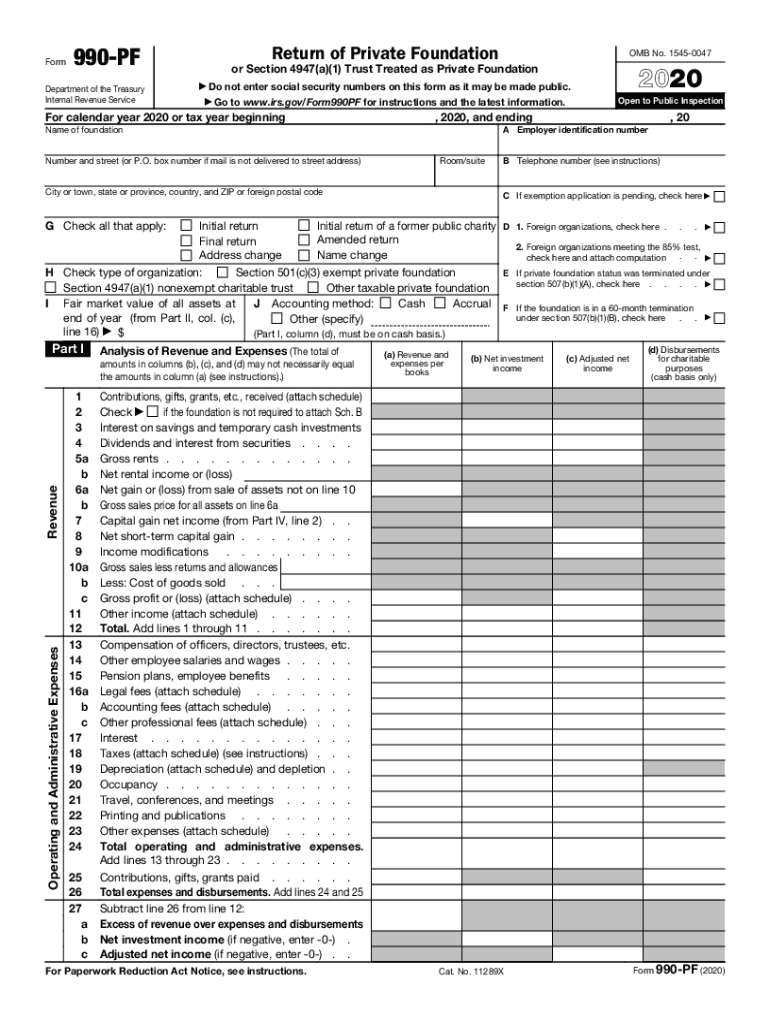

Understanding Form 990-PF

Form 990-PF, also known as the Private Foundation Form, is required for tax-exempt organizations that are classified as private foundations. These foundations include family and corporate foundations, as opposed to public charities. The form is designed to document the financial operations of the foundation, covering revenues, expenses, and activities conducted for charitable purposes.

Important Terms Related to Form 990-PF

Understanding the terminology is crucial for accurately completing Form 990-PF:

- Private Foundation: A tax-exempt organization funded by a single source, such as a family or corporation, and primarily grants funds to other organizations.

- Charitable Distributions: Monetary contributions made by the foundation to support charitable activities.

- Qualifying Distributions: Expenditures that count toward the foundation's requirement to distribute a percentage of its assets annually.

- Excise Taxes: Federal taxes imposed on private foundations, particularly concerning investment income.

Steps to Complete Form 990-PF

Completing Form 990-PF involves several steps:

- Gather Financial Information: Collect data on income, expenses, assets, and liabilities for the reporting year.

- Document Contributions and Grants: Record all grants provided and contributions received within the year.

- Calculate Excise Taxes: Determine and report excise taxes on investment income as prescribed by IRS regulations.

- Detail Operational Activities: Provide an overview of the administrative and operating expenses incurred.

- Review and File: Thoroughly review the completed form for accuracy before filing.

Who Typically Uses the Form 990-PF

The primary users of Form 990-PF are privately funded charitable foundations. This also includes:

- Family foundations, where donations are predominantly from a single family.

- Corporate foundations, established by businesses to manage their charitable donations.

- Grant-making foundations that allocate funds to other charitable entities.

Filing Deadlines and Important Dates

Timely submission of Form 990-PF is critical to avoid penalties. The filing deadline is the 15th day of the 5th month following the end of the foundation’s fiscal year. For instance, if the foundation's fiscal year ends on December 31, the form is due on May 15 of the following year. Extensions are available if requested before the original due date.

How to Obtain Form 990-PF

Form 990-PF can be acquired through several channels:

- IRS Website: Available for download from the official IRS website.

- Tax Preparation Software: Integrated into many tax software solutions.

- IRS Offices: Obtained directly from IRS offices upon request.

Penalties for Non-Compliance

Failing to file Form 990-PF accurately and on time can result in significant penalties:

- Monetary Fines: Possible fines for late filing or incorrect information, calculated per day the form is late.

- Revocation of Tax-Exempt Status: Severe non-compliance may lead to the loss of tax-exempt status.

- Public Disclosure: Non-filed forms become public, potentially impacting the foundation's reputation.

IRS Guidelines

Adherence to IRS guidelines ensures compliance:

- Record-Keeping: Maintain detailed financial records for transparency.

- Documentation of Grants: Keep supporting documents for all grants and contributions.

- Annual Reporting: Follow IRS protocols for filing Annual Information Returns.

Case Examples of Using Form 990-PF

Foundations often use Form 990-PF to highlight their initiatives and financial stewardship:

- Grant Disbursement: Reporting large grants to educational institutions or healthcare facilities.

- Operational Budgeting: Documenting administrative costs and operational budgets.

- Impact Reporting: Demonstrating the foundation's societal contributions and achievements over the year.

By understanding these critical elements, users of Form 990-PF can effectively manage their reporting requirements and enhance their foundation’s compliance and transparency.