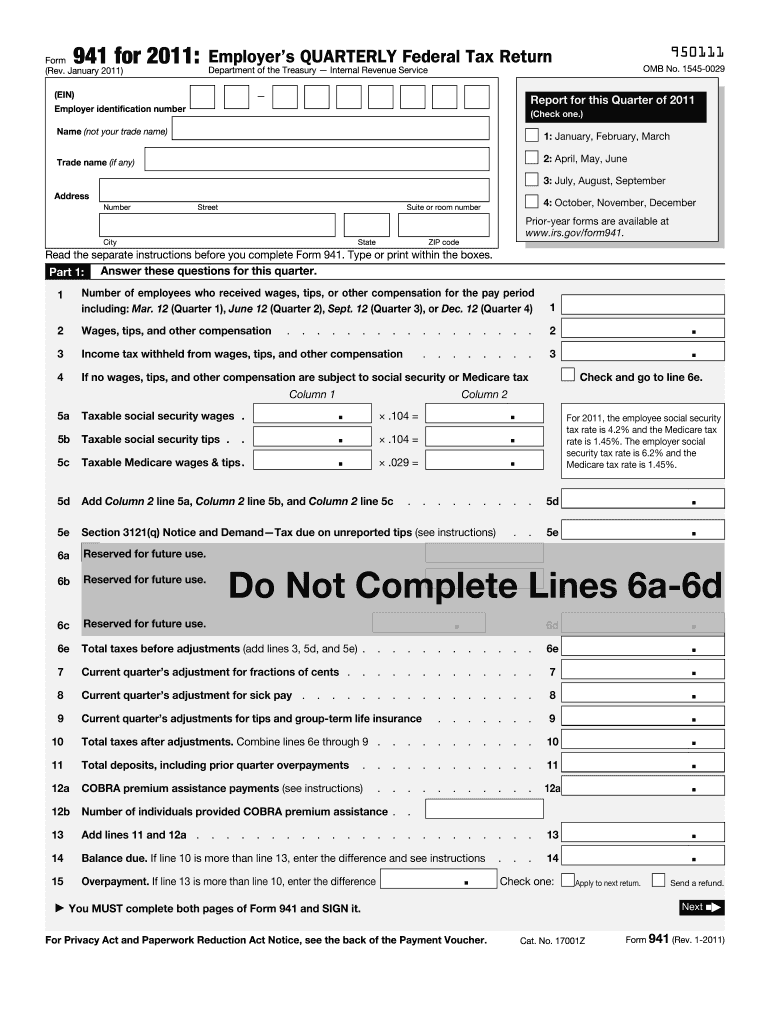

Definition and Purpose of the 2011 Form 941

The 2011 Form 941, known officially as the Employer's Quarterly Federal Tax Return, is essential for employers in the United States. This form reports wages, tips, and other compensations paid to employees, along with the federal income taxes and payroll taxes withheld. Employers must also report Social Security and Medicare taxes using this form. The information provided on Form 941 helps the IRS track employer compliance with tax obligations, ensuring the correct amount is withheld from employees.

Who Typically Uses the 2011 Form 941

Employers across various business sectors use Form 941 to fulfill their tax reporting duties. Typically, any business with employees receiving wages or tips must file this form every quarter. This includes large corporations, small businesses, and non-profit organizations. Self-employed individuals who are not on payroll and do not withhold taxes for other employees generally do not use Form 941.

Steps to Complete the 2011 Form 941

-

Gather Necessary Information: Prepare employee wage data, including total wages paid, withheld federal income tax, and both employee and employer portions of Social Security and Medicare taxes.

-

Complete Part 1: Report the number of employees, total wages, tips, and other compensation paid. Detail federal income tax withheld, and Social Security and Medicare taxes.

-

Complete Part 2: Provide the deposit schedule and tax liability for the quarter.

-

Complete Part 3: Declare if a seasonal employer or if the business is closed.

-

Complete Part 4: Authorize a third-party designee if applicable.

-

Sign and Date: The forms must be signed by the responsible person or officer of the business.

How to Use the 2011 Form 941

Employers use the 2011 Form 941 every quarter to report tax withholdings and other related tax information to the IRS. The process involves calculating the precise amounts of taxes withheld from employees and ensuring that deposits are made according to IRS rules. The form acts as a summary of these transactions, verifying the employer has fulfilled their tax duties.

Filing Deadlines and Important Dates

Form 941 must be filed by the last day of the month following the end of each quarter. The quarters end on March 31, June 30, September 30, and December 31. Therefore, the deadlines for filing are April 30, July 31, October 31, and January 31. Failure to file on time may result in penalties and interest charges.

IRS Guidelines for the 2011 Form 941

The IRS provides detailed guidelines on completing Form 941, emphasizing accuracy and timeliness. Employers should reference the instructions available on IRS.gov for filling specific sections. The guidelines also detail how to correct errors on previously submitted forms using Form 941-X.

Penalties for Non-Compliance

Failing to file Form 941 or paying the required taxes could lead to significant penalties. The IRS imposes fines based on a percentage of the unpaid taxes, which accrue each month the return remains unfiled or unpaid. Additionally, intentional disregard of filing requirements could result in higher penalties.

Key Elements to Include in Form 941

- Employee Count: Total number of employees during the reporting period.

- Taxable Wages: Sum of all employee wages and tips.

- Tax Liability: Detailed breakdown of taxes withheld, including federal income tax and both portions of Social Security and Medicare.

Important Terms Related to the 2011 Form 941

- Withholding: The process of an employer deducting taxes from an employee's wages.

- FICA: Federal Insurance Contributions Act, which encompasses Social Security and Medicare taxes.

- Quarterly Filing: The requirement to report tax information every three months.

Form Submission Methods

Form 941 can be filed electronically through IRS-approved e-file providers, mailed to designated IRS addresses, or submitted in person at an IRS office. Electronic filing is encouraged as it reduces errors and expedites processing.

Software Compatibility with Form 941

Many tax preparation software platforms, such as TurboTax and QuickBooks, support Form 941 filing. These programs offer templates and instructions to simplify form completion, ensuring accuracy and compliance with the latest tax law updates.