Definition and Meaning of the Occupiers Consent Form

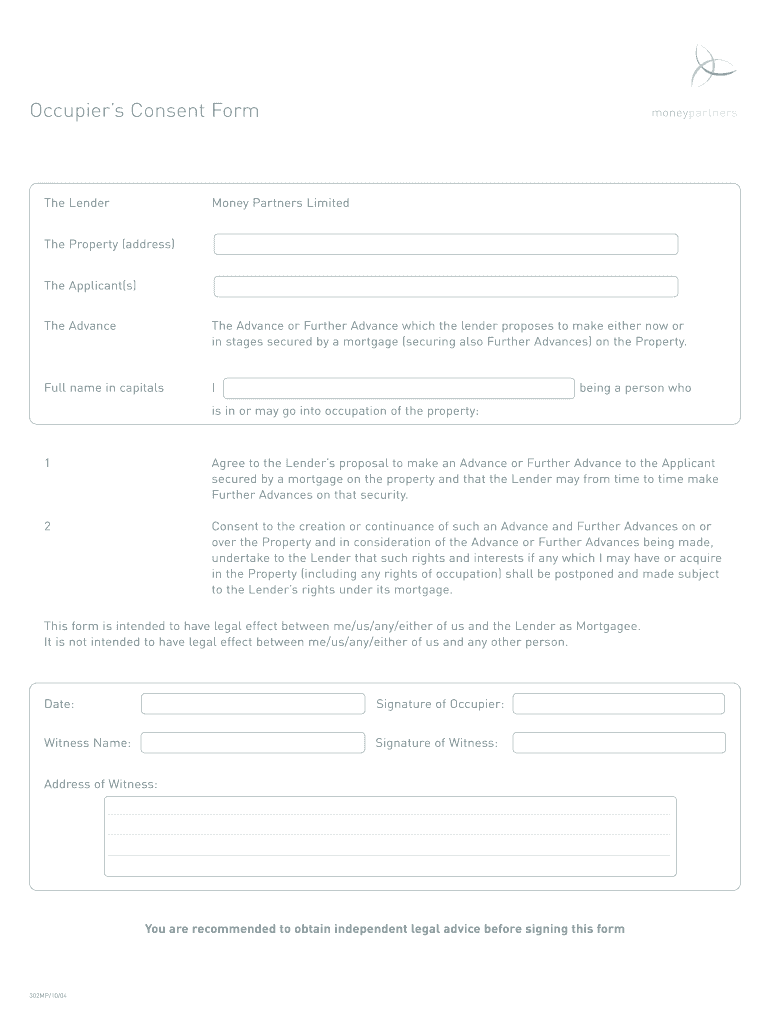

The occupiers consent form is a legal document that enables individuals occupying a property to provide their consent to a lender when a mortgage is being arranged. This form is prevalent in situations involving residential mortgages where one or more individuals, not named on the mortgage deed, might be living at the property. By signing the form, the occupier acknowledges that their rights related to the property will be subordinate to the rights of the lender, thereby allowing for the mortgage to proceed without their name being on the legal title.

The importance of this form cannot be understated, as it ensures that the lender obtains the necessary rights to the property while protecting both the lender's interests and the rights of the occupier. Essentially, it serves as a formal agreement that provides transparency regarding the occupier's status and expectations concerning the mortgage agreement.

This document is particularly crucial in various financial transactions, including remortgaging and acquiring buy-to-let mortgages. It also protects lenders by clarifying the terms of occupancy related to the property without requiring the occupier to be a formal party to the mortgage.

How to Use the Occupiers Consent Form

The occupier's consent form can be accessed digitally or in paper format. Its use generally involves the following:

-

Acquisition of the Form: The form can typically be obtained from the lender's website or during the mortgage application process, often included in the documentation provided by the mortgage lender.

-

Completion of the Form: After downloading or receiving the form, the occupier must fill out their personal details accurately, including their full name and the address of the property in question.

-

Acknowledgment of Terms: Upon filling out the form, the occupier must read the terms carefully to understand their rights and obligations, including the implications of their consent regarding the mortgage arrangement.

-

Signing the Form: The occupier must sign the document, providing their formal consent. The form may require witnessing to ensure its validity, especially in some jurisdictions.

-

Submission to the Lender: After signing, the completed form must be submitted to the lender, usually as part of the mortgage processing documents. It should be kept on file for reference.

Steps to Complete the Occupiers Consent Form

Completing the occupiers consent form involves a systematic process:

-

Obtain the Form:

- Access the form from the lender's website or request it directly from them. Verify that you have the correct version, especially if there are multiple types available (e.g., Halifax occupiers consent form PDF).

-

Provide Accurate Information:

- Fill in your full legal name, the address of the property in question, and any other requested personal information. Ensure that spelling and details are correct to avoid future complications.

-

Read Legal Total Acknowledgements:

- Carefully review the terms stated on the form. Pay attention to how your rights may be affected based on the consent you are providing.

-

Sign the Document:

- Once you are satisfied with your understanding of the form, sign it. Ensure that you meet any specific witnessing requirements, as there may be differing legal stipulations depending on the state.

-

Submit the Form:

- Return the signed document to the lender as instructed, either online or via postal mail. Confirm receipt if possible, to protect against any disputes regarding submission.

Important Terms Related to the Occupiers Consent Form

Understanding key terminology associated with the occupiers consent form is vital for occupants and lenders alike:

- Consent: An agreement by the occupier that grants the lender certain rights related to the property, such as the right to enforce the mortgage in the event of default.

- Occupier: An individual residing in the property who is not necessarily a party to the mortgage loan but may still have an interest in the property.

- Mortgage: A legal agreement wherein the lender provides funds to purchase a property, secured against the property itself.

- Deed: A legal document that formally conveys ownership or interest in a property. This term also encompasses any rights related to the property.

- Witness: An individual who observes the signing of a legal document and affirms the authenticity of the signatory’s identity.

Understanding these terms will help demystify the processes surrounding the occupier's consent form and ensure all parties involved are adequately informed.

Legal Use of the Occupiers Consent Form

The occupiers consent form carries legal weight, and proper adherence to its stipulations is essential:

-

Legality and Binding Nature: Signing the form creates a legally binding obligation where the occupier consents to the lender’s claims on the property. This acknowledgment is crucial during mortgage proceedings and can affect the rights of the occupier significantly.

-

Independent Legal Advice: It is advisable for occupiers to seek independent legal advice before signing the form, as doing so can ensure that they fully understand the implications of their signature and the rights they are waiving.

-

Enforcement by Lenders: Should a situation arise where the mortgage is enforced due to default by the borrower, the occupiers consent form means that the occupier cannot claim rights against the lender, as they consented to the priority of the lender’s rights.

-

Jurisdictional Variations: Legal use of the form can vary by state, so it is essential to verify any specific legal requirements applicable within the jurisdiction where the property is located. Some states may have additional regulations or stipulations that influence how the occupier's consent process is carried out.