Definition and Meaning of Form 720

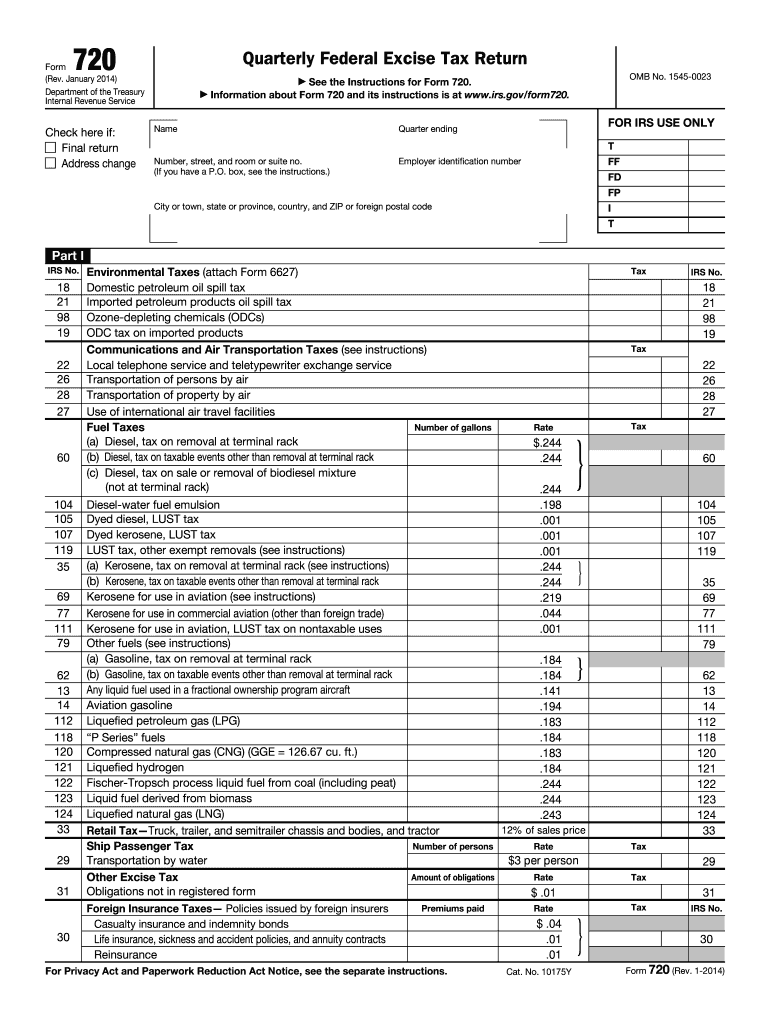

The 2014 Form 720 is the IRS document utilized for reporting and paying various federal excise taxes. It specifically addresses taxes associated with specific goods and services, including but not limited to fuel taxes, environmental taxes, and transportation taxes.

This form serves as a comprehensive return for reporting multiple types of excise taxes on a quarterly basis. Taxpayers must accurately complete the form to ensure compliance with federal regulations, as it provides critical information necessary for the IRS to assess and collect the appropriate taxes owed.

How to Obtain the 2014 Form 720

Obtaining the 2014 Form 720 is straightforward. Here are several methods to secure a copy:

- IRS Website: The easiest way to obtain the form is via the IRS official website, where it can be downloaded for free in PDF format.

- Tax Professionals: Many tax preparation services provide copies of this form to their clients, especially those who handle business or excise taxes frequently.

- Office Supply Stores: Retailers that sell tax-related products may also stock physical copies of IRS forms, including Form 720.

- Local IRS Offices: Individuals can visit their nearest IRS branch for assistance in obtaining the form.

When accessing the form, ensures that the version corresponds to the specific tax year you need, in this case, 2014.

Steps to Complete the 2014 Form 720

Completing the 2014 Form 720 involves several key steps:

-

Gather Necessary Information: Before filling out the form, collect all relevant documentation, including prior IRS correspondence, financial records, and specifics regarding the excise taxes applicable to your situation.

-

Enter Taxpayer Information: Provide accurate taxpayer details at the top of the form, including your name, address, and Employer Identification Number (EIN) or Social Security Number (SSN) if applicable.

-

Report Excise Tax Liability: Fill in the various sections detailing your excise tax liabilities. This includes specifying the type of excise taxes owed based on the goods or services provided and calculations of the tax amounts for each category.

-

Claim Refunds or Credits: If applicable, indicate any refunds or credits you are claiming on the form. Be sure to follow the specific guidelines for claiming these amounts to ensure that they are processed correctly.

-

Sign and Date: After verifying all information is accurate and complete, ensure that you or an authorized representative signs and dates the form.

-

File the Form: Submit the completed form according to IRS guidelines, either through mail or electronically as specified by the IRS.

Following these steps carefully will help ensure that the form is completed correctly, thereby reducing the risk of errors that could lead to penalties or delays in processing.

Important Terms Related to Form 720

Understanding key terms associated with the 2014 Form 720 can aid in its completion and compliance:

- Excise Tax: A type of tax imposed on specific goods or services, distinct from income or sales taxes, often included in the cost of the product.

- Taxpayer Identification Number (TIN): A unique identifier assigned to individuals and businesses for tax purposes. This includes Social Security Numbers for individuals and Employer Identification Numbers for businesses.

- Filing Deadline: The due date for submitting the form, which is typically the last day of the month following the end of the quarter for which the taxes are reported.

- Refund or Credit: Amounts refundable to the taxpayer or credits applicable against future tax liabilities based on overpaid taxes in previous filings.

Familiarity with these terms supports accurate completion and better understanding of the forms and associated obligations.

IRS Guidelines for Filing the 2014 Form 720

The IRS provides specific guidelines for the completion and submission of Form 720, essential for ensuring compliance:

- Quarterly Filing Requirement: Form 720 must be filed quarterly, generally due the last day of the month after the quarter ends.

- Accuracy in Reporting: It's crucial to accurately report all taxable activities associated with excise taxes. Inaccurate reporting may result in audits or additional penalties.

- Payment Instructions: The IRS specifies methods for paying taxes owed, which may include electronic payment options or paper checks. Ensure to follow the directions closely to avoid processing delays.

- Record Retention: Taxpayers should retain copies of submitted forms and any supporting documentation for a period of at least three years, as the IRS may request these in case of audits or inquiries.

Adhering to these guidelines will assist taxpayers in successfully meeting their tax obligations related to excise taxes.

Filing Deadlines for the 2014 Form 720

Meeting filing deadlines is essential to avoid penalties and interest. The deadlines for the 2014 Form 720 are:

- For the First Quarter: Due by April 30, 2014, covering January, February, and March.

- For the Second Quarter: Due by July 31, 2014, for April, May, and June.

- For the Third Quarter: Due by October 31, 2014, covering July, August, and September.

- For the Fourth Quarter: Due by January 31, 2015, for October, November, and December.

Timely submission of Form 720 for each quarter ensures compliance with IRS requirements and avoids potential penalties for late filing.