Definition & Meaning

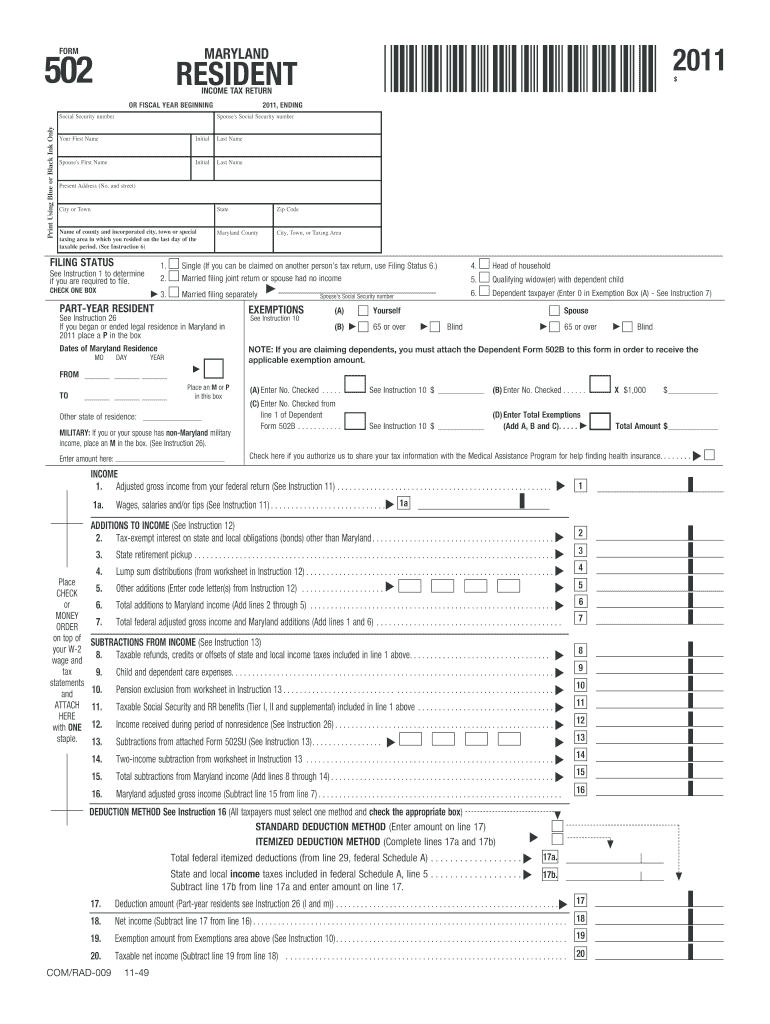

The 2011 502 form is a Maryland Resident Income Tax Return form used for reporting an individual’s income, exemptions, deductions, and tax credits for the fiscal year 2011. This form is specifically designed to help Maryland residents calculate their state income tax liability or refund by detailing all taxable income sources and applicable tax credits.

How to Use the 2011 502 Form

To effectively use the 2011 502 form, begin by gathering all relevant financial documents, including W-2s, 1099s, and records of other income. Identify all income sources and deductions applicable to your situation, ensuring accuracy in reporting. Use the form to detail your annual income and any adjustments to gross income, then proceed to compute the Maryland adjusted gross income. Lastly, apply any exemptions or credits and calculate the tax liability or refund owed to or from the state.

Steps to Complete the 2011 502 Form

- Personal Information: Enter your full name, Social Security number, and filing status.

- Income Details: Include all income earned in the fiscal year, such as wages, dividends, and capital gains.

- Adjustments and Deductions: Detail allowable deductions and any adjustments to income.

- Exemptions and Credits: List exemptions and any credits you are eligible for, which may reduce your taxable income.

- Calculate Tax Liability/Refund: Compute your Maryland adjusted gross income and determine the amount owed or any refund due.

- Signature and Submission: Sign the form and submit it via the chosen method, ensuring all information is complete and accurate.

Filing Deadlines / Important Dates

The filing deadline for the 2011 502 form for the fiscal year 2011 was April 15, 2012. It is crucial to submit the form by this date to avoid potential penalties. Extensions could be requested, which might extend the deadline, but late filing penalties and interest may apply unless due taxes are paid by the original deadline.

Required Documents

When completing the 2011 502 form, it is essential to have all necessary documentation on hand, including:

- W-2 forms for reporting wages and salary

- 1099 forms for other types of income

- Records of deductible expenses

- Documents for any credits claimed, such as education credits or energy-efficient home improvements

- A copy of your federal tax return, which can assist in accuracy and consistency

State-Specific Rules for the 2011 502 Form

Maryland has specific guidelines and tax laws that can affect how the 2011 502 form is completed. Taxpayers must be aware of state-specific deductions, like credit for taxes paid to other states, pension exclusions, and other Maryland-only credits. Maryland tax laws can change annually, so it’s important to verify that year-specific laws are followed.

Eligibility Criteria

Eligible individuals for filing the 2011 502 form are those who resided in Maryland for the entire 2011 tax year. Non-residents or part-year residents may need to use an alternative form like the 505. Eligibility is also dictated by income thresholds that require filing and dependents that affect filing status, exemptions, and credits.

Key Elements of the 2011 502 Form

- Personal Information: Ensure the correct personal details and status.

- Income Details: Accurately present all taxable income.

- Deductions and Credits: Identify applicable deductions and claim all eligible credits.

- Calculated Tax: Finalize the calculation of tax liability or refund due.

- Signature: Certify authenticity and completion of the form.

Examples of Using the 2011 502 Form

Consider a taxpayer who earned wages, interest from savings, and received student loan interest deductions. This individual would use the 2011 502 form to declare all income, apply allowable deductions, and compute the total tax due. For another example, a retired couple with pension income and significant medical deductions would use the form to potentially receive eligible tax credits while calculating their final tax responsibility or refund from the state.