Definition & Meaning

Form 50-230 is a specific motion form used in Texas for property tax purposes, specifically designed to request a hearing for correcting a one-third over-appraisal error. This form serves as a formal request to reassess property tax valuations that are believed to be inaccurately high, thus offering property owners or chief appraisers an opportunity to ensure fairness in their property tax obligations. By submitting Form 50-230, involved parties can initiate a legal process to review and potentially adjust the property assessment to better reflect its true value under the Texas Property Tax Code.

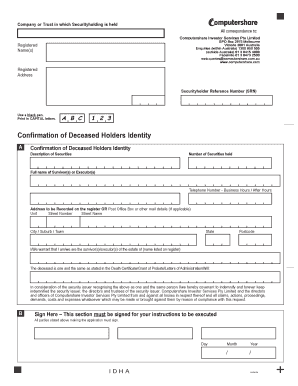

How to Use the Form 50-230

Using Form 50-230 involves a detailed process ensuring all necessary information is accurately provided. Generally, the movant, who can be the property owner or the chief appraiser, begins by filling out the form with the essential details, including the property's identification and the nature of the alleged over-appraisal. The form requires comprehensive information to substantiate the claim of over-appraisal, and completing it accurately is crucial for the request to be considered. Once filled out, the form is submitted to the relevant taxing authorities as a formal motion to schedule a hearing.

Steps to Complete the Form 50-230

-

Gather Necessary Information: Start by collecting all required documents that support the claim of over-appraisal, such as recent appraisals, property sale proofs, or comparative market analyses.

-

Fill Out the Form: Enter all relevant details, including property identification, indication of the one-third appraisal error, and any supporting calculations or evidence.

-

Identify the Movant: Clearly state whether the form is submitted by the property owner or the chief appraiser to establish who is initiating the motion.

-

Check Compliance: Ensure that the property taxes are not delinquent and comply with sections of the Texas Property Tax Code.

-

Sign and Date: Confirm the accuracy of all provided information, then sign and date the form to authenticate the motion.

-

Submit the Form: Send the completed form to the appropriate local government office responsible for tax assessments.

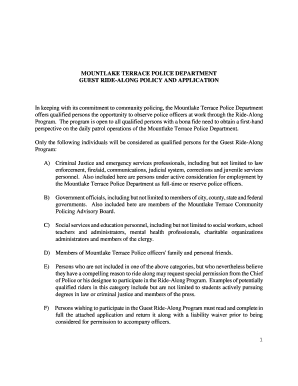

Who Typically Uses the Form 50-230

Form 50-230 is primarily used by property owners and chief appraisers in Texas who believe there has been an over-appraisal of property taxes. This includes individuals who suspect that their property value has been assessed too high by at least one-third, resulting in unjust property tax bills. It is crucial for these users to have a clear understanding of the form to effectively communicate their need for a reassessment.

Legal Use of the Form 50-230

The legal use of Form 50-230 is grounded in the regulations of the Texas Property Tax Code, which outlines specific conditions under which a property tax appraisal can be contested. The submission of this form represents a formal motion to the appraisal review board for a hearing and does not, by itself, constitute a change in valuation. It is a legally binding document that initiates a process requiring official review and potential correction of an erroneous property tax assessment.

State-Specific Rules for the Form 50-230

While Form 50-230 is specific to Texas, its use is subject to additional state-specific guidelines. This form must be submitted in accordance with Texas state requirements, particularly concerning the timelines and conditions under which property tax reconsiderations are assessed. It is crucial for applicants to familiarize themselves with these state-specific criteria to ensure compliance and maximize the likelihood of a successful appraisal adjustment.

Filing Deadlines / Important Dates

Timing is critical when submitting Form 50-230. Typically, there are specific deadlines by which the form must be filed, often tied to the issuance date of the property tax assessment notification. In Texas, these filing deadlines are established to allow sufficient time for review and scheduling of hearings, thus creating a fair opportunity for both parties to prepare their case. Missing these deadlines can preclude the ability to contest the appraisal, so adherence to the schedule is imperative.

Required Documents

When submitting Form 50-230 for a review of property tax assessments, several supporting documents are typically required to validate the motion. These might include:

- Current property appraisal reports

- Sales comparisons reports

- Photographic evidence of the property's condition

- Previous tax assessment records

- Documentation of any errors in the current assessment

These documents collectively provide the necessary evidence to support the claim, establishing a stronger case for appraisal revision during the hearing process.