Definition & Meaning

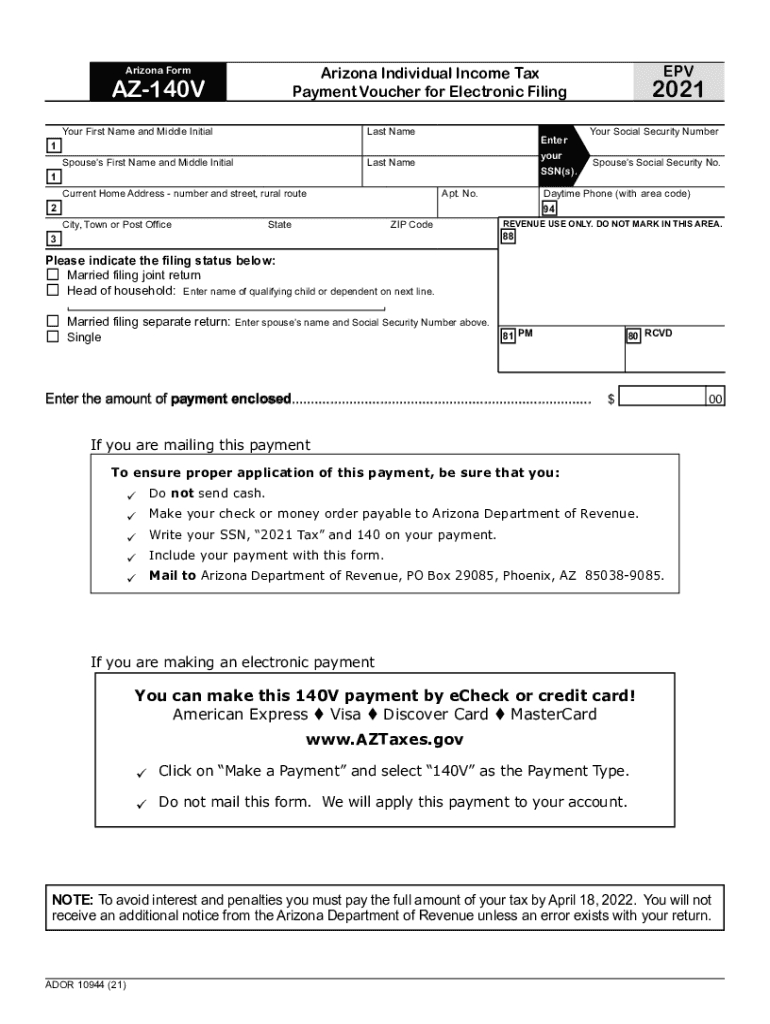

The Arizona Form AZ-140V, commonly referred to as the Individual Income Tax Payment Voucher, is utilized by residents of Arizona to facilitate and record electronic or check payments of personal income tax to the Arizona Department of Revenue (ADOR). It acts as a formal acknowledgment and proof of payment for taxpayers. The form is crucial in ensuring proper crediting of your payments, thus avoiding possible interest and penalties associated with late or missing payments.

How to Obtain the Arizona Form AZ-140V

Taxpayers can easily obtain the Form AZ-140V through a few different methods. The most direct method is to download it from the official Arizona Department of Revenue website. Alternatively, tax preparation software like TurboTax or QuickBooks may also provide access to this form during the filing process. For those who prefer, hard copies can be requested from the AZ Department of Revenue by mail or picked up at their offices. When downloading from a website or using software, ensure that the form version is current to avoid any complications with old alterations.

Steps to Complete the Form AZ-140V

-

Personal Information: Begin by filling out your full name, Social Security Number (SSN), and current address. This ensures the payment is credited to the correct account.

-

Tax Year Details: Clearly indicate the tax year for which the payment is being made. This helps in associating your payment accurately with your account's records for that fiscal year.

-

Payment Amount: Enter the exact amount of the payment you are submitting. Double-check this figure to avoid any inconsistencies.

-

Payment Method: Specify whether the payment is made via online transfer, check, or money order. If paying by check or money order, ensure it is made payable to "Arizona Department of Revenue."

-

Mailing the Voucher: Use a standard envelope and affix proper postage. Mail the completed voucher along with your payment to the address specified on the form instructions.

Key Elements of Form AZ-140V

-

Identification Information: Includes taxpayer's name, address, and SSN for proper identification.

-

Payment Type and Amount: Details that ensure the payment is for the correct tax year and amount.

-

Signature Line: While not a primary component of this voucher, ensuring the form is accompanied by any necessary official confirmations or signatures depending on the method of submission, further authenticates the payment.

Important Terms Related to Arizona Form AZ-140V

-

Tax Year: The yearly accounting period for reporting income and taxes, specified on the form to allocate the payment correctly.

-

Social Security Number (SSN): A unique identifier for personal tax records needed to match payments with the correct taxpayer account.

-

ADOR (Arizona Department of Revenue): The state body that handles tax collection and related tasks.

Legal Use of Form AZ-140V

Form AZ-140V serves not just as a payment record but as an official document ensuring compliance with legal tax payment obligations. Arizona law requires that state income taxes are to be paid timely to avoid penalties, and using this form appropriately ensures adherence to such statutory requirements.

Filing Deadlines / Important Dates

For annual income tax filers, the Arizona Form AZ-140V should be submitted by April 15 of each year, aligning with the federal tax deadline. If this date falls on a weekend or holiday, the deadline shifts to the next business day. For estimated payments through the year, refer to state guidelines for quarterly deadlines to stay compliant.

Form Submission Methods (Online / Mail / In-Person)

Submissions for this form can be made online via the official Arizona tax payment portal or through mail. While mailing provides physical proof of submission, online payment is often quicker and provides immediate confirmation. In-person submissions can be rare but are permitted at designated Arizona Department of Revenue locations, ensuring receipt with a timestamp acknowledgment.