizens or permanent residents to request an Individual Taxpayer Identification Number (ITIN) from the Internal Revenue Service (IRS). This form, applicable to the version revised in February 2007, assists individuals in filing tax returns when they are not eligible to obtain a Social Security Number. It is specifically targeted toward those who need to fulfill federal tax reporting obligations without an SSN.

How to Use Form W-7(SP)

To effectively use the Form W-7(SP), applicants must ensure that the form is filled out accurately to avoid processing delays. The form requires basic personal information, the reason for applying for an ITIN, and details about supporting documentation. Follow these steps:

- Fill out the personal information section, including name, address, and country of citizenship.

- Indicate the reason for applying for an ITIN. Common reasons include being a nonresident alien required to file a U.S. tax return.

- Prepare and attach required documentation to verify identity and foreign status.

- Submit the completed form and documents as directed in the IRS instructions.

Steps to Complete Form W-7(SP)

Completing the Form W-7(SP) involves several key steps:

-

Section 1: Personal Information

- Enter full legal name, birth date, and location.

- Include foreign address and U.S. mailing address if applicable.

-

Section 2: Reason for Submitting

- Choose the appropriate category that necessitates applying for an ITIN.

- Describe specifics if 'Other' is selected.

-

Section 3: Supporting Documents

- Attach original documents or certified copies from the issuing agency to prove identity and foreign status.

-

Section 4: Signature and Date

- Review all information for accuracy.

- Sign and date the form.

Required Documents for Form W-7(SP)

To accompany the Form W-7(SP), individuals must submit documentation proving both identity and foreign status. Acceptable documents include:

- A valid passport (the most streamlined option, providing both identity and foreign status)

- National identification card

- U.S. or foreign driver’s license

- Birth certificate (for dependents only)

Form Submission Methods

Applicants can submit the Form W-7(SP) through several channels:

- In-Person: Visit an IRS Taxpayer Assistance Center or an IRS-authorized Certifying Acceptance Agent for personal verification.

- Mail: Send the form and supporting documents to the address specified in the form’s instructions.

- Through an Acceptance Agent: Some individuals may prefer using an Acceptance Agent to handle submission details and facilitate identity verification.

IRS Guidelines & Compliance

The IRS provides explicit guidelines that applicants must follow to ensure compliance:

- Ensure all information is up-to-date and matches attached documentation.

- Double-check the eligibility criteria for obtaining an ITIN.

- Be aware that failing to comply with IRS guidelines could result in processing delays or rejection of the application.

Eligibility Criteria for ITIN

Eligibility for an ITIN is primarily for individuals who are not eligible for a Social Security Number but require a unique identifier for U.S. tax purposes. The form covers various categories, including:

- Nonresident aliens required to file a U.S. tax return

- U.S. resident aliens (based on substantial presence) filing a U.S. tax return

- Dependents or spouses of U.S. citizens or resident aliens

Penalties for Non-Compliance

Failure to comply with the guidelines for applying for an ITIN may result in several issues, such as:

- Delays in tax processing

- Potential fines or penalties for failing to meet filing deadlines

- Rejection of the ITIN application, requiring resubmission correctly

Application Process & Approval Time

Once submitted, the IRS reviews the Form W-7(SP) for accuracy and completeness. The approval time can vary based on workload and accuracy of the submitted documents. Typical processing times can range from six to ten weeks. Applicants should ensure complete and accurate submissions to expedite approval.