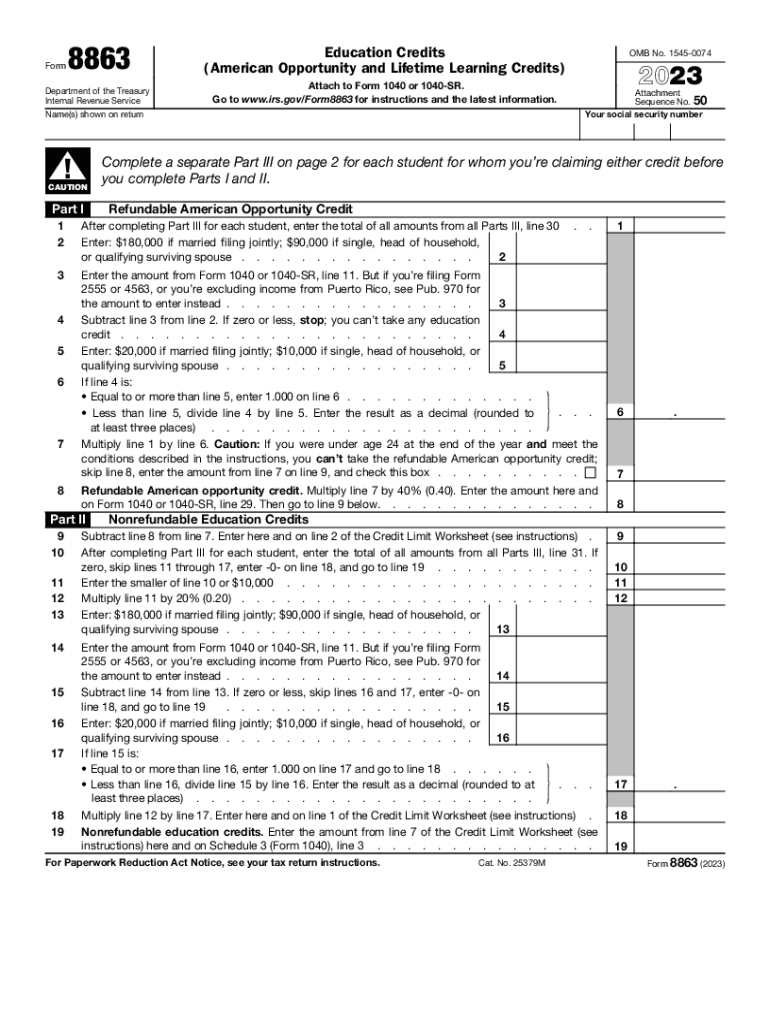

Understanding the 2023 Form 8863 for Education Credits

Form 8863 is utilized to claim education credits on your federal income tax return, specifically the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC). These credits are crucial for taxpayers who incur qualified education expenses for higher education.

Key Education Credits Explained

- American Opportunity Tax Credit (AOTC): Designed for students pursuing a degree or other recognized education credential. This credit can cover up to $2,500 in education expenses per eligible student, and is available for the first four years of higher education. The AOTC is partially refundable, meaning you may receive some credit even if you owe no tax.

- Lifetime Learning Credit (LLC): This credit offers up to $2,000 per tax return for qualified education expenses. There is no limit on the number of years the LLC can be claimed, making it beneficial for those pursuing courses to improve skills or for non-degree programs.

Steps to Complete the 2023 Form 8863

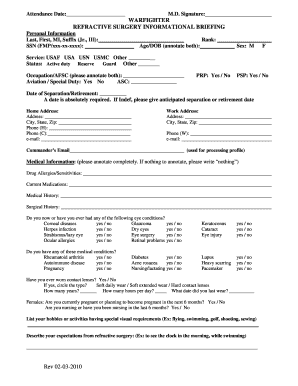

- Gather Documentation: Before starting, collect all necessary documents, including Form 1098-T from educational institutions, which report tuition payments.

- Determine Eligibility: Review the eligibility criteria for the AOTC and LLC. Make sure your qualified expenses meet the requirements set by the IRS.

- Complete Identification Section: Fill out your personal information at the top of the form, ensuring accuracy.

- Calculate Credits:

- For the AOTC, complete the worksheet to find out how much credit you can claim based on your qualified expenses and income level.

- For the LLC, similarly calculate the totals to determine your potential credit.

- Transfer Totals to Tax Return: After determining your credits, input the total amounts onto your Form 1040 or 1040-SR.

Important Terms Related to Form 8863

- Qualified Education Expenses: These include tuition, fees, and course materials required for enrollment or attendance at an eligible institution.

- Eligible Institutions: Colleges, universities, vocational schools, or other post-secondary educational institutions that are eligible to participate in federal student aid programs.

Eligibility Criteria for Education Credits

To qualify for the AOTC:

- The student must be enrolled at least half-time in a degree program.

- The student must not have completed four years of post-secondary education at the beginning of the tax year.

- Credit is available for students who have a modified adjusted gross income (MAGI) of below $90,000 (or $180,000 for married couples filing jointly).

To qualify for the LLC:

- There is no requirement for the number of years of education, making it available beyond undergraduate studies.

- The MAGI limit for the LLC is $80,000 for single filers and $160,000 for married couples filing jointly.

IRS Guidelines for Form Submission

- Filing Deadline: The completed form must be submitted by the tax filing deadline, typically April 15, to be considered for a credit for the preceding tax year.

- Submission Methods: Form 8863 can be filed electronically using tax software that supports IRS forms or printed and mailed to the IRS address specified for your region.

Common Scenarios Using Form 8863

- Traditional Students: A typical undergraduate student attending college who pays tuition and qualified fees would use Form 8863 to claim either the AOTC or LLC.

- Adult Learners: Individuals taking classes to improve job skills or career advancement opportunities often utilize the LLC.

- Parents Claiming Students: Parents who pay for their child’s education may claim the credits on their tax return if the student is a dependent.

Required Documents for Claiming Education Credits

To successfully complete Form 8863, the following documents should be at hand:

- Form 1098-T: This form provides information about tuition and other related expenses.

- Receipts and Statements: Keep detailed records of all educational expenses claimed.

Legal Use and Compliance for Form 8863

The IRS provides strict guidelines on using Form 8863. Taxpayers must ensure that all information provided is accurate and that they are eligible for the credits claimed. Misrepresentation of expenses may result in penalties, so it is essential to maintain transparency and use the form appropriately in compliance with IRS regulations.

By understanding these aspects of the 2023 Form 8863, taxpayers can effectively navigate their education credits, ensuring they maximize their tax benefits while adhering to legal requirements.