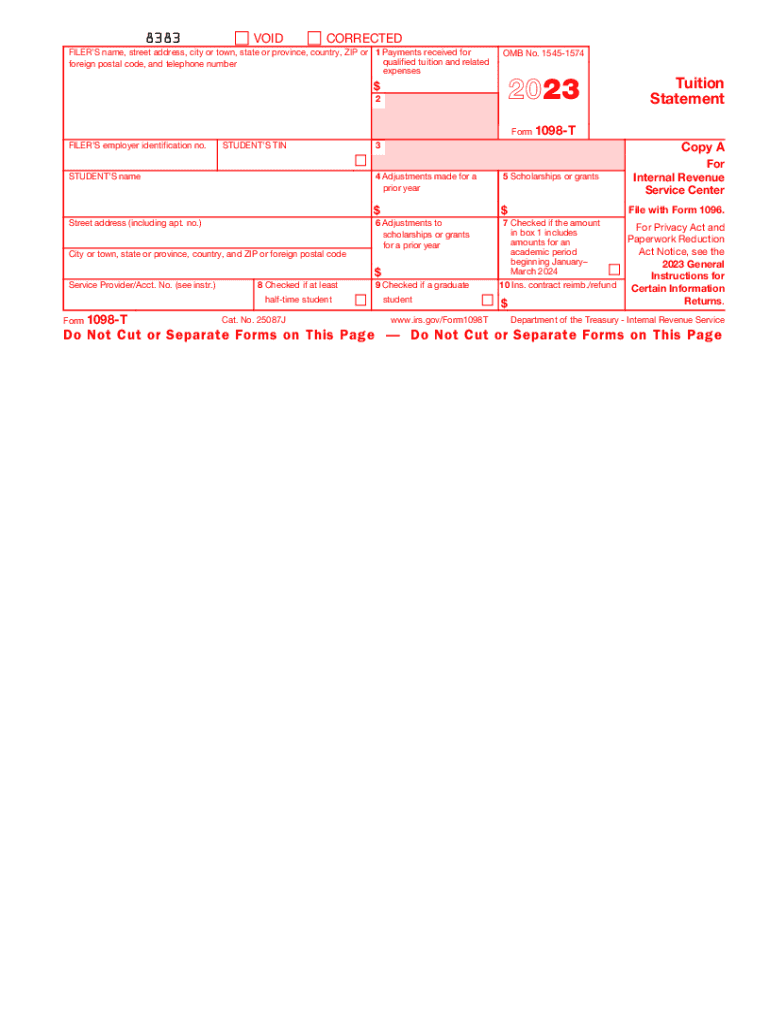

Definition and Meaning of the 2023 Form 1098-T Tuition Statement

The 2023 Form 1098-T Tuition Statement is an important tax document provided by educational institutions to report qualified tuition and related expenses paid for eligible students. This form helps students and taxpayers claim educational tax credits, such as the American Opportunity Credit and the Lifetime Learning Credit, which can significantly reduce the tax burden. The Form 1098-T contains information required by the Internal Revenue Service (IRS) to verify educational expenses, scholarships, and adjustments throughout the tax year.

Educational institutions must report various essential details on the form, including:

- The name and address of the institution.

- The name and taxpayer identification number of the student.

- Amounts billed for qualified tuition and related expenses.

- Scholarships or grants received by the student.

Understanding the 2023 Form 1098-T is vital for students and families to ensure accurate tax reporting and maximize potential benefits from education-related deductions or credits.

Who Typically Uses the 2023 Form 1098-T Tuition Statement

The 2023 Form 1098-T Tuition Statement is utilized primarily by students and their families. However, it is important to recognize the roles of various stakeholders involved in its distribution and use:

- Educational Institutions: Colleges, universities, and other qualifying educational providers issue the form to enrolled students. They must ensure accurate reporting of funds received for education-related expenses.

