Understanding a Revocation of Living Trust

A revocation of a living trust is a legal document that allows the Trustor(s) to terminate a revocable trust and reclaim any assets or property previously transferred into the trust. The revocation must be in writing and is typically used when the Trustor(s) decide that they no longer need or want the trust structure. A clear understanding of this form is crucial for any party involved in estate planning.

Definition and Meaning

A living trust is initially created as a flexible estate planning tool that allows individuals to manage their assets during their lifetime and specifies how these assets should be handled upon their death. However, situations change, and there might be various reasons to revoke this trust, such as changes in financial circumstances, personal relationships, or estate planning goals. The revocation document specifically outlines the effective date of termination, making it clear when the trust is considered null and void.

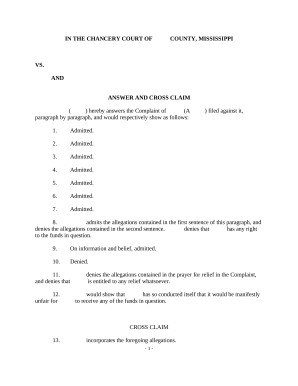

Key Elements of the Revocation Document

When crafting or analyzing a revocation document, several critical components are typically included:

- Date of Revocation: Establishes the precise moment the trust is officially terminated.

- Identification of Trustor(s): Names and details of the individuals who originally established the trust.

- Trust Details: Information about the original trust, including its name and date of creation.

- Acknowledgment of Withdrawal: Statement by the Trustor(s) reclaiming all assets and revoking the trust.

- Signatures: Legal validation of the document, often requiring notarization for authenticity and recognition.

These components ensure that all parties involved are aware of the revocation and its implications.

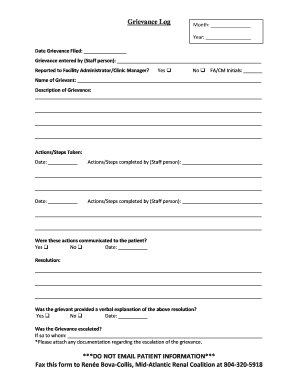

Steps to Complete the Revocation

Completing a revocation of living trust involves several precise steps to ensure legal compliance:

- Draft the Document: Begin with a comprehensive document that outlines intent, effective date, and trust details.

- Review Legal Framework: Verify that the revocation adheres to state-specific legal requirements.

- Notarization: Have the document notarized to ensure it is legally binding.

- Distribute Copies: Provide copies to relevant parties, including trustees or beneficiaries.

- Reclaim Assets: Formally reclaim the assets previously held in trust.

Each step must be thoroughly considered to avoid potential legal challenges in the future.

Why You Might Revoke a Living Trust

Revoking a living trust is often a strategic decision influenced by several factors:

- Change in Relationships: Divorce, marriage, or new family members might necessitate a reassessment of estate plans.

- Asset Reallocation: Changes in asset value or ownership can prompt a restructuring.

- Updated Estate Plans: New legal instruments or tax strategies may offer more advantageous benefits.

Such decisions are usually made after consulting with a legal or financial advisor and considering all potential implications.

Legal Use and Considerations

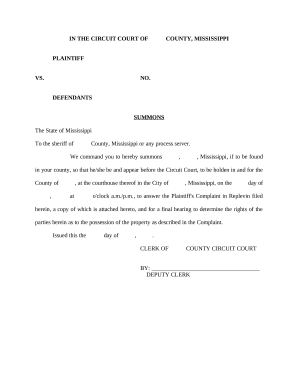

A revocation of a living trust must comply with specific state laws governing trusts and estate planning. The document has to be precise and legally sound to avoid disputes. In most U.S. jurisdictions, a notarial act is required, and additional state-specific statutes might dictate further procedural obligations.

State-Specific Rules

Each state may impose unique requirements regarding the documentation and execution of trust revocations. For example:

- Notarization: Some states mandate notarized signatures, while others might accept two witnesses.

- Registration: Filing the revocation with a public registry may be necessary in some jurisdictions.

Understanding these variations ensures adherence to local laws and prevents future legal challenges.

Who Typically Uses This Form

The form is most often utilized by:

- Individual Trustors: Those who've created personalized estate plans.

- Legal Advisors: Attorneys facilitating estate management changes.

- Financial Planners: Professionals advising on asset management and distribution.

It's vital to involve the relevant parties who understand the intricacies of the trust and its implications.

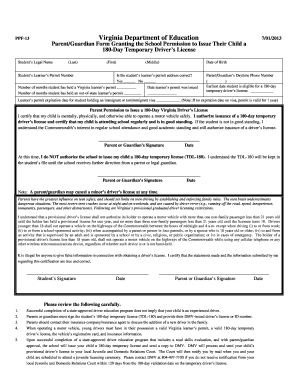

Software Compatibility and Digital Transition

In today's digital age, software platforms like DocHub facilitate the editing, signing, and management of such legal documents online, streamlining the process from drafting to execution.

Document Workflow on Digital Platforms

Utilizing platforms like DocHub provides:

- Ease of Access: Manage documents from any device with internet connectivity.

- Secure Signatures: Legally compliant e-signatures following ESIGN Act guidelines.

- Collaboration Tools: Enables input from multiple stakeholders with real-time updates.

This digital transition enhances both the efficiency and security of handling sensitive legal documents.