Definition and Meaning

The "Invoicing Policy Awarding Organisation" refers to the set of guidelines and procedures established by an entity to manage the issuance, payment, and retention of invoices. This policy is crucial for ensuring compliance with both legal requirements and specific regulations, such as those outlined by the Office of Qualifications and Examinations Regulation (Ofqual) in the context of educational organizations. The policy covers various aspects, including the timings for issuing invoices, required information on invoices, credit control measures for debt collection, and retention protocols for financial records. It aims to maintain financial accountability and transparency within an organization.

Key Elements of the Invoicing Policy Awarding Organisation

To ensure effective invoicing management, the policy outlines several essential elements:

- Regular Issuance of Invoices: Invoices must be issued promptly after the delivery of services or products to reinforce timely payments.

- Required Content: Every invoice should include specific details such as the date, unique invoice number, details of services or products provided, payment terms, and contact information.

- Credit Control Measures: Procedures should be in place for managing late payments, including follow-up actions and credit terms review.

- Record Retention: The policy outlines the timeline for retaining invoicing records to support audits and compliance with regulations.

Steps to Complete the Invoicing Policy Awarding Organisation

Creating and maintaining an effective invoicing policy involves several steps:

- Establish Clear Guidelines: Define the procedures for invoice creation, approval, distribution, and storage.

- Specify Payment Terms: Clearly outline payment terms, including due dates, early payment discounts, and penalties for late payments.

- Implement a Monitoring System: Set up a system to track invoice processing and payment receipts.

- Regular Review and Updates: Regularly review and update the policy to reflect any changes in regulatory requirements or organizational processes.

Detailed Breakdown

- Invoice Approval Process: Establish who needs to validate and approve invoices before they are sent out.

- Reconciliation Procedures: Outline how invoices are reconciled with payments and bank statements.

Why Use the Invoicing Policy Awarding Organisation

A comprehensive invoicing policy is vital for several reasons:

- Ensures Compliance: Adherence to legal and regulatory requirements, such as those imposed by Ofqual.

- Improves Cash Flow: Timely and accurate invoicing helps maintain cash flow and financial health.

- Reduces Errors: Clear guidelines reduce the risk of errors and discrepancies in financial records.

- Facilitates Audits: Organized invoicing processes simplify financial audits and reviews.

Who Typically Uses the Invoicing Policy Awarding Organisation

The policy is primarily used by educational institutions and awarding organizations that need to comply with specific regulatory standards. Additionally, it is applicable to various types of businesses where formal invoicing is a routine part of operations, such as:

- Educational Organizations: Ensure compliance with educational standards and regulations.

- Large Corporations: Manage significant volumes of transactions efficiently.

- Small Businesses: Streamline invoicing processes to maintain consistent cash flow.

Legal Use of the Invoicing Policy Awarding Organisation

The invoicing policy must comply with applicable laws and regulations. In the U.S. context, this includes tax regulations enforced by the Internal Revenue Service (IRS), as well personal data protection laws. Ensuring legal compliance protects the organization from potential legal liabilities and penalties.

- IRS Guidelines: Invoices must adhere to particular tax obligations and documentation standards.

- Data Protection Compliance: Secure handling of personal and financial information in line with privacy laws.

Examples of Using the Invoicing Policy Awarding Organisation

Real-world application of this policy includes several scenarios:

- Prompt Billing: An educational institute uses the policy to issue tuition invoices immediately after enrollment confirmation, thus avoiding any delay in payment collection.

- Debt Collection: A business applies credit control measures outlined in the policy to efficiently manage overdue accounts and improve recovery rates.

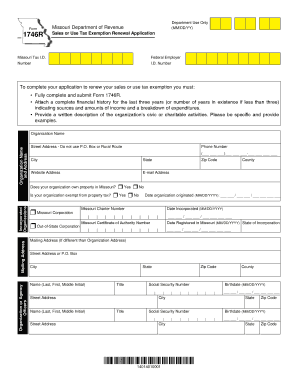

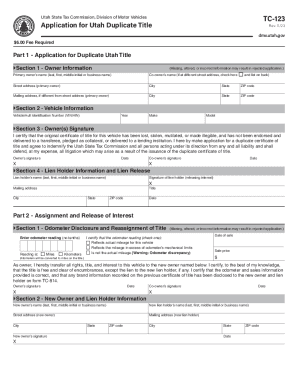

Required Documents

Implementing the policy typically requires the following documentation:

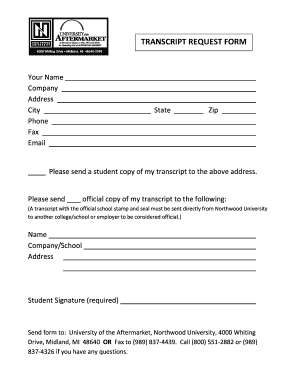

- Invoice Template: A standardized template outlining the necessary details and format.

- Payment Terms Document: A detailed document clearly specifying payment conditions and expectations.

- Approval List: A list of personnel authorized to approve invoices before issuance.

Supporting Documents

- Customer Contracts: These outline terms that must be reflected in invoicing.

- Financial Statements: Used to reconcile and track income from invoicing.

Form Submission Methods (Online / Mail / In-Person)

For compliance purposes, the policy may include preferred methods for submitting and approving invoices:

- Online Platforms: Utilizing digital platforms like DocHub for efficient invoice management and record-keeping.

- Mail: For organizations that prefer physical documentation, invoices can be sent through the postal service.

- In-Person: Especially relevant for entities with localized operations requiring direct interaction with clients.