- Students and Taxpayers: Individuals who attend eligible educational institutions will receive this form to report tuition paid and any associated financial aid, scholarships, or grants.

- Tax Preparers and Software: Tax professionals and software programs, such as TurboTax and H&R Block, utilize the Form 1098-T data to assist in preparing accurate tax returns for clients, ensuring they receive any eligible credits.

- Parents: Many students do not file taxes independently; thus, their guardians may use the form to claim tax benefits associated with the student's education.

Understanding who engages with the 2023 Form 1098-T is essential for ensuring proper use and compliance with IRS regulations.

Steps to Complete the 2023 Form 1098-T Tuition Statement

Completing the 2023 Form 1098-T can appear daunting, but breaking it down into manageable steps can simplify the process. Follow these steps to ensure accuracy:

- Gather Required Information: Before filling out the form, collect all necessary information, including the student’s name, taxpayer identification number, and amounts paid for qualified expenses. Also, gather details on scholarships or grants received.

- Fill Out Institutional Information: As the institution issuing the form, enter your name, address, and employer identification number (EIN) in the specified sections of the form.

- Complete Student Information: Input the student's name, address, and taxpayer identification number in the corresponding fields.

- Report Qualified Expenses: Indicate the total amount of qualified tuition and related expenses billed to the student during the calendar year. This information helps in determining applicable educational tax credits.

- Document Scholarships and Grants: Include any scholarships or grants received by the student during the tax year. This information is crucial, as it offsets the total educational costs reported.

- Verify and Submit: Review all entries for accuracy. Submit the completed Form 1098-T to the applicable party by the required deadline.

Following these steps carefully will help ensure compliance with IRS regulations and facilitate claiming any eligible education credits on tax returns.

IRS Guidelines Related to the 2023 Form 1098-T Tuition Statement

The IRS provides specific guidelines regarding the reporting and use of the 2023 Form 1098-T. Educational institutions must adhere to these guidelines to ensure compliance and avoid penalties. Key points include:

- Filing Requirements: Institutions must file Form 1098-T if they received payments for qualified tuition and related expenses, and if they enrolled students in courses. It’s necessary to determine who qualifies as a student to ensure compliance.

- Due Dates: There are strict deadlines for issuing the form to students, as well as submitting it to the IRS, typically January 31 for student distribution and February 28 for IRS filing if mailed or March 31 if filed electronically.

- Accurate Reporting: Any reported amounts must accurately reflect the payments for qualified tuition and related expenses, while also accounting for scholarships or grants. Discrepancies can lead to audits and penalties.

- Compliance with Tax Credits: Understanding the educational tax credits associated with the Form 1098-T is essential for institutions and students alike. The form serves to facilitate claims for the American Opportunity Credit and the Lifetime Learning Credit, ensuring compliance with eligibility criteria for these benefits.

Institutional adherence to these IRS guidelines ensures that both educational providers and students can maximize their potential tax benefits.

Key Elements of the 2023 Form 1098-T Tuition Statement

The 2023 Form 1098-T Tuition Statement contains several crucial elements that facilitate the reporting of educational expenses. Familiarity with these components is essential for both students and institutions. The main elements include:

- Institution Information: Name, address, and EIN of the educational institution issuing the form.

- Student Information: The student’s name, address, and taxpayer identification number must be filled out accurately.

- Qualified Tuition and Related Expenses: The total amounts charged for qualified tuition and fees during the year, broken down for clarity.

- Scholarships and Grants: Section highlighting the total amount of scholarships and grants received by the student, which must be reported as they can affect tax credits.

- Box Codes: Specific boxes are designated for various types of information, including payments received and adjustments made. Understanding box designations aids in accurate data reporting.

- Instructions: The form includes guidance snippets to ensure accurate completion and understanding of how the reported figures affect potential tax credits.

Familiarizing oneself with these key elements ensures proper handling of Form 1098-T and maximizes potential benefits.