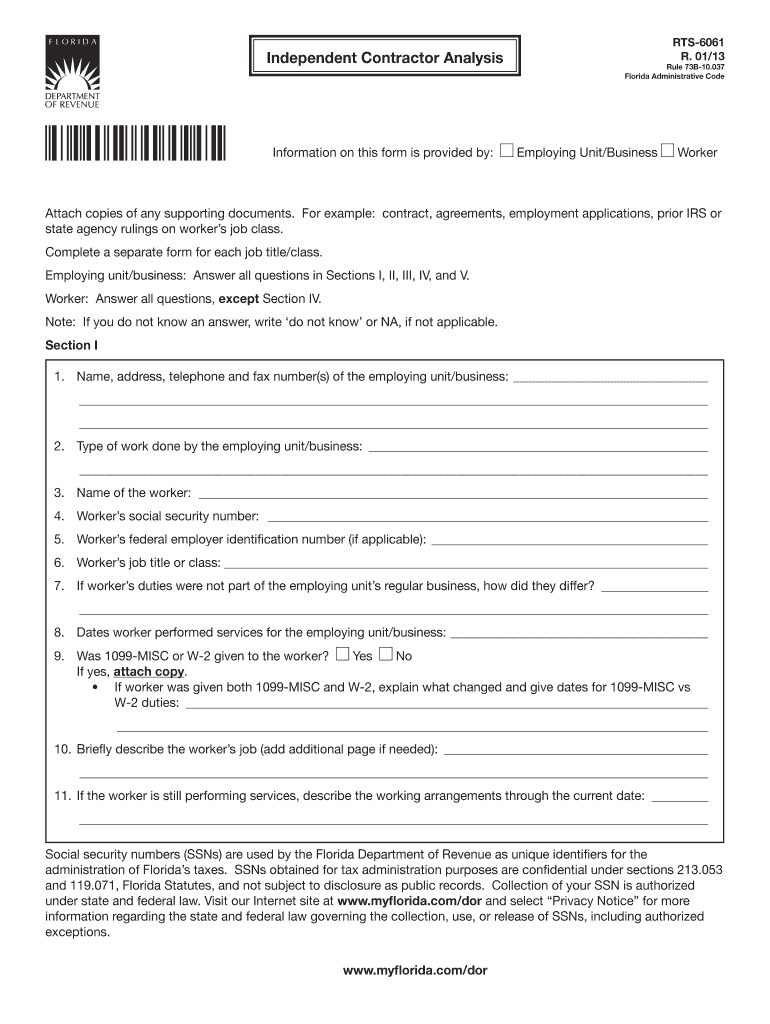

Definition & Purpose of the Independent Contractor Analysis

The Independent Contractor Analysis - Florida Department of Revenue is a critical form used to determine the employment classification of a worker. It helps establish whether an individual should be classified as an independent contractor or an employee. This distinction affects how taxes are filed, liability issues, and compliance with state laws. The form requires detailed information from both the worker and the business, including work nature, payment methods, and conditions of employment.

Key Elements of the Analysis

- Nature of Work: Describing the kind of services rendered by the worker.

- Payment Methods: Details about how the worker is compensated, such as by the hour or project.

- Working Conditions: Information about supervision, schedule flexibility, and training provided by the business.

Steps to Complete the Independent Contractor Analysis

- Gather Required Information: Collect details from both parties about job functions, payment, and working conditions.

- Complete Business Section: The employing unit fills out details concerning their operations and the relationship with the worker.

- Fill Out Worker Information: The worker provides information related to job tasks and responsibilities.

- Review for Accuracy: Double-check all entries to ensure they are correct and truthful.

- Sign and Submit: Both the employer and worker must sign the form before submission to the Florida Department of Revenue.

Important Terms Related to the Analysis

- Independent Contractor: A self-employed individual performing services under a contract.

- Employee: A person who works under the control and direction of the hiring entity.

- Misclassification: Wrongly classifying a worker which can lead to penalties.

State-Specific Rules for Florida

The Florida Department of Revenue has tailored guidelines that must be adhered to when utilizing the Independent Contractor Analysis form. These guidelines emphasize the correct categorization of workers to ensure compliance with state tax laws and labor regulations. Florida's rules may differ slightly from general federal guidelines, so understanding these state-specific criteria is essential for proper form completion.

Legal Use and Compliance

The form's legal purpose is to ensure that all parties involved comply with state employment and tax laws. Properly completing and submitting the Independent Contractor Analysis aids in avoiding misclassification issues that could result in financial penalties and legal disputes. There are legal disclaimers within the form addressing confidentiality and the penalties for false statements, reinforcing the need for honesty and accuracy.

Filing Deadlines and Important Dates

Adhering to specific deadlines is crucial for legal compliance. Typically, the form should be completed and submitted as soon as the working relationship is established to avoid discrepancies in employment classification and penalties for late filing. Some companies may be required to evaluate their contractor relationships periodically, and deadlines may vary depending on organizational needs or legislative changes.

Examples of Using the Independent Contractor Analysis

- New Business Ventures: When starting a new business in Florida and hiring workers, understanding their correct classification can provide clarity on tax obligations.

- Subcontracting Projects: Companies engaging independent contractors for specific projects need to evaluate each relationship to ensure proper tax treatment.

- Regular Review: Businesses increasingly conducting worker audits may use the form as part of a broader compliance strategy to verify correct classifications.

Penalties for Non-Compliance with the Independent Contractor Analysis

Failure to accurately complete the Independent Contractor Analysis or misclassifying workers can lead to significant legal and financial repercussions, such as back taxes, fines, and potential lawsuits. The state of Florida imposes strict penalties to enforce correct worker classification, reflecting the necessity of diligent form completion and honesty in reporting.

Who Typically Uses This Analysis

The form is indispensable for businesses, HR departments, and legal professionals who must ensure compliance with employment classifications in Florida. It is often used by companies across various industries that engage independent contractors regularly for projects or services. Understanding this analysis’s importance helps prevent common pitfalls associated with employment classifications.