Definition & Meaning

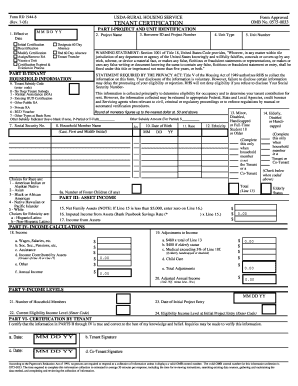

The 2013 Social Worksheet Form is a tool used to help individuals determine the taxable portion of their Social Security benefits when filing their taxes. Primarily, this form is essential for those completing a Form 1040, where it assists in calculating the figures needed for lines 20a and 20b. The form's primary focus is on outlining the steps required to determine if any portion of Social Security benefits needs to be taxed based on additional income sources and the total benefits received. It ensures taxpayers enter information accurately to avoid errors with the IRS.

How to Use the 2013 Social Worksheet Form

Using the 2013 Social Worksheet Form involves several key steps aimed at determining taxable income. Here are the sequential steps to utilize this form effectively:

-

Gather Your Documents: Before starting, collect your Social Security Benefit Statement (SSA-1099) and any other income documentation such as W-2s or 1099 forms.

-

Calculate Combined Income: Begin by adding your adjusted gross income, non-taxable interest, and half of your Social Security benefits to calculate your combined income.

-

Use the Worksheet: Follow the worksheet's instructions to compute whether your benefits are taxable. This includes entering your combined income figures and comparing them against the set thresholds for your filing status.

-

Enter Results on Form 1040: Transfer the results onto line 20 of Form 1040, ensuring accuracy.

This step-by-step process ensures that taxpayers cover all necessary areas comprehensively, avoiding IRS errors or audits.

Steps to Complete the 2013 Social Worksheet Form

Completing the 2013 Social Worksheet Form requires careful attention to detail. Follow this detailed guide:

-

Identify Your Filing Status: Determine if you are filing as single, married filing jointly, or another status, as this will dictate the income threshold.

-

Calculate Total Income: Sum up all income sources, including employment and investment incomes.

-

Determine Half of Social Security Benefits: Calculate and include half of your received Social Security benefits into the worksheet.

-

Apply Filing Status Thresholds: Compare your totals against the applicable thresholds for your filing status.

-

Input Results into Tax Return: Use the worksheet's results to fill in line 20 of Form 1040 accurately.

By following these steps, taxpayers ensure their Social Security benefits are reported correctly, minimizing the risk of IRS inquiries.

Key Elements of the 2013 Social Worksheet Form

Understanding the fundamental components of the 2013 Social Worksheet Form is crucial:

- Filing Status: Different thresholds based on whether you're filing singly or jointly.

- Combined Income: Total income including half of Social Security benefits and other incomes.

- Income Thresholds: Set IRS thresholds that dictate if benefits are taxable.

- Adjustments and Deductions: Details on how to factor in certain adjustments for accurate calculations.

These elements serve to guide taxpayers towards correctly identifying taxable Social Security income.

IRS Guidelines

The IRS provides clear guidelines on using the 2013 Social Worksheet Form. Taxpayers need to:

- Use the worksheet to align with IRS rules on taxable income from Social Security benefits.

- Ensure all calculations comply with IRS regulations to avoid penalties.

- Follow proper filing procedures on Form 1040 as per IRS documentation.

Adhering to these guidelines ensures compliance and accuracy in tax submissions.

Required Documents

To effectively use the 2013 Social Worksheet Form, gather essential documents:

- Social Security Benefit Statement (SSA-1099): Shows total benefits received.

- W-2 Forms: For all wage and salary incomes.

- 1099 Forms: For any additional income sources like freelancing or other contract work.

- Interest Income Statements: Documents detailing any non-taxable or taxable interest income.

Having these documents on hand facilitates a smooth calculation process.

Software Compatibility

The form integrates seamlessly with various tax software systems, enhancing the ease of completing your taxes:

- TurboTax: Offers step-by-step assistance with inputting worksheet figures.

- H&R Block: Provides tools for determining taxable benefits based on combined income.

- TaxSlayer: Supports direct input of Social Security documents into the tax return.

Using compatible software streamlines the taxpayer's journey, reducing manual effort and potential errors.

Important Terms Related to 2013 Social Worksheet Form

Familiarity with specific terminology aids in proper use of the 2013 Social Worksheet Form:

- Adjusted Gross Income (AGI): Total income minus allowable deductions, forming the base for calculations.

- Taxable Social Security: The portion of benefits subject to income tax.

- Combined Income: An overall income estimate used to apply thresholds for taxation.

Knowing these terms equips taxpayers with the necessary language to navigate documents and forms effectively.