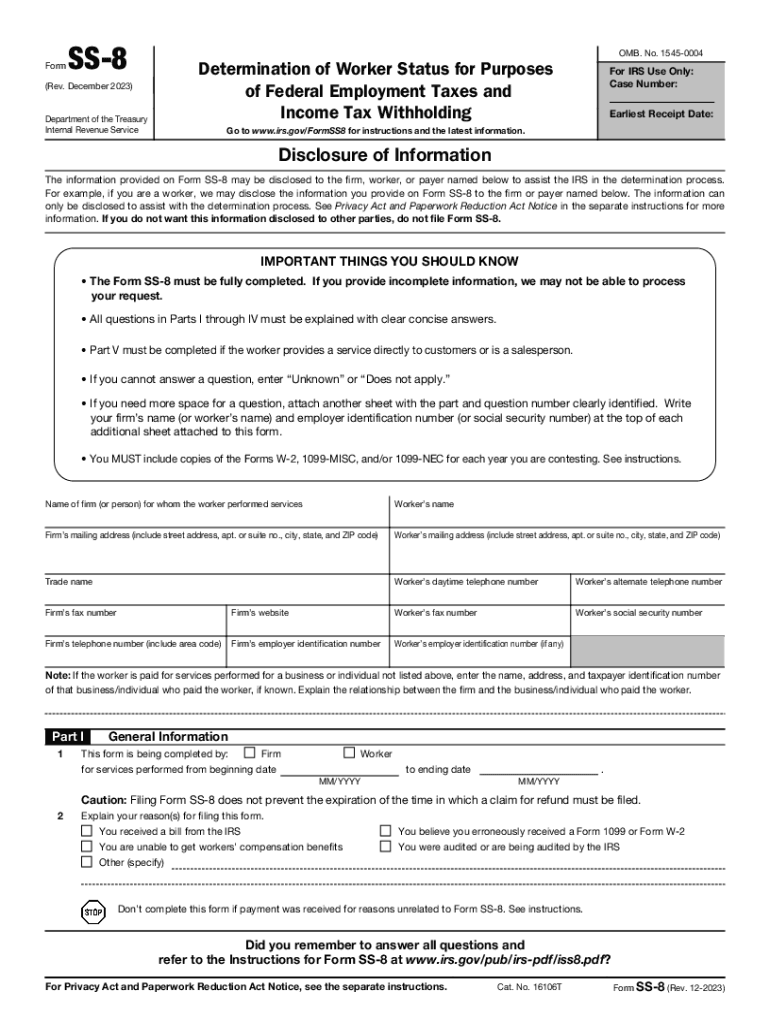

Definition and Purpose of Form SS-8

Form SS-8 (Rev December 2023) is utilized to determine the worker status for federal employment taxes and income tax withholding. This determination is critical for classifying whether an individual is an employee or an independent contractor, which has significant implications for taxation and compliance. The form helps both the worker and the employer understand their tax obligations and rights under federal law.

Importance of Worker Status Determination

- Tax Implications: Misclassification can lead to underpayment of federal taxes, which may result in penalties for the employer.

- Employee Benefits: Employees are typically entitled to benefits such as health insurance, retirement plans, and unemployment insurance, which may not apply to independent contractors.

- Legal Rights: Different legal protections apply to employees compared to independent contractors; understanding one's classification can help safeguard entitlements.

In essence, Form SS-8 serves as a formal request to the IRS to clarify the relationship between a worker and an employer, based on various factors including behavioral control, financial control, and the type of relationship established.

Steps to Complete the Form SS-8

Filling out Form SS-8 requires careful attention to detail to ensure all required information is provided accurately. Below are the essential steps to complete the form effectively.

-

Obtain the Form: Download or access Form SS-8 from the IRS website or through authorized providers.

-

Provide General Information:

- Include the name and address of the firm and the worker involved.

- List the phone numbers for both parties.

-

Describe the Working Relationship:

- Outline the job duties performed by the worker.

- Detail any instructions or training the worker receives from the employer.

-

Financial Control Information:

- Indicate how the worker is paid (e.g., hourly, salary, project-based).

- Mention any expenses incurred by the worker and whether these are reimbursed.

-

Behavioral Control Details:

- Specify how much control the employer has over how the work is done.

- Include information on comprehensive supervision, direction, and support provided to the worker.

-

Sign and Submit:

- Ensure the form is signed by the appropriate parties.

- Submit the completed form to the IRS for review.

Completing the form accurately is crucial to avoid delays in the IRS's determination process and to ensure compliance with federal employment tax regulations.

How to Obtain the Form SS-8

Acquiring Form SS-8 is straightforward. Here’s how to do it:

- Visit the IRS Website: The most efficient way to obtain Form SS-8 is to visit the official IRS website. The form is available in a downloadable PDF format, making it easily accessible.

- Request via Phone: Alternatively, you can call the IRS helpline to request a paper version of the form if you prefer to fill it out by hand.

- Tax Software: Many tax preparation software solutions also include access to this form, allowing users to file electronically.

It is advisable to ensure you have the most current version of the form, as tax laws and regulations can evolve, making older versions obsolete.

Examples of Using Form SS-8

Understanding practical applications of Form SS-8 can elucidate its importance. Here are common scenarios where this form is used:

- Freelancers in Different Roles: A graphic designer working on multiple projects might use Form SS-8 to confirm whether they qualify as an independent contractor or should be classified as an employee due to the employer's level of control.

- Service Providers: A contractor who provides janitorial services for a corporation might seek clarity on their status if they are told to follow a strict schedule and reporting process set by the employer.

- Consultants: An IT consultant who works regularly with a company may fill out Form SS-8 if they believe their consistent work arrangements resemble that of an employee.

Invariably, these examples illustrate the form's key role in clarifying worker classification, thereby avoiding potential misunderstandings regarding tax obligations and employment status.

Key Elements of Form SS-8

The contents of Form SS-8 are structured to gather specific, relevant information necessary for a proper classification of the worker status. Here are the key elements included in the form:

- Contact Information: The form requires comprehensive contact details for both the worker and the hiring firm.

- Nature of Services: A detailed description of the services or work being performed is crucial. This includes specific job duties and collaborative expectations.

- Verification of Control: Information regarding who provides the tools and materials, and the degree of control exercised over the work is evaluated.

- Remuneration Structure: Insights into payment arrangements and any deductibles the worker may have experience help in establishing the level of financial control.

These components work together to provide the IRS with a clear picture of the working relationship, facilitating an accurate determination of the worker's status.