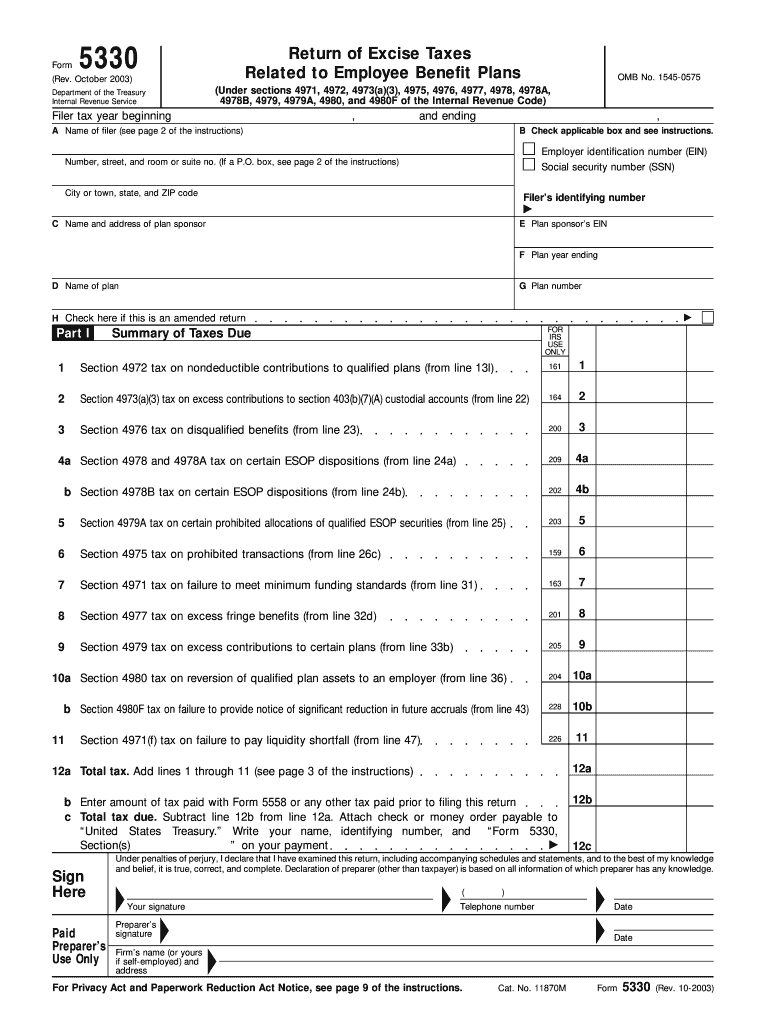

Definition and Meaning

Form 5330 is a crucial tax document used to report excise taxes associated with employee benefit plans, in line with various sections of the Internal Revenue Code. It specifically addresses taxes related to nondeductible contributions, excess contributions, disqualified benefits, prohibited transactions, and other penalties tied to these employee plans. Individuals responsible for reporting these taxes must provide detailed information about the filer, plan sponsor, and precise calculations for each tax type owed. This form is essential for maintaining compliance with federal tax regulations surrounding employee benefits.

How to Obtain the Form 5330 Fillable Form 2003

Acquiring the Form 5330 fillable form for 2003 can be straightforward if you know where to look. Typically, it can be downloaded directly from the IRS website, which offers the most reliable source. Tax professionals and businesses might also have direct access to printed copies if needed. It’s crucial to ensure that you have the correct version corresponding to the year of your business activities, as tax codes and requirements can differ from one year to the next. Always verify the download source to prevent security risks or outdated versions.

Steps to Complete the Form 5330 Fillable Form 2003

Completing Form 5330 requires attention to detailed financial activities related to employee benefit plans. Here’s a step-by-step guide:

-

Provide Basic Information: Start with the general information section where you’ll need to input details about the filer and plan sponsor, including names and identification numbers.

-

Declare Contributions: Accurately report any nondeductible contributions to ensure precise tax calculations.

-

Calculate Excess Contributions: Identify and document any contributions that exceed prescribed limits, as these are subject to additional excise taxes.

-

Address Disqualified Benefits: Note any benefits or transactions that do not comply with regulatory standards.

-

Complete the Tax Calculation: Use IRS guidelines to compute the exact tax amounts owed based on the provided data.

-

Review and Sign: To ensure accuracy, review all entered data before signing the form. Any errors could lead to penalties.

Important Terms Related to Form 5330 Fillable Form 2003

Familiarity with certain key terms can significantly aid in the accurate completion of Form 5330:

- Excise Tax: A tax levied on specific activities or transactions within employee benefit plans.

- Nondeductible Contributions: Contributions made to a plan that cannot be deducted from taxable income.

- Excess Contributions: Contributions that exceed the limits set by the IRS for that particular year.

- Disqualified Benefits: Benefits considered outside of tax compliance regulations.

- Prohibited Transactions: Transactions that involve conflicts of interest or do not meet standard guidelines.

Filing Deadlines and Important Dates

Understanding the timeline for submitting Form 5330 is crucial for compliance. The form is typically due seven months after the end of the plan year. However, special circumstances or different plan types might alter this deadline. Businesses should mark their calendars and plan for potential IRS extensions if they anticipate needing additional time.

Required Documents

When completing Form 5330, ensuring all necessary documentation is at hand is vital. These may include:

- Plan Documents: Details of the employee benefit plan need to be documented in full.

- Financial Statements: To verify numbers given in contributions or transactions.

- Prior Year’s Forms: If applicable, for comparative analysis.

- Staff Certifications: Any documentation or certifications about the staff involved in the plan.

Penalties for Non-Compliance

Failure to accurately file Form 5330, or missing the deadlines, can lead to substantial penalties. The IRS may levy penalties that include fines or extended tax liabilities. It is always advisable to keep abreast of any updates from the IRS regarding penalties and compliance requirements, to avoid any potential issues or financial losses.

IRS Guidelines

Form 5330 is governed by strict IRS guidelines. These outline the specific criteria for each part of the form, ensuring compliance with federal tax laws. Ensure that you review the IRS instructions thoroughly and if needed, consult a tax professional to meet all guidelines. The IRS website provides detailed instruction pages that can be invaluable during the form-filling process.

By covering these elements comprehensively, you can ensure accurate and compliant submission of Form 5330 for 2003, adeptly managing any excise tax liabilities related to employee benefit plans.