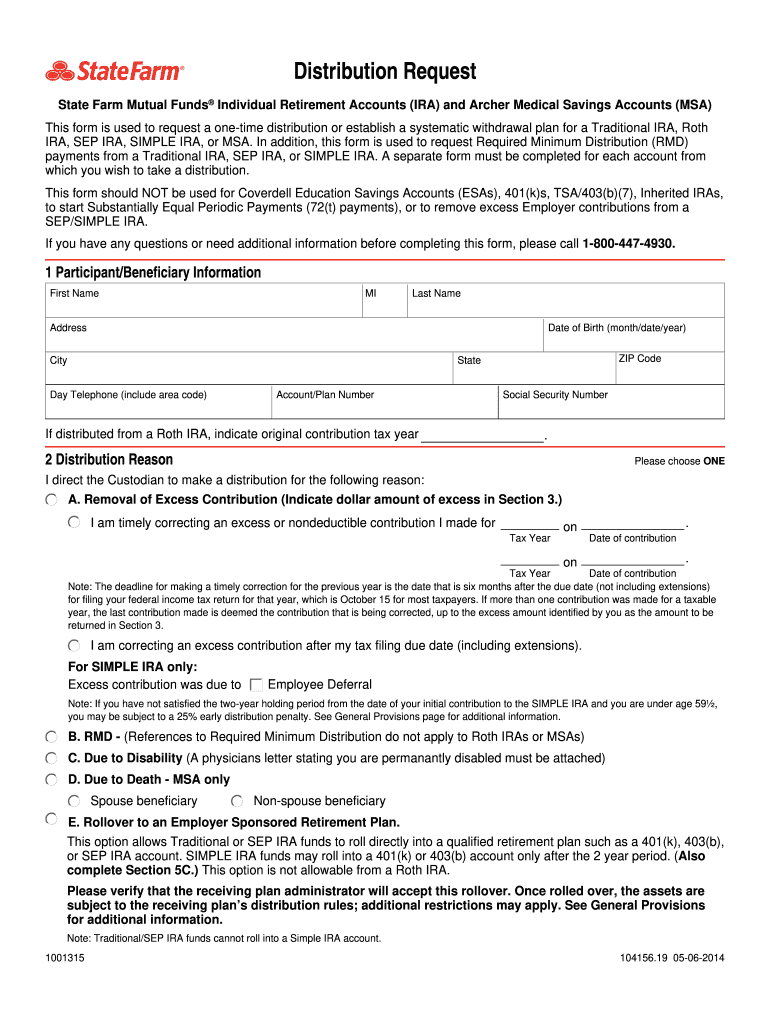

Definition and Purpose of the State Farm Disbursement Request Form

The State Farm disbursement request form is a crucial document for policyholders seeking to access funds from their State Farm insurance accounts. This includes various types of accounts such as Individual Retirement Accounts (IRAs), life insurance policies, and mutual funds. By utilizing this form, account holders can request either a one-time distribution or set up systematic withdrawal plans according to their financial needs. The form facilitates the distribution process by ensuring that all necessary information is provided clearly and accurately, which is vital for prompt processing.

The form serves multiple purposes, including:

- One-Time Distributions: Customers can request a single payout from their policies, which may be necessary for urgent financial needs.

- Systematic Withdrawal Plans: For those needing recurring funds, the form allows the establishment of a planned payment schedule.

- Required Minimum Distributions (RMDs): Account holders must comply with IRS regulations regarding RMDs, and this form is essential for fulfilling those requirements.

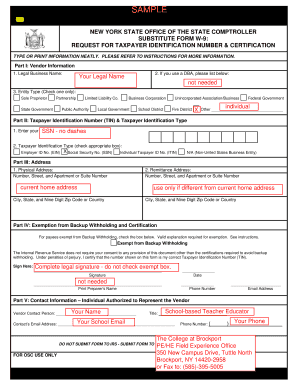

Steps to Complete the State Farm Disbursement Request Form

Filling out the state farm disbursement request form properly is critical to ensure the request is processed without delays. The following steps outline how to efficiently complete the form:

- Gather Necessary Documentation: Before starting, collect all pertinent documents, such as your policy number, account information, and identification details.

- Provide Personal Information: Fill in all fields related to your personal information, including your full name, address, phone number, and email. This ensures the form is accurately linked to your account.

- Specify the Type of Distribution: Clearly indicate whether you are requesting a one-time payout, a systematic withdrawal plan, or an RMD. This helps State Farm to process your request appropriately based on your needs.

- Detail the Amount Requested: Clearly state the amount you wish to withdraw, ensuring it aligns with account limits and regulations.

- Choose Payment Methods: Select your preferred method for disbursement, which may include a direct deposit to your bank account or a check mailed to your address.

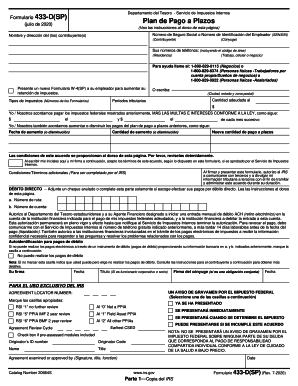

- Review Tax Withholding Options: State Farm allows you to opt for tax withholding on your distribution. It is essential to review the implications of your choices on your tax obligations.

- Sign and Date the Form: Your signature certifies the validity of your request, making it essential to complete this final step before submission.

Important Components of the State Farm Disbursement Request Form

Understanding the key components of the state farm disbursement request form can enhance accuracy and compliance. The form is typically structured to include various sections:

- Account Information: This section enables you to provide necessary details about your insurance or investment account, ensuring the correct allocation of funds.

- Amount Requested: Clearly specifying the requested amount ensures that funds can be processed quickly without ambiguity.

- Payment Options: This component outlines how you wish to receive your funds, offering choices such as direct deposit or check.

- Tax Implications: The form provides options for withholding taxes, allowing you to tailor your tax obligations to meet your financial situation.

Filling out these sections correctly is crucial to avoid processing delays and ensure compliance with relevant regulations.

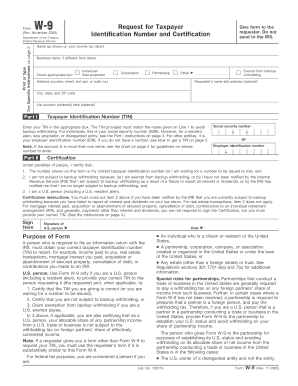

Legal Use of the State Farm Disbursement Request Form

The state farm disbursement request form is a legally binding document that complies with the guidelines set forth by State Farm and relevant regulatory authorities. Proper use of the form includes:

- Adherence to IRS Guidelines: When requesting withdrawals from accounts like IRAs, the form must align with IRS regulations regarding distributions and potential penalties for early withdrawal.

- Accuracy and Honesty: Providing false or misleading information on the form can result in legal repercussions, including potential fines.

- Understanding Participant Rights: Account holders must be aware of their rights under their policy, including how and when they can access funds.

Understanding these legal aspects can help prevent issues and ensure compliance.

Who Typically Uses the State Farm Disbursement Request Form?

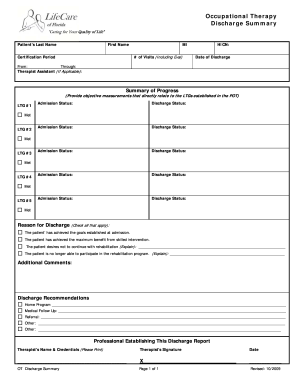

The state farm disbursement request form is utilized by various individuals depending on their insurance and investment needs. Typical users include:

- Individual Retirement Account (IRA) Holders: Those looking to make withdrawals from their retirement accounts for personal use.

- Life Insurance Policyholders: Individuals needing to access funds from their life insurance policies for emergencies or planned expenditures.

- Investors in Mutual Funds: Investors who wish to liquidate portions of their mutual fund investments.

- Beneficiaries: Individuals who are authorized to request disbursements on behalf of policyholders who have passed away.

Each of these users may have different motivations and complexities related to their request, making familiarity with the form essential.