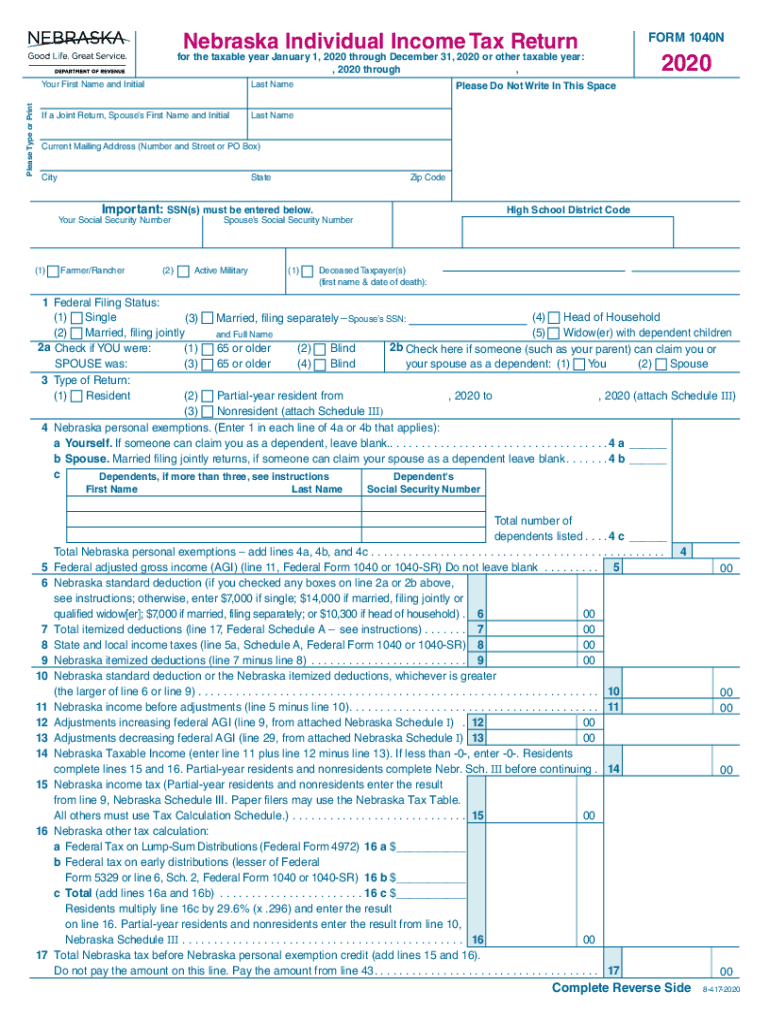

Definition and Meaning of the Form 1040N Instructions

The Form 1040N instructions are detailed guidelines provided to assist taxpayers in completing the Nebraska Individual Income Tax Return, known as Form 1040N. These instructions offer comprehensive insights on how to accurately fill out the form, ensuring compliance with Nebraska state tax laws. By following these instructions, taxpayers can understand critical aspects such as eligibility criteria, deduction entitlements, and tax credits applicable in Nebraska.

How to Use the Form 1040N Instructions

Using the Form 1040N instructions involves several steps to ensure an accurate filing process. These guidelines are designed to simplify the completion of the 1040N form by providing a step-by-step approach to each section of the return:

- Read the Entire Document: Before starting, it is crucial to read through all the instructions to gain a full understanding of the requirements.

- Gather Required Information: Collect necessary personal and financial details, including income, deductions, and credits.

- Section Analysis: Go through each part of the 1040N instructions that corresponds to the form sections you need to complete, focusing on income reporting, credits, and deductions.

- Complete Calculations: Utilize the instructions to perform necessary calculations for your income tax liability and potential refunds.

- Review for Accuracy: Double-check all entered information against the instructions to ensure completeness and correctness before submission.

Steps to Complete the Form 1040N Instructions

Following the steps outlined in the Form 1040N instructions is vital for a successful tax return submission:

- Detail Personal Information: Fill in your personal details on the form, including name, address, and social security number.

- Report Income Sources: Use the guidelines to report all forms of income, such as wages, dividends, and any additional earnings.

- Claim Deductions and Credits: Carefully follow the instruction to apply any relevant deductions or credits you qualify for, such as the School Readiness Tax Credit.

- Compute Tax Liability: Use the provided worksheets to calculate your total tax liability for the tax year.

- Verify Entries: Double-check all details and calculations before finalizing your submission.

Key Elements of the Form 1040N Instructions

The key elements of the Form 1040N instructions include:

- Income Reporting: Guidance on reporting wages, interest, dividends, and other income sources.

- Deduction Explanations: Detailed information on available deductions and how to claim them accurately.

- Credit Applications: Instructions on applying for state-specific tax credits.

- Filing Status Definitions: Clarification on selecting the correct taxpayer filing status.

- Tax Tables and Worksheets: Tools for calculating your exact tax liability and potential refund.

Important Terms Related to Form 1040N Instructions

Understanding important terms is crucial for correctly interpreting the Form 1040N instructions:

- Tax Year: The calendar year for which the tax return is being filed.

- Filing Threshold: Minimum income level at which a taxpayer is required to file a tax return.

- Adjusted Gross Income (AGI): Total income after specific adjustments, used as a basis for calculating taxable income.

- Standard Deduction: A set deduction amount subtracted from AGI if the taxpayer does not itemize deductions.

- Tax Credit: A direct reduction in tax liability, potentially resulting in a refund if it exceeds taxes owed.

IRS Guidelines Related to the Form 1040N Instructions

The Form 1040N instructions align with IRS guidelines, ensuring that state tax filings are consistent with federal obligations. This includes:

- Identifying Taxpayers: Ensuring the correct identification of taxpayers through personal information.

- Consistency with Federal Returns: Aligning the Nebraska state tax return with details reported on the federal income tax return.

- Compliance with Tax Regulations: Following IRS guidelines for deductions, credits, and overall tax calculations to prevent errors.

Filing Deadlines and Important Dates

Adhering to filing deadlines and important dates as indicated in the Form 1040N instructions is crucial:

- Regular Filing Deadline: Typically due by April 15 each year, aligning with the federal tax filing deadline.

- Extensions: Guidelines on how to apply for an extension if more time is needed to complete the 1040N.

- Amendments: Instructions on filing amended returns if errors or omissions are discovered post-submission.

Form Submission Methods: Online, Mail, In-Person

The Form 1040N instructions offer multiple submission methods to accommodate different taxpayer preferences:

- Online Filing: Utilize the Nebraska e-filing system for faster processing and confirmation of receipt.

- Mail: Traditional paper filing options are available, with instructions on where to send completed forms.

- In-Person Assistance: Details on how to seek help from local tax offices for personal submission and clarification of queries.