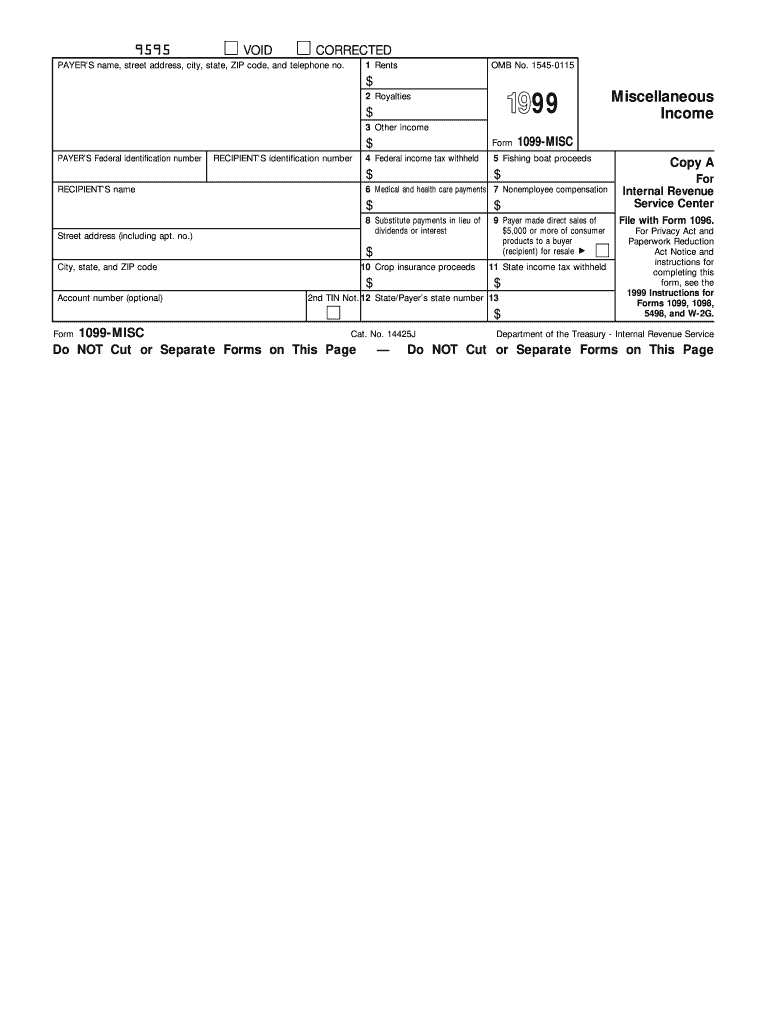

Definition and Meaning of the 1999 IRS Form 1099-MISC

The 1999 IRS Form 1099-MISC is primarily used to report various types of income other than wages, salaries, and tips to the Internal Revenue Service (IRS), notably nonemployee compensation. This form is a crucial document for freelancers, contractors, and consultants since these groups typically receive earnings that must be reported on Form 1099-MISC rather than the traditional W-2. Understanding its purpose is vital for both issuers and recipients to ensure adherence to tax regulations.

How to Use the -MISC Form

To effectively use the -MISC form, both issuers and recipients must follow specific steps. For issuers, it is important first to gather the necessary information about the payee, including their name, address, and taxpayer identification number (TIN). Once the form is filled out with detailed recordkeeping of payments made, it should be distributed to both the recipient and the IRS. Recipients need to use the information on the 1099-MISC to accurately file their income tax returns, ensuring that all reported income matches their individual records.

How to Obtain the -MISC Form

The -MISC form can be obtained through various avenues. Traditionally, the forms were available directly from the IRS or from certain authorized retailers. Additionally, many businesses use accounting software that can generate these forms electronically. It is important for businesses to acquire this form from a reliable source to ensure compliance with IRS regulations and facilitate smooth reporting processes.

Steps to Complete the -MISC Form

Completing the -MISC form involves several precise steps:

- Information Gathering: Collect the payer’s and recipient’s details, including their names, addresses, and TINs.

- Income Reporting: Identify the specific type of income being reported and fill in the corresponding amount in the correct boxes on the form.

- Tax Withholding: If applicable, note any federal or state tax withheld.

- Form Distribution: Provide copies to the recipient for their records and the IRS through the appropriate channels.

Key Elements of the -MISC Form

The -MISC form includes several critical sections:

- Payer Information: Name, address, and TIN of the entity paying out income.

- Recipient Information: Details of the recipient receiving the payments, crucial for both parties in maintaining accurate records.

- Income Categories: Sections where specific payments, such as rents, royalties, and nonemployee compensation, are recorded.

- Amounts Withheld: Spaces for any withholdings that may apply, ensuring a clear record of tax deductions.

Filing Deadlines and Important Dates

Filing deadlines for the -MISC form are critical to avoid penalties. Typically, issuers are expected to furnish the form to recipients by January 31 and submit it to the IRS by the last day of February if filing by paper, or by March 31 if filing electronically. Adhering to these deadlines is essential to maintain compliance with IRS requirements.

Required Documents for Completing the 1099-MISC Form

To complete the -MISC form, certain documents should be at hand:

- Payment records: Detailed accounts of the compensations made over the tax year.

- W-9 Form: A filled-out request for taxpayer identification, which helps verify the recipient’s information.

- Prior Year’s Forms: These can serve as a reference to check consistencies in reporting.

Penalties for Non-Compliance

Failure to issue, file, or correct a -MISC form on time can result in significant penalties imposed by the IRS:

- Late Filing Penalties: Charges for each form not filed within the deadline, increasing the longer it remains unfiled.

- Incorrect Information Penalties: Fines for misinformation if not corrected promptly.

- Intentional Disregard Penalties: Heavier penalties for willfully neglecting to pay attention to filing requirements.

Awareness of these penalties emphasizes the importance of accuracy and timeliness in handling the -MISC form while promoting accountability from all involved parties.