Definition & Meaning

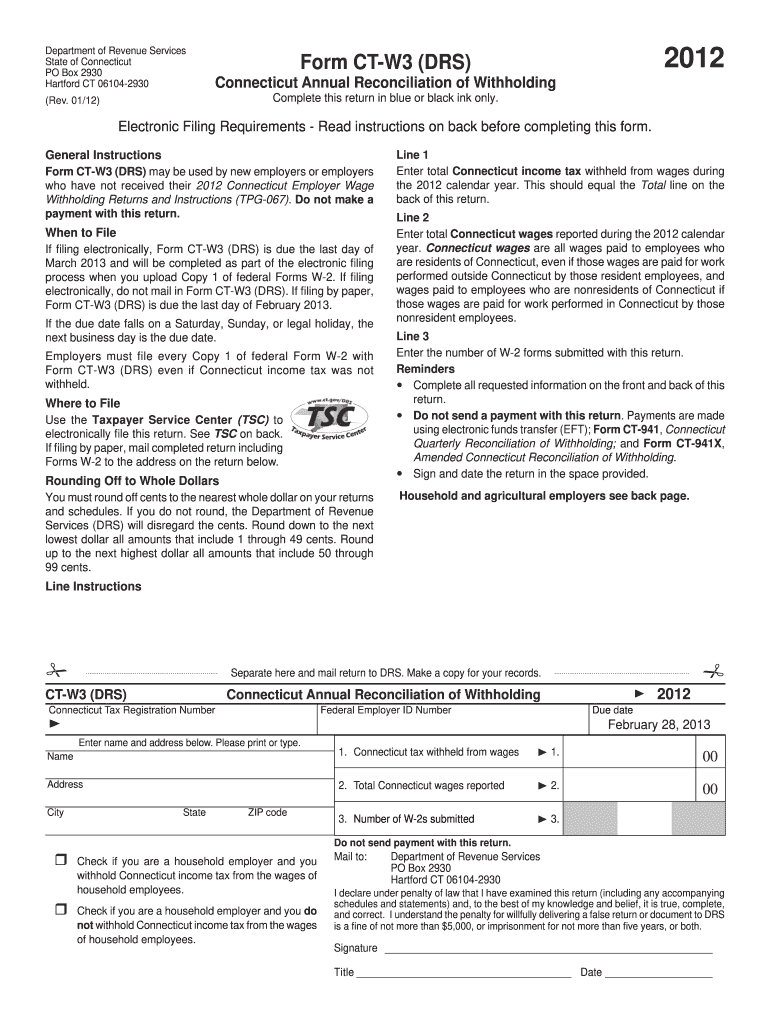

The 2012 Form CT-W3 HHE is specifically designed for the annual reconciliation of withholding for household employers in Connecticut. This form is used to report the total wages paid and the Connecticut income tax withheld for household employees over the course of the year. It ensures that employers reconcile the amounts withheld throughout the year with the total amount reported on the employees' W-2 forms. By completing this form accurately, household employers verify compliance with state withholding requirements and maintain proper financial records for both their benefit and that of their employees.

Steps to Complete the Form CT-W3 HHE

-

Gather Employee Information:

- Collect all W-2 forms issued to household employees.

- Ensure each W-2 contains accurate personal details and tax amounts.

-

Calculate Total Wages and Withholdings:

- Sum up the total wages paid to household employees.

- Calculate the total Connecticut income tax withheld over the calendar year.

-

Complete the Form:

- Fill in the employer information, including name, address, and Federal Employer Identification Number (FEIN).

- Enter the total wages and withholdings in the respective sections of the form.

- Verify that all sections are completed accurately.

-

Review and Sign:

- Review the completed form for accuracy.

- Sign and date the form, affirming the truth and completeness of the information provided.

-

Submit the Form:

- Submit the completed form to the Connecticut Department of Revenue Services by the specified deadline, ensuring proper reconciliation of all withholding amounts.

Filing Deadlines / Important Dates

The Form CT-W3 HHE must be submitted by the last day in January following the year for which the form is being filed. This deadline is crucial as it aligns with the requirement to furnish W-2 forms to employees and file electronic copies with the Connecticut Department of Revenue Services. Missing this deadline may result in penalties and interest charges, which can impact both the employer's financial standing and legal compliance.

Key Elements of the Form CT-W3 HHE

- Employer Identification: This includes the employer’s name, address, and FEIN, crucial for matching records with other tax documents submitted to the state.

- Wage and Tax Data: Accurate reporting of total wages and Connecticut income tax withheld.

- Employee Count: The number of employees for whom W-2 forms were issued, reflecting the scale of employment and payroll operations for household employers.

Who Typically Uses the Form

Household employers in Connecticut, such as those employing nannies, caretakers, or housekeepers, commonly use Form CT-W3 HHE. These employers are required to report tax withholding on behalf of their household employees to ensure compliance with state tax regulations. Outside of traditional businesses, this form is essential for individuals or families who hire domestic workers and must reconcile withholding responsibilities.

Penalties for Non-Compliance

Failure to file Form CT-W3 HHE accurately and on time can result in penalties from the Connecticut Department of Revenue Services. These penalties may include fines for late filing or inaccuracies in the reported amounts. Furthermore, interest could accrue on any missed tax payment obligations, leading to compounded financial liabilities. Compliance with filing requirements is vital to avoid these penalties and maintain good standing with state tax authorities.

State-Specific Rules for the Form

Connecticut-specific rules dictate that household employers must reconcile their tax withholding via this form. Unlike other states, Connecticut requires specific identification and reconciliation of taxes withheld for household employees, ensuring compliance with state regulations. Additionally, employers in Connecticut must adhere to state mandates for electronic submission of multiple W-2 forms, emphasizing the state's focus on streamlined tax reporting processes.

Who Issues the Form

The Connecticut Department of Revenue Services is the issuing authority for Form CT-W3 HHE. This department oversees the administration of Connecticut state taxes, ensuring accurate collection and recording of tax obligations at the state level. Household employers must ensure they are sourcing the most current version of the form directly from this department to meet compliance requirements.

Software Compatibility

Household employers may utilize software like TurboTax or QuickBooks to manage payroll and tax obligations, including the preparation of Form CT-W3 HHE. These platforms often support form completion and electronic submission, aligning with Connecticut’s state requirements for accuracy and efficiency in tax reporting. Employers should verify that their chosen software is up-to-date and integrates with state tax submission processes for seamless filing.