Definition & Purpose of the 2014 IRS Address Form

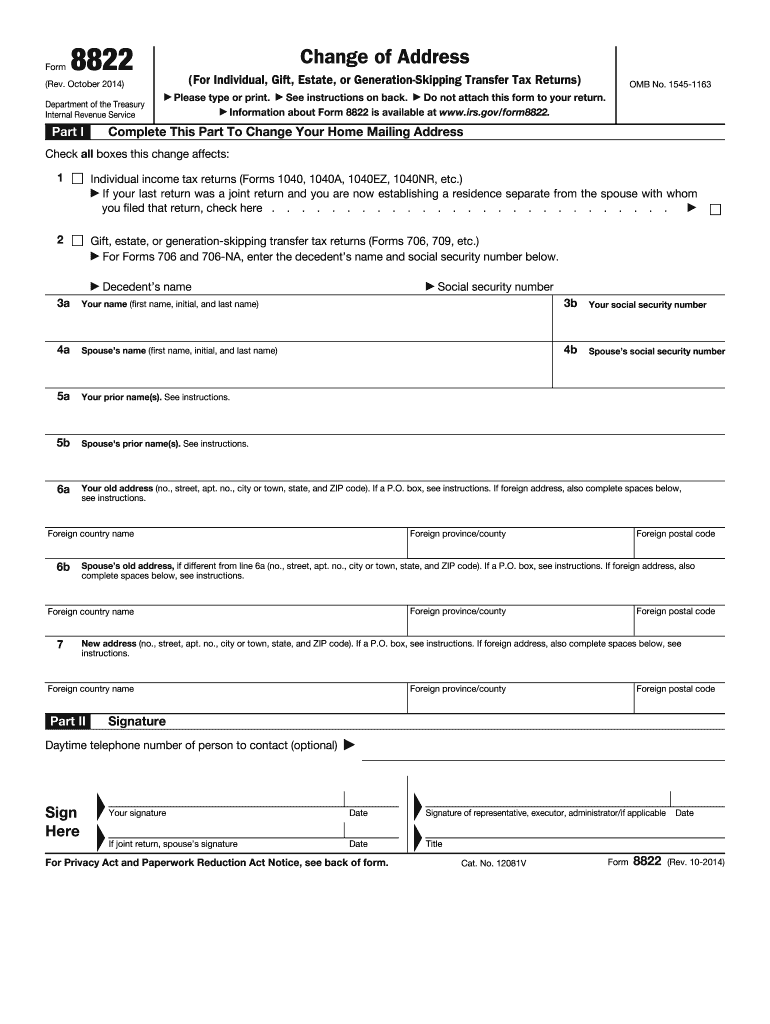

The 2014 IRS Address form, officially known as Form 8822, is used to inform the Internal Revenue Service (IRS) of changes to the home mailing address for anyone responsible for filing tax returns, including those related to gift, estate, or generation-skipping transfer taxes. Changing addresses with the IRS is crucial to ensure that tax documents, notices, and any potential refunds reach the taxpayer in a timely manner. The form collects vital information such as the taxpayer's previous and new addresses, names, and social security numbers, serving as a formal update to the IRS records.

How to Obtain the 2014 IRS Address Form

To obtain the 2014 IRS Address form, individuals can download it directly from the IRS website in PDF format. Additionally, the form can be requested by calling the IRS or visiting a local IRS office. For those who prefer digital methods, platforms like DocHub allow users to import forms from cloud services like Google Drive, Dropbox, or OneDrive and fill them out electronically.

Steps to Complete the 2014 IRS Address Form

- Personal Information: Begin by entering personal details such as your full name, social security number, and the names of your spouse or others listed on your tax return.

- Address Details: Provide the old address that the IRS has on file as well as the new address where future correspondence should be sent.

- Tax Information: Indicate the type of tax return affected (for instance, individual, business, or estate).

- Signature & Date: Sign and date the form to validate the information. If applicable, the signature of your spouse or a co-filer is also needed.

- Mail the Form: Follow the instructions on the form to determine the correct IRS office address for submission based on your old address.

Who Typically Uses the 2014 IRS Address Form

The form is used by a broad range of taxpayers, including individual filers, businesses, and estates. Individuals who have changed their primary residence, businesses that have moved their operations, and estates undergoing administrative changes are common users. Self-employed individuals, retirees moving to new states, and students relocating after graduating are specific examples of taxpayers who might need to utilize this form.

Key Elements of the 2014 IRS Address Form

- Personal Identification: Names, social security numbers, and contact numbers.

- Address Information: Both previous and current addresses are necessary for the IRS to update their system accordingly.

- Tax Categories: Specifies which types of tax forms or documentation the address change affects.

- Signature Requirement: Ensures that the information is authenticated and processed correctly.

Important Terms Related to the 2014 IRS Address Form

- Change of Address: Refers to updating the primary location where the IRS sends correspondence.

- Tax Notice: Official communications from the IRS regarding tax responsibilities or issues.

- Estate Tax: A tax levied on the estate of a deceased person before distribution to the heirs.

- Authentication: The process of verifying identity and the validity of information.

Legal Use of the 2014 IRS Address Form

Using Form 8822 is a legal requirement for notifying the IRS of an address change. This notification helps ensure that taxpayers remain compliant by receiving all necessary tax-related documents and communications. The failure to update an address could result in missed communications, potentially leading to penalties or audits due to unintentional non-compliance.

State-Specific Rules for the 2014 IRS Address Form

While the federal form 8822 is uniform across states, certain states may have additional requirements or their own change-of-address forms for state tax purposes. It is advisable for taxpayers to check with their state's Department of Revenue to ensure compliance with both federal and state addressing needs.

Filing Deadlines and Important Dates for the 2014 IRS Address Form

There is no fixed deadline for submitting the 2014 IRS Address form, but it is recommended to file it as soon as possible after an address change occurs. Prompt submission ensures that the IRS updates their records in time for the next tax cycle, minimizing the risk of missing critical tax notices or refunds.