Definition & Purpose of Form 8621

Form 8621 is an information return required by shareholders of Passive Foreign Investment Companies (PFICs) or Qualified Electing Funds (QEFs). The form is crucial for reporting holdings, distributions, and elections related to these investments, ensuring compliance with U.S. tax laws concerning foreign investment earnings. It collects detailed information about the shareholder and the specific foreign investment entity, facilitating accurate tax reporting of income and gains. This form is integral to maintaining transparency in international investments and avoiding potential tax penalties.

How to Obtain Form 8621

To obtain Form 8621, visit the official Internal Revenue Service (IRS) website, where the form is available for download. The PDF version can be filled out digitally or printed for manual completion. Alternatively, tax preparation software such as TurboTax or QuickBooks may offer integrated versions of the form, streamlining the process for digital submissions. Financial advisors or tax professionals can also provide the form, especially when acting as intermediaries in completing or filing it on behalf of investors.

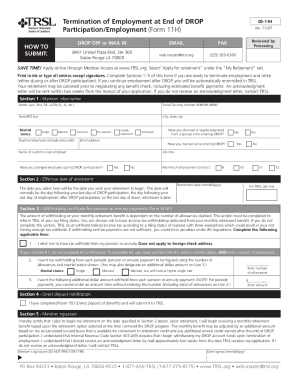

Steps to Complete Form 8621

-

Download the Form: Access the IRS website or trusted tax software to download Form 8621.

-

Shareholder Information: Fill out personal and contact information accurately.

-

Entity Details: Provide the name, address, and identifier of the PFIC or QEF.

-

Elections and Distributions: Indicate any elections made and report all distributions received from the entity.

-

Calculations: Complete the necessary calculations for income inclusion, excess distributions, and relevant gains or losses, utilizing the specific instructions and guidance provided with the form.

-

Review and Submit: Thoroughly review the form for accuracy before submission. Errors could lead to penalties or delayed processing.

Who Typically Uses Form 8621

Form 8621 is predominantly used by U.S. taxpayers with direct or indirect holdings in PFICs or QEFs. This includes individual investors, estates, and trusts. The form is vital for those who, as shareholders, need to report specific financial activities involving foreign investment entities to the IRS. Additionally, businesses or other entities involved in cross-border investments might also utilize Form 8621 to ensure regulatory compliance and proper tax reporting.

Key Elements of Form 8621

-

Shareholder and Entity Identification: Clear identification sections for the taxpayer and the foreign entity.

-

Election Information: Sections to indicate any tax elections made under PFIC or QEF status.

-

Income and Distribution Reporting: Detailed fields for reporting income and distributions obtained from foreign investments.

-

Tax and Penalty Calculations: Areas dedicated to computing excess distributions and related penalties, if applicable.

These elements help ensure that taxpayers furnish all necessary details to the IRS, allowing for accurate tax assessments.

IRS Guidelines for Form 8621

The IRS provides comprehensive guidelines detailing who must file Form 8621, how it should be completed, and when it needs to be submitted. These guidelines cover eligible taxpayers, key filing deadlines, and the proper methods for submission. Potential tax scenarios, exceptions, and amendments are also discussed, ensuring that taxpayers have a clear understanding of their obligations. Following these official instructions minimizes risks associated with filing inaccuracies and potential audits.

Filing Deadlines and Important Dates

Form 8621 does not have a standalone filing date. Instead, it must be attached to the taxpayer's annual return (Form 1040). However, particular attention is necessary if seeking extensions, as extensions for tax returns do not automatically apply to Form 8621 unless explicitly specified. Remaining cognizant of standard tax return deadlines is essential to remaining compliant.

Penalties for Non-Compliance

Failing to file Form 8621 or submitting incorrect information can result in severe tax penalties or increased scrutiny by the IRS. Penalties may include interest charges on unpaid tax obligations or additional fines for significant underreporting. Consistent and precise reporting is necessary to mitigate the risk of penalties and ensure favorable tax compliance regarding international investments.

By covering these aspects, individuals and businesses can better understand the complexities and requirements of Form 8621 in the context of their foreign investment activities.