Definition and Meaning of a Self Declaration Form

A self declaration form is a document wherein an individual certifies their identity and provides specific information about themselves, often for compliance, tax, or legal purposes. It serves as a written statement affirming the truth of the information provided, making it a crucial component in various professional and personal scenarios. These forms can take different formats, depending on their intended use. For instance, when applied for tax reasons, it might include details related to income or residency, whereas in a corporate context, it may contain information about compliance with specific regulations or standards.

Key Features of Self Declaration Forms

- Identity Verification: The primary purpose is to help establish an individual's identity or status.

- Affirmation of Truth: Individuals declare that the information they are providing is accurate and truthful to the best of their knowledge.

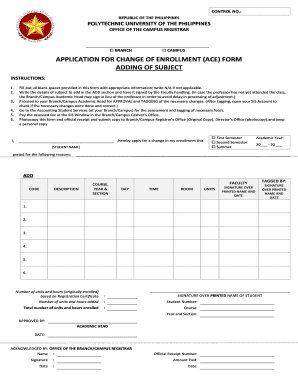

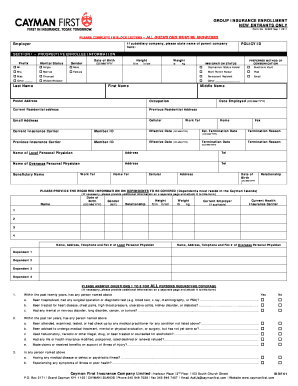

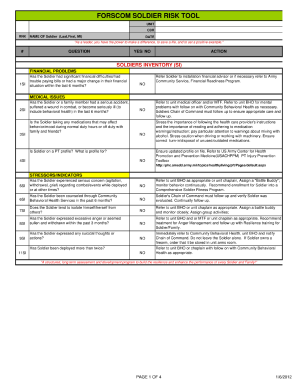

- Variety of Applications: These forms can relate to different sectors including finance, health, and regulatory compliance.

How to Use the Self Declaration Form

Using a self declaration form is straightforward, but it requires attention to detail to ensure that all information is accurate and complete. Typically, the process involves:

- Select the Appropriate Form: Determine if the self declaration form is needed for purposes like tax, health, or legal proceedings.

- Gather Necessary Information: Collect all relevant data required, such as identification numbers, addresses, and financial information.

- Fill Out the Form: Carefully enter the information in the prescribed sections.

- Review and Verify: Check for accuracy before submitting the form.

- Submit the Form: Depending on the requirements, submit it online, by mail, or in person.

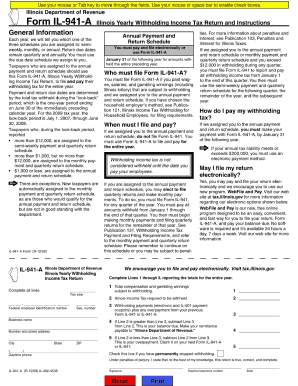

Common Uses for Self Declaration Forms

- Tax Filing: Often used to declare income, residency status, or tax-related affiliations.

- Health Declarations: For assuring health status, especially in contexts like international travel or health insurance applications.

- Regulatory Compliance: For organizations ensuring that they meet specific legal requirements.

Steps to Complete the Self Declaration Form

Completing a self declaration form involves several critical steps to ensure that the document meets its intended purpose. These steps typically include:

- Obtain the Form: Access the form from an official source or agency, ensuring you have the latest version.

- Read Instructions Carefully: Understand the guidelines provided with the form to avoid common pitfalls.

- Fill in Personal Information: Includes your full name, address, date of birth, and any relevant identification numbers.

- Complete Required Sections: Provide specific declarations based on the form's purpose, such as income details for a tax declaration.

- Sign and Date the Form: Ensure that your declaration is signed and dated, affirming its authenticity.

- Submit the Form: Follow the specified submission guidelines for the relevant agency or organization.

Important Considerations

- Accuracy is Key: Mistakes can lead to legal repercussions or financial penalties.

- Document Verification: It may be necessary to include supporting documents or identification for certain declarations.

Legal Use of the Self Declaration Form

A self declaration form can serve various legal purposes, including tax compliance and legal proceedings. Its primary function is to establish the credibility of the information provided and can be pivotal in scenarios involving audits or investigations.

Legal Implications

- Binding Nature: The declaration is legally binding, meaning that providing false information can have serious consequences, including legal action.

- Regulatory Compliance: Many industries require these forms to comply with state or federal regulations, making them essential for businesses.

Relevant Regulations

- IRS Guidelines: In the context of tax, specific IRS regulations dictate how these forms must be filled out and the consequences of non-compliance.

- Business Regulations: Companies in regulated industries (like finance or healthcare) must often utilize self declaration forms to ensure compliance with industry standards.

Important Terms Related to Self Declaration Form

Understanding the key terminology associated with self declaration forms can help users navigate their completion and legal significance effectively. Key terms include:

- Affidavit: A formal statement verifying the truth of certain facts, often used in legal settings.

- Verification: The process of confirming the authenticity of the information provided in the declaration.

- Compliance: Adhering to laws, regulations, or standards, often necessitating a self declaration form.

Examples of Using the Self Declaration Form

The application of a self declaration form varies widely across different contexts. Here are several common examples:

- Tax Filing: Individuals often use it to declare their status (e.g., self-employed) and provide information necessary for tax calculations.

- Health Insurance: A health declaration form may be required to confirm vaccination status or pre-existing conditions.

- Travel: A self declaration form may be necessary when traveling internationally to confirm health status or other eligibility requirements.

Real-World Scenarios

- Tax Compliance: A self-employed individual completing their tax returns may need to fill out a self declaration form to confirm income and expenses, ensuring compliance with IRS regulations.

- Travel Requirements: Before boarding an international flight, travelers may be required to complete a health declaration form, asserting their health status amidst global health concerns.

Filing Deadlines and Important Dates

Adhering to filing deadlines is critical when submitting a self declaration form, especially in contexts like tax compliance. These deadlines are typically outlined by relevant authorities, such as the IRS for tax forms.

Key Dates to Consider

- Tax Deadlines: Federal tax filing typically occurs on April 15 each year, unless otherwise specified.

- State Requirements: Many states have their own deadlines for submission of self declaration forms related to tax or compliance issues.

- Periodic Updates: Certain forms may have annual or biannual updates requiring re-submission or revision.

Compliance Importance

Failing to meet these deadlines can result in penalties, interest, or other administrative repercussions, emphasizing the need for individuals and businesses to track crucial dates.

Conclusion

Through these comprehensive insights into the self declaration form's definition, usage, and various applications, individuals can better navigate their requirements and obligations related to this significant document type. The self declaration form remains an essential tool in both personal and professional contexts, facilitating compliance, identity verification, and legal affirmation across a range of scenarios.