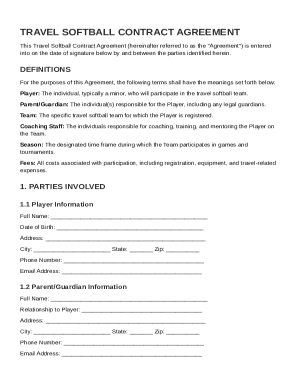

Definition and Meaning of IT-214 Form 2019

The IT-214 form, officially titled "Claim for Real Property Tax Credit," is a document utilized within New York State's tax system, intended for residents to claim a real property tax credit. Specifically, the IT-214 form for 2019 pertains to tax activities undertaken during the year 2019. This form is instrumental for both homeowners and renters, facilitating the process of obtaining financial relief based on property taxes paid or rent amounts that are deemed to contribute indirectly to property taxes.

Primary Purpose

- The central purpose of the IT-214 form is to enable lower-income demographics to receive a tax credit that alleviates the burden of excessive property taxation.

- It assists in determining and documenting eligibility criteria, such as income levels, residency status, and property ownership details, that are necessary for claiming the credit.

Eligibility Specifications

- Homeowners: Should have owned and occupied the residence for a specified period—usually part of the tax year in question.

- Renters: Must provide proof of rent payments with the understanding that landlords transfer property taxes as part of the rent cost.

How to Obtain the IT-214 Form 2019

Acquiring the IT-214 form for the 2019 tax year involves several straightforward options intended to maximize accessibility for eligible New York residents.

Available Channels

-

Online Access:

- The New York State Department of Taxation and Finance website offers the IT-214 form for download. Here, you can directly print or fill it out digitally before submission.

-

Via Mail:

- You can request the form by contacting the department directly and asking for it to be mailed to your home address.

-

In-Person Visits:

- Visit local taxation offices where forms are available, allowing individuals to acquire them and ask questions if needed.

Importance of Accurate Forms

- Ensure that the form pertains exclusively to the 2019 tax year; incorrect versions might lead to processing delays or rejection.

Steps to Complete the IT-214 Form 2019

Filling out the IT-214 form correctly is imperative to avoid any errors that could impact the processing of your tax credit claim.

Step-by-Step Completion Instructions

-

Personal Information:

- Complete all personal details, including name, address, and social security number, to ensure that your identity is accurately verified.

-

Determine Eligibility:

- Carefully read and fill out sections that ascertain your eligibility, including qualifications based on income and residential status.

-

Financial Calculations:

- Accurately enter property tax amounts paid or rent figures that contribute towards it. Utilize the instructions to make precise financial computations required.

-

Form Review:

- Double-check all details for accuracy and completeness to avoid errors that could result in claim rejection or processing delays.

-

Submission and Record Maintenance:

- Retain copies of the completed form for your records before submitting either electronically or by mail.

Who Typically Uses the IT-214 Form 2019

This form serves specific groups that fit the eligibility criteria and are within New York State jurisdiction.

Targeted Users

- Homeowners: Residents who own property and wish to alleviate some financial burden through claiming tax credits.

- Renters: Occupants not owning property but contributing to property tax equivalents through their rent.

Additional Considerations

- Age Groups: Generally includes seniors, as they often qualify for further exemptions and considerations based on fixed income status.

- Low-Income Residents: Those whose earnings fall below a certain threshold and are most in need of financial support.

Key Elements of the IT-214 Form 2019

Understanding the components of the IT-214 form helps you better prepare for its completion and submission.

Critical Segments

- Eligibility Criteria: Determination of qualification based on income level, residency duration, and property occupation status.

- Financial Disclosures: Sections dedicated to income and expenses relevant to property taxes or rent allocations.

- Final Calculation: Provides the method for computing the actual tax credit you can claim upon proper compliance with the form’s requirements.

Eligibility Criteria for IT-214 Form 2019

This form has particular prerequisites that dictate who can rightly benefit from its tax credits.

Factors Influencing Eligibility

- Income Limitations: Specific thresholds are established, ensuring aid targets those with genuine financial needs.

- Residency Duration: Generally requires part-year or full-year residency within the tax year in New York.

- Property Engagement: Homeownership or lease contracts reflecting occupancy during the tax year.

Considerations for Approval

- Documentation: Supporting documents such as proof of rent or property tax statements greatly enhance the likelihood of successful credit claims.

Filing Deadlines and Important Dates

It's critical to respect timelines related to the IT-214 to ensure its proper processing and the receipt of due tax credits.

Notable Dates

- Date of Filing: Typically, the IT-214 form follows the April deadline aligned with income tax submissions.

- Form Availability Periods: While forms are available year-round, timely submissions are critical to avoid missed credits.

Extensions and Exceptions

- In certain cases, extensions may be provided for late filings, which require justification and adherence to additional filing rules.

Form Submission Methods

Understanding how to effectively submit the IT-214 form enhances the efficiency of the filing process.

Submission Options

-

Electronic Submission:

- Often preferred for speed and ease, allowing the form to be directly uploaded through official income tax filing software.

-

Mail Options:

- Physical submission remains viable for those uncomfortable with digital formats or lack internet access.

-

In-Person Delivery:

- Direct delivery to a local tax office can occur; this provides an opportunity to ask questions if needed.

Ensuring Successful Submission

- Always verify the completion and accuracy of the form before utilizing any submission method to mitigate delays and complications.