Definition and Purpose of the 401k Termination Form - Colville

The 401k Termination Form - Colville is a specialized document used to terminate an existing 401k plan, specifically related to the Colville/Brooks Range Supply 401K Plan. This form is essential for employees who wish to close their 401k accounts, disburse their funds, or initiate a rollover to another retirement account. Understanding the purpose of this form is crucial to ensure that all financial implications and requirements are adequately addressed.

Key Functions

- Account Closure: Facilitates the complete termination of the 401k account.

- Fund Disbursement: Outlines how and when funds will be distributed to the account holder.

- Rollover Guidance: Provides instructions and required fields for rolling over funds to another qualified retirement plan.

How to Use the 401k Termination Form - Colville

To effectively utilize the 401k Termination Form - Colville, individuals must follow specific steps to ensure a successful termination process. Each step involves careful attention to detail to avoid errors that could delay processing or result in undesired financial consequences.

Steps to Follow

- Review Eligibility: Verify eligibility criteria to ensure that the plan participant can legally terminate their plan.

- Complete Personal Details: Fill out personal information sections accurately to avoid any discrepancies.

- Indicate Termination Reason: Clearly state the reason for termination, which may involve retirement, changing employment, or financial considerations.

- Select Disbursement Option: Choose how the funds should be distributed, either via direct payout or rollover.

- Provide Documentation: Attach any required supporting documents, such as identification or account statements.

- Submit Form: Follow the chosen submission method, such as online, mail, or in-person submission, to finalize the procedure.

Who Typically Uses the 401k Termination Form - Colville

The 401k Termination Form - Colville is predominantly utilized by former employees of the Colville/Brooks Range Supply and anyone within the plan structure seeking to terminate their 401k. Understanding who typically uses this form can help tailor its application for the appropriate scenarios.

Common Users

- Retirees: Individuals who are retiring and plan to use or reinvest their retirement savings.

- Employee Transfers: Workers transitioning to new jobs where different retirement plans are available.

- Financial Restructurers: Those looking to consolidate their retirement funds into a singular account for ease of management.

Steps to Complete the 401k Termination Form - Colville

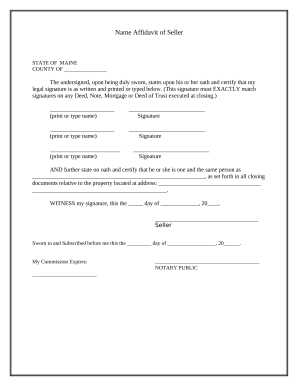

Completing the 401k Termination Form requires meticulous attention to detail to ensure accuracy and compliance with legal standards. Here is a detailed guide on how to fill out the form from start to finish.

Detailed Instructions

- Acquire the Form: Access the form through official channels, ensuring it is the latest version.

- Personal Information: Include name, address, social security number, and current employment status.

- Plan Details: Specify the details of the current 401k plan, including plan ID and account number.

- Termination Details: Clearly outline the desired termination date and reason for account closure.

- Distribution Preferences: Check all relevant boxes for fund distribution methods, such as direct deposit or checks.

- Rollover Options (if applicable): Provide detailed information about the receiving retirement account for rollovers.

- Sign and Date: Ensure the completed form is signed and dated, confirming the authenticity of the submitted information.

Legal Use of the 401k Termination Form - Colville

The legal implications of using the 401k Termination Form cannot be understated, as improper handling might result in financial or legal penalties. Here's a concise overview of its legal use.

Compliance Guidelines

- Adherence to Regulations: Ensures compliance with federal and state financial regulations concerning retirement account terminations.

- Secure Fund Transfers: Outlines secure methods for transferring or disbursing funds to mitigate unauthorized transactions.

- Tax Implications: Awareness of any tax liabilities or benefits resulting from account termination or fund distribution.

Required Documents for the 401k Termination Form - Colville

Submitting the 401k Termination Form requires a set of accompanying documents to verify identity and assess eligibility. Here's a list of what might be necessary.

Essential Documentation

- Identification Proof: Government-issued ID, such as a driver's license or passport.

- Supporting Forms: Any additional forms specific to Colville/Brooks Range Supply financial instructions.

- Financial Statements: Recent 401k account statements highlighting fund activity.

Penalties for Non-Compliance with the 401k Termination Form - Colville

Failure to properly complete or submit the 401k Termination Form can lead to a number of penalties. It's important to be aware of these potential consequences to avoid unnecessary issues.

Potential Risks

- Financial Penalties: Possible fee impositions for incorrect submission or delays in processing.

- Tax Consequences: Risk of facing unexpected tax bills or complications if funds are not rolled over correctly.

- Legal Action: Potential for legal repercussions if fraud or misinformation is detected.

State-Specific Rules for the 401k Termination Form - Colville

Certain states may have specific guidelines or exceptions when processing 401k Termination Forms, influencing the way forms are filled out or processed.

Colville-Specific Regulations

- Plan-Specific Policies: Rules set by Colville affecting termination processes and document requirements.

- State-Specific Taxation: Additional tax implications or benefits specific to Colville state regulations that could affect financial decisions related to plan termination.

Understanding the intricacies of the 401k Termination Form - Colville is essential for effective financial and legal management of retirement funds. Following each step and acknowledging legal requirements ensures a smooth and compliant termination process.