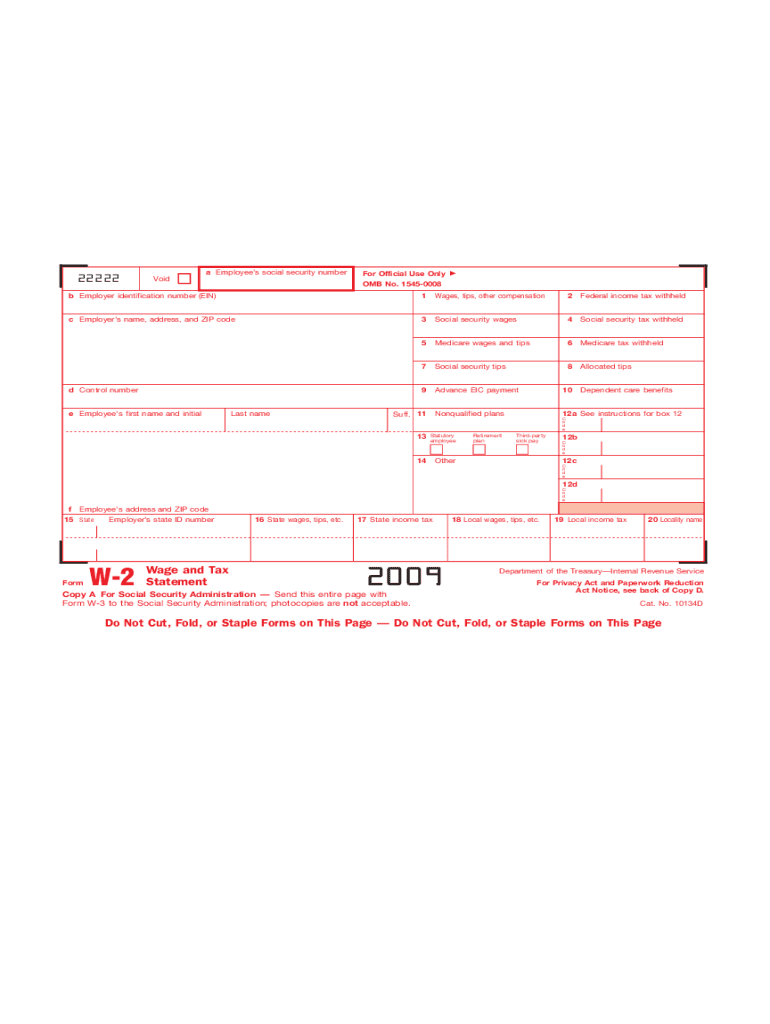

Definition and Meaning of the 2009 Form

The "2009 form" refers to a standard document used for specific reporting or tax purposes. This form plays a critical role in ensuring compliance with regulatory and legal requirements set by government entities. Understanding its purpose, requirements, and implications is crucial for accurate filing and adherence to legal standards.

How to Use the 2009 Form

Using the 2009 form requires a clear understanding of its fields and the information to be provided. The form typically includes sections that capture personal, financial, or business-related information. Users must carefully fill in all required fields, ensuring that each entry is accurate to prevent errors that could result in penalties. It is advisable to review the form guidelines to correctly interpret each section.

How to Obtain the 2009 Form

You can obtain the 2009 form from several sources, including online platforms or direct requests from relevant agencies. One common approach is to download the form from official websites of issuing bodies. Alternatively, you can request a physical copy via mail or pick it up at designated offices. It's important to ensure you have the latest version of the form for accurate completion.

Steps to Complete the 2009 Form

-

Read Instructions: Begin by thoroughly reading the instructions accompanying the form. Understanding the requirements and terminology will guide accurate completion.

-

Gather Required Information: Before filling out the form, collect all necessary documents and information. This preparation avoids interruptions and ensures accuracy.

-

Accurate Entry: Fill in the form carefully, double-checking each entry for accuracy. Pay attention to mandatory fields to avoid incomplete submissions.

-

Review and Correct: After completing the form, review it for any missing or incorrect information. Rectify errors before signing or submitting the form.

-

Submit: Follow the prescribed method of submission, whether by mail, online, or in person, ensuring compliance with deadlines.

Who Typically Uses the 2009 Form

The 2009 form is used by various individuals and entities, such as businesses, tax filers, or other specific groups that the form pertains to. This form serves to report financial data or other relevant information that impacts legal standing or compliance with regulatory obligations. Identifying the typical users helps tailor its completion to specific needs and circumstances.

Key Elements of the 2009 Form

Critical sections of the 2009 form often include:

- Identification Information: Includes fields for names, addresses, and identification numbers.

- Specific Financial or Business Data: Captures details pertinent to the form's objective, such as income, deductions, or transactions.

- Certification: A section for the filer’s signature, confirming the accuracy of the information provided.

Filing Deadlines and Important Dates

Complying with filing deadlines is crucial to avoid penalties. The 2009 form must be filed by a specific date, typically dictated by regulatory bodies. Familiarize yourself with these deadlines to ensure timely submission. Missing these dates can lead to financial penalties or other repercussions.

Penalties for Non-Compliance with the 2009 Form

Failing to comply with the form's requirements can lead to various penalties. These may include fines, interest on unpaid amounts, or legal action. It's crucial to meet all deadlines, provide accurate information, and adhere to submission guidelines to avoid these consequences.

Digital vs. Paper Versions of the 2009 Form

The 2009 form may be available in both digital and paper formats. Understanding the pros and cons of each format is essential. Digital versions offer convenience, speed, and error-checking functionalities. Conversely, paper versions might be preferred for those who require a traditional approach due to lack of internet access or personal preference. Each version must align with the submission requirements specified by the issuing entity.