Understanding the Fillable Credit Reference Form

The fillable credit reference form serves as a critical tool for businesses to assess the creditworthiness of prospective clients or customers. This form collects essential information that helps businesses make informed decisions when extending credit. It typically requires details about the applicant's business, financial history, and trade references.

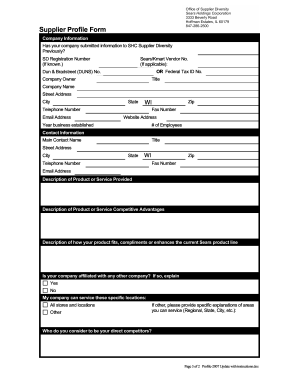

Components of the Fillable Credit Reference Form

The structure of a fillable credit reference form usually includes the following key components:

-

Business Information:

- Business name

- Business address

- Contact number

- Type of business (LLC, Corporation, Partnership, etc.)

-

Ownership Details:

- Owner's name

- Owner's contact information

-

Trade References:

- Up to four trade references, including:

- Company name

- Contact person

- Phone number

- Email address

- Up to four trade references, including:

Filling Out the Credit Reference Form

Filling out the fillable credit reference form accurately is essential for efficient processing. Here are the steps involved:

- Input Business Information: Begin by providing comprehensive details about your business.

- List Trade References: Include reliable contacts from previous vendors or suppliers who can vouch for your creditworthiness.

- Tidy Up Any Required Fields: Ensure that all mandatory fields, indicated on the form, are completed before submission.

- Review and Proofread: Double-check all entries for accuracy to avoid delays in processing.

Importance of Trade References

Trade references play a significant role in determining your credibility in the eyes of potential creditors. The benefits of including robust trade references include:

- Credibility: Established relationships with other businesses can enhance your company’s reputation.

- Verification: Creditors can contact trade references to confirm your payment history and reliability.

By selecting trustworthy references and ensuring their contact details are current, you improve the chances of receiving favorable credit terms from prospective suppliers.

Legal Considerations

When using the fillable credit reference form, it is important to be aware of the legal implications:

- Confidentiality: Ensure that sensitive information shared in the form is handled responsibly and kept secure.

- Consent: Prior to listing a trade reference, obtain permission from the organizations you wish to include. Unauthorized use of a business's name could lead to legal complications.

Common Use Cases for the Credit Reference Form

The fillable credit reference form is utilized by various sectors, particularly:

- Retail: Businesses may require credit references from suppliers before granting terms for large orders.

- Service Providers: Service-based companies may seek credit references to ensure that clients have a solid credit history.

Understanding these scenarios can help business owners better prepare their forms and provide adequate references.

Variants of the Credit Reference Form

There are several types of credit reference forms tailored for specific needs. Examples include:

- Business Credit Reference Template: This version may include comprehensive sections tailored specifically for B2B transactions.

- Simple Credit Reference Form: A streamlined version with essential fields for quick reference, often used for smaller credit assessments.

Keeping Track of Submissions

Once the fillable credit reference form is completed and submitted, tracking the status of requests for credit can be beneficial. Consider the following suggestions:

- Maintain Copies: Keep a digital or physical copy of the submitted form for your records.

- Follow-Up: Contact the references after a reasonable time to check if creditors have connected for feedback.

Conclusion on Fillable Credit Reference Forms

The fillable credit reference form is not only a tool for credit assessment but a means of establishing partnerships based on trust and reliability. By understanding its components and legal implications, businesses can enhance their credibility and improve their chances of successful credit applications. Ensuring precision and clarity in this document can lead to better financial opportunities and more robust business relationships